Neither rigged nor fair

Le numéro du 25 juin 2016 de The Economist offre un bel article intitulé : « Neither rigged nor fair ». Cet article analyse la rémunération des dirigeants de manière critique.

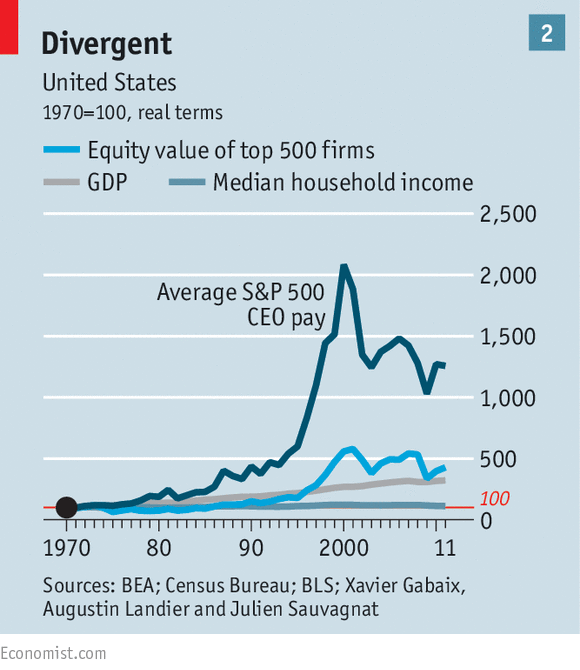

Peter Drucker, the doyen of management theorists, reckoned that exceeding a 20-1 multiple of pay within a firm between executives and the average worker was bad for morale. Mr Drucker was worrying about the gap back in the 1980s, when the economy-wide difference between CEOs of big American firms and average workers was in the 40-1 range. How quaint that seems: depending on how you count things, the multiple now is somewhere between 140-1 and 335-1 (…)

Perhaps the biggest, ironically, is the shift to performance-related pay. However valid the arguments for this kind of compensation structure, it introduces more risk for the executive. Managers behave just like everyone else: when a payoff is uncertain and a long way into the future, it counts for less in their mind. As a result, they are incentivised to demand a higher absolute amount to compensate. Research by Sandy Pepper of the London School of Economics shows that the typical discount rate that managers apply to deferred bonuses is 30%, far in excess of the risk-free interest rate used in accounting valuations of LTIs. To get executives like Mr de Castro to move jobs, you have to pay them more.

À la prochaine…

Ivan Tchotourian

Ce contenu a été mis à jour le 29 juin 2016 à 22 h 02 min.

Commentaires