Nouvelles diverses | Page 14

Gouvernance Nouvelles diverses parties prenantes

Hiérarchiser les parties prenantes : comment ?

Ivan Tchotourian 14 juillet 2020 Ivan Tchotourian

Dans l’Harvard Law School Forum on Corporate Governance, un article intéressant – et court – apporte un bel éclairage sur la gestion des parties prenantes : « A Hierarchy of Stakeholder Needs » (de Sarah Keohane Williamson, FCLTGlobal, 22 juin 2020).

Extrait :

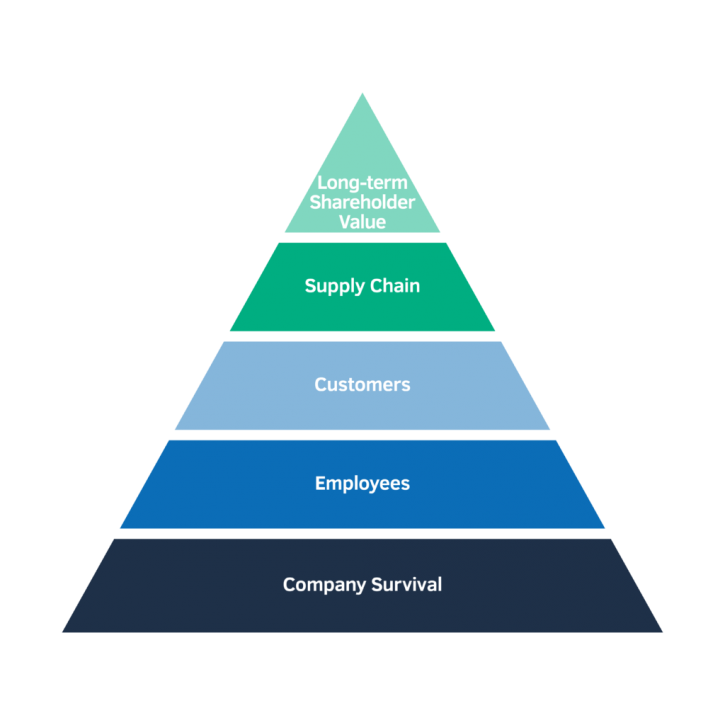

Amid the extraordinary circumstances and economic difficulties brought on by COVID-19, companies in 2020 are faced with decisions on how to best serve the many stakeholders that rely on them—customers, investors, suppliers, employees, and so on. Each group has its own distinct needs and contributions to the company’s overall success, and companies recognize that these groups build on each other to serve their purpose.

(…) Survival for the company itself represents the basic need of the hierarchy. A company’s first priority has to be ensuring it is resilient (and liquid) enough to outlast the crisis. If this need is not met, there are no employees, customers, or other stakeholders to serve. Hard decisions may have to be made to ensure the long-term survival of the enterprise that will affect other tiers of needs—closing stores, furloughing employees, or postponing dividends to investors. Once the basic need is met, however, and the company is a going concern, the company can reorient its focus.

Employees look to their employer for security in more ways than one—financial, to be sure, but also physical. Many companies addressed this area first in its response to COVID-19—89% of respondents to a recent FCLTGlobal survey indicated that employee health and safety was its top priority. (…)

Once the house is in order, customers’ needs can follow. Just as customers depend on a company’s products, the company relies on a consistent, repeatable client base to stay in operation. Like before, this tier is dependent on the one that precedes it—if there were no company, or no employees to keep it running, there would be no customers to serve.

(…) Once customers’ needs are met and business can continue, the supply chain must be maintained. COVID-19 has presented a real challenge in terms of supply for many companies, particularly when sourcing products from countries that are in strict lockdowns.

(…) Then, finally, the company is able to achieve long-term value for its shareholders. Meeting the preceding needs—viability through liquidity, employee wellbeing, extraordinary customer care, and supply chain continuity—may have resulted in near-term shortfalls for shareholders by way of lower earnings or a temporary pause in issuing dividends.

À la prochaine…

Gouvernance mission et composition du conseil d'administration Nouvelles diverses

Une vedette dans votre CA ?

Ivan Tchotourian 9 juillet 2020 Ivan Tchotourian

À leur habitude, Sophie-Emmanuelle Chebin et Joanne Desjardins offrent un billet très intéressant : faut-il faire la place à une célébrité dans son CA ? (« Vedettes au CA: une pratique qui suscite l’intérêt! », Les affaires.com, 8 juillet 2020) Une belle question que je ne m’étais pas posée tant je crois davantage dans la compétence qu’à la notoriété. Toutefois, leur billet me fait réfléchir…

Extrait :

Voici quelques recommandations pour tirer le meilleur parti de ces additions au sein du CA :

Gérer les attentes de part et d’autre

Il est essentiel d’avoir les discussions d’usage sur l’intérêt et la disponibilité de cette personne pour la charge d’administrateur. Personne ne veut d’un administrateur fantôme au sein de son CA, peu importe que cette personne soit connue ou non !

Il est aussi recommandé de clarifier auprès de l’administratrice vedette son rôle et les attentes quant à sa contribution. Sera-t-elle ambassadrice de l’organisation ou jouera-t-elle un rôle plus effacé sur la place publique? Devra-t-elle partager son réseau? Il est aussi crucial d’aborder la question des prises de position publiques de cette personnalité dans l’espace médiatique. Sans la museler, il faudrait éviter que ses prises de positions publiques portent ombrage à la réputation de l’entreprise et de sa marque.

En s’assurant que les attentes du CA et celles de l’administratrice sont alignées, on maximise les chances de bâtir une relation fructueuse et durable.

Mettre à profit leurs compétences

Comme pour tout administrateur, il est essentiel de mettre en valeur les compétences uniques de cette personne pour l’engager dans les travaux du CA. Révélée au monde pour son interprétation du personnage d’Hermione Granger dans l’adaptation cinématographique de la saga « Harry Potter », ce sont les prises de position d’Emma Watson à l’égard de la mode éthique qui lui ont valu d’être nommée présidente du comité de développement durable de Kering, compagnie mère de Gucci.

La dynamique au CA

La présence d’une personnalité publique au sein du CA peut modifier la dynamique des discussions. Le grand défi pour ces administrateurs est de ne pas asphyxier les réflexions des CA que l’on souhaite larges et inclusives. Parmi les autres administrateurs, personne n’est à l’abri d’être groupie, d’être subjugués par les prises de positions de cette personne ou de devenir moins expressif de peur du jugement de cette personnalité connue. Aussi, il faut être à l’affût de l’impact que cette nouvelle personne peut avoir sur les débats du CA.

À la prochaine…

actualités canadiennes Base documentaire doctrine Gouvernance mission et composition du conseil d'administration normes de droit Responsabilité sociale des entreprises

Sociétés fermées et diversité au Canada : que dit le droit ?

Ivan Tchotourian 9 juillet 2020 Ivan Tchotourian

Sympathique petit billet de Me Lapierre du cabinet TJD sur une question simple : « Est-ce qu’une société fermée a l’obligation d’avoir un certain nombre d’administrateurs et de dirigeants issus de la diversité? ».

Extrait :

Non. Les sociétés par actions à capital fermé régies par la Loi sur les sociétés par actions et par la Loi canadienne sur les sociétés par actions n’ont pas de règles particulières à suivre en matière de diversification des membres composant le conseil d’administration et la haute direction.

Un important mouvement de diversification des administrateurs et dirigeants d’entreprises de divers secteurs a cependant vu le jour au cours des dernières années. Plusieurs sociétés canadiennes, qu’elles soient ou non des émetteurs assujettis, ont adopté, dans le cadre de ce mouvement, des politiques internes afin de promouvoir la diversité au sein de leur entreprise.

Le 1er janvier 2020, la Loi canadienne sur les sociétés par actions a par ailleurs été modifiée afin d’imposer aux sociétés fédérales ayant fait un appel public à l’épargne et aux émetteurs émergents de divulguer à leurs actionnaires des renseignements sur la diversité au sein de leur conseil d’administration et de la haute direction. La représentation relative de quatre groupes désignés soit les femmes, les autochtones (Premières nations, Inuit et Métis), les personnes handicapées et les personnes qui font partie des minorités visibles est désormais obligatoire pour ces sociétés. Les sociétés doivent soit divulguer des renseignements sur leurs politiques et objectifs relativement à la représentation des groupes désignés ou expliquer les raisons pour lesquelles elles n’ont pas adopté de tels politiques et objectifs.1 Cela aura vraisemblablement pour effet de promouvoir dans les prochaines années la participation des membres issus de ses groupes dans des postes importants au sein de ces entreprises.

Nous ne retrouvons cependant pas à l’heure actuelle cette exigence pour les sociétés à capital fermé et pour les sociétés régies par la loi provinciale. Il y a lieu d’indiquer que nombreuses sont les études et les recherches dans le milieu des affaires démontrant une corrélation entre la diversité au sein d’un conseil d’administration, la performance financière et la création de valeur pour les entreprises ayant fait le choix de diversifier le profil des candidats dans des postes décisionnels. Il serait par ailleurs pertinent pour certaines d’entre-elles de se questionner quant à la pertinence d’adopter une politique en ce sens, afin de bénéficier, qui sait, des avantages rattachés à cette diversification.

À la prochaine…

actualités internationales Gouvernance mission et composition du conseil d'administration normes de droit Responsabilité sociale des entreprises

Grèce : 25 % de femmes au CA imposé par la loi

Ivan Tchotourian 9 juillet 2020

Minerva Analytics apporte une belle mise à jour à la problématique de la diversité en m’apprenant que la Grèce vient de renforcer son dispositif juridique en matière de féminisation : « Greek companies will soon be mandated to meet a 25% female quota on their boards following a landmark decision for gender diversity ».

Extrait :

The quota requirement has been included as an amendment to the bill transposing the EU Shareholder Rights Directive II (SRD II) into Greek law, and is the result of a consultation led by a group of academics specialising in corporate governance.

(…)

Overall, the directive is designed to encourage companies away from short-termism, focusing on areas such as director remuneration. However, the Greek amendment marks the first time it has been used to tackle the EU’s poor record on gender diversity at a board level.

According to the European Commission’s 2019 report on equality between men and women, since 2015, progress on corporate gender inclusivity has stalled. As of October 2018, the proportion of women on the boards of the EU’s biggest companies was only 26.7%.

Within this, France was the only EU member state with at least 40% female representation at board-level, while women account for less than a third of board-level positions in Italy, Sweden, Finland and Germany.

According to the same data, women made up less than 10% of board members in Greece.

À la prochaine…

actualités internationales Divulgation Gouvernance normes de droit

Tranparence en matière de COVID-19 : quel bilan des entreprises aux États-Unis ?

Ivan Tchotourian 9 juillet 2020 Ivan Tchotourian

David Larcker, Bradford Lynch, Brian Tayan et Daniel Taylor publient un texte qui revient sur la transparence des ghrandes entreprises américaines en matière de COVID-19 « The Spread of Covid-19 Disclosure » (29 juin 2020). Un document plein de statistiques et de tendances sur la transparence… vraiment intéressant sachant que l’enjeu de la question n’est pas à négliger.

Extrait :

The COVID-19 pandemic presents an interesting scenario whereby an unexpected shock to the economic system led to a rapid deterioration in the economic landscape, causing sharp changes in performance relative to expectations just a few months prior. For most companies, the pandemic has been detrimental. For a few, it brought unexpected demand. In many cases, supply chains have been strained, causing ripple effects that extend well beyond any one company.

How do companies respond to such a situation? What choices do they make, and how much transparency do they offer? How does disclosure vary in a setting where the potential impact is so widely uncertain? The COVID-19 pandemic provides a unique setting to examine disclosure choices in a situation of extreme uncertainty that extends across all companies in the public market. This devastating outlier event provides a rare glimpse into disclosure behavior by managers and boards.

Why This Matters

- The COVID-19 pandemic provides a unique opportunity to examine disclosure practices of companies relative to peers in real time about a somewhat unprecedented shock that impacted practically every publicly listed company in the U.S. We see that decisions varied considerably about whether to make disclosure and, if so, what and how much to say about the pandemic’s impact on operations, finances, and future. What motivates some companies to be forthcoming about what they are experiencing, while others remain silent? Does this reflect different degrees of certitude about how the virus would impact their businesses, or differences in managements’ perception of their “obligations” to be transparent with the public? What does this say about a company’s view of its relation and duty to shareholders?

- In one example, we saw a consumer beverage company make zero references to COVID-19 in its SEC filings and website, despite the virus plausibly having at least some impact on its business. In another example, we saw a company claim no material changes to its previously reported risk factors when managers almost certainly had relevant information about the virus and the likely impact on sales and operations. What discussion among the senior managers, board members, external auditor, and general counsel leads to a decision to make no disclosures? What should shareholders glean from this decision, particularly in light of peer disclosure?

- The COVID-19 pandemic represents a so-called “black swan” event that inflicted severe and unexpected damage to wide swaths of the economy. What strategic insights will companies learn from this event? Can boards use these insights to prepare for other possible outlier events, such as climate events, terrorism, cyber-attacks, pandemics, and other emergencies? Should these insights be disclosed to shareholders?

À la prochaine…

actualités internationales Gouvernance mission et composition du conseil d'administration

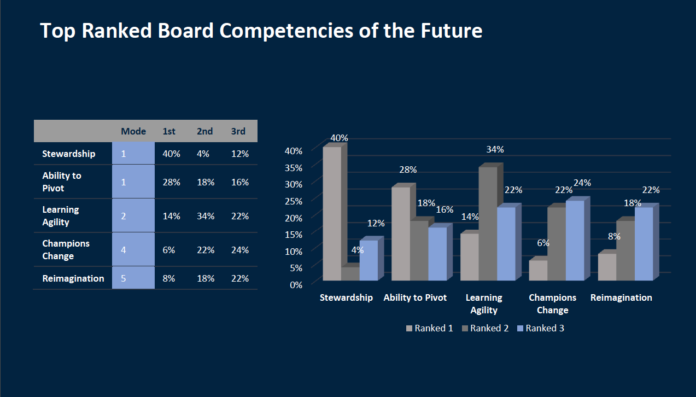

What The Director Of The Future Will Need To Succeed

Ivan Tchotourian 8 juillet 2020 Ivan Tchotourian

Board Member vient de publier une étude sur les CA du futur : « What The Director Of The Future Will Need To Succeed ». Intéressant dans le monde post COVID-19.

Merci à Louise Champoux-Paillé de l’information !

Extrait :

“The future of business will be different,” surmised a director on a recent virtual board roundtable hosted by RSR Partners, “in ways we can’t anticipate in this moment. Our board is focused on assessing whether all our directors are truly ready for what’s coming.”

Over the past few months, RSR Partners hosted more than a dozen roundtables for sitting directors, providing a forum for the participants to share what their boards are learning as they navigate the current crisis and pivot into the “new normal.” While tackling topics as diverse as commercial strategy, operations, health and safety, and the future of business, one theme was pervasive throughout the discussions: leadership and stakeholders will be looking to the boardroom for guidance, and board members not only need to have the requisite experience and skills to confidently provide direction, but the leadership characteristics that will allow them to be effective.

Fundamentally, the global business disruption and current uncertainty has created a need for a higher level of involvement from board members. “This is a time to have board members who have experienced really tough issues, such as major ecessions, difficult mergers, major cost cutting, insolvency and bankruptcy, and top management departures, along with experience in reinventing companies, including supply chain, product engineering and simplification, digital transformation, offshore manufacturing and procurement, sale of subsidiaries, and comprehensive refinancing,” stated Edward A. Kangas, former Chairman and CEO of Deloitte Touche. “This is not a time for deep thinking. It’s time for people with real experience who know how to oversee and support management in a time of crisis and reinvention.” (Mr. Kangas currently serves on the following boards: Deutsche Bank USA Corp., Intelsat SA, VIVUS, Inc., and Hovnanian Enterprises, Inc.).

Characteristics of Directors Who Succeed in the “New Normal”

From a practical perspective, there is now a higher premium placed on a director’s proven ability to navigate a business through a crisis while mitigating risk and understanding how and when to pull the levers that will impact balance sheets. The demand to optimize results, sustain business, and adapt to changes in a regional and global market has increased alongside the time commitment and attention to detail required of directors to address these issues. Normal requirements for sound governance, audit oversight, compensation strategies, business performance goals, and succession of key leadership have continued to be paramount during the crisis. However, what the current crisis has forced boards to recognize is that a combination of specialized and diversified skillsets and characteristics will produce good corporate governance in and after 2020.

In addition to listening to the characteristics discussed in the recent roundtables, RSR Partners polled more than 250 public company board members of Fortune 50-1000 companies to identify the traits they hope to see emerge in this generation of board members. The results indicated that stewardship, the ability to pivot and learn agility, to be a champion of change, and to be capable of reimagination will be most needed by the directors charged with steering their boards in the “new normal.”

1. Stewardship

2. Ability to Pivot

3. Learning Agility

4. Champions of Change

5. Reimagination

À la prochaine…

Gouvernance Nouvelles diverses

COVID-19 et gouvernance : et l’éthique ?

Ivan Tchotourian 7 juillet 2020 Ivan Tchotourian

Le 26 juin 2020, Deloitte a publié une étude intéressante : « Global businesses divided on implications of COVID-19 crisis for company ethics ».

Extrait :

As businesses start to look beyond the COVID-19 crisis, the EY Global Integrity Report 2020 reveals divisions on the repercussions for company ethics as a result of the pandemic.

The findings are part of a survey of almost 3,000 respondents from 33 countries up to February 2020, analyzing the ethical challenges companies face in turbulent times. An additional 600 employees across all levels of seniority were surveyed at the height of the COVID-19 crisis in April in companies across six countries – China, Germany, Italy, the UK, India and the US.

The majority (90%) of respondents surveyed during the crisis believe that disruption, as a result of COVID-19, poses a risk to ethical business conduct, but there is a concerning disparity between boards, senior management and employees on the implications for compliance. While 43% of board members and 37% of senior managers surveyed believe the pandemic could lead to change and better business ethics, only 21% of junior employees appear to agree.

The survey highlights that signs of an integrity disconnect at different levels within organizations were evident even before the pandemic with more than half of board members (55%) believing management demonstrate professional integrity, but only 37% of junior employees sharing the same sentiment. In addition, over half of board members (55%) believe there are managers in their organization who would sacrifice integrity for short term gain.

À la prochaine…