Nouvelles diverses

actualités canadiennes Gouvernance Nouvelles diverses parties prenantes

Raison d’être et gouvernance : un couple

Ivan Tchotourian 29 avril 2021 Ivan Tchotourian

Pas de raison d’être sans gouvernance ! clament André Coupet et Marie-France Veilleux (Gestion, 21 avril 2021). Cet articles est intéressant car il fait le lien entre la raison d’être et la gouvernance et montre que la gouvernance doit évoluer si la raison d’être ne veut pas être de façade.

Extrait :

(…) Il existe une troisième implication sous-jacente aux deux premières. Elle implique la gouvernance de l’entreprise. Celle-ci est l’élément central qui fait que l’exercice de se donner une raison d’être devient une réussite. C’est la gouvernance de l’entreprise qui doit déployer la nouvelle stratégie et qui doit piloter la mise en œuvre effective de cette raison d’être et des engagements stratégiques qui en découlent.

Le moteur de la raison d’être

La gouvernance est trop souvent comprise sous l’angle de la conformité aux réglementations et aux institutions. Or, il s’agit plutôt de l’art de diriger et de prendre des décisions, dans le respect des règles ou des statuts de l’organisation, tout en ayant en tête l’horizon des décisions. Les choix à court terme ne doivent pas aller à l’encontre de la pérennité de l’organisation.

Pour construire une raison d’être et s’assurer que celle-ci soit transformative, la gouvernance doit être forte. Elle doit être capable de réorienter l’entreprise et d’assumer les engagements, par exemple en lançant de nouveaux produits et services conformes à la raison d’être, ou en abandonnant, s’il le faut, une partie du chiffre d’affaires jugé trop émetteur de CO².

La gouvernance doit être ouverte :

À la consultation effective des parties prenantes : cette consultation, qui servivra à la définition de la raison d’être de l’organisation, doit retenir aussi bien les critiques à l’égard de l’entreprise que les besoins, les attentes et les suggestions pour bâtir les différentes propositions de valeur.

Au partage de la prise de décision par de nouveaux acteurs : habituellement moins présents autour des tables de décision. Un conseil diversifié à tous niveaux démontre l’acceptation d’une autre façon de penser. Pensons à la nomination d’administrateurs salariés au sein des conseils d’administration (CA). Aujourd’hui, le succès d’une organisation est davantage basé sur le talent que sur le capital. Les actionnaires ne sont donc plus les seuls détenteurs du savoir. Le capitalisme des parties prenantes, perspective évoquée notamment au dernier forum de Davos2, ne sera une réalité que lorsque les CA, lieux de pouvoir par excellence, s’ouvriront aux parties prenantes, soit directement, soit, à minima, en tenant compte des avis d’un comité des parties prenantes

À l’ajustement des valeurs de l’organisation : le respect, la solidarité ou la générosité sont des guides indispensables qui permettent à l’entreprise de s’adresser à des problématiques de pauvreté, d’éducation, d’isolement, etc.

Une boussole entre les mains du CA

Si la raison d’être de l’entreprise est comprise comme étant non seulement le but de l’organisation, mais aussi la boussole de l’entreprise qui donne quotidiennement la route à suivre, alors il est clair que le gardien de la raison d’être est le CA. Son nouveau rôle vient conforter le premier, soit celui de gardien de la pérennité de l’organisation.

Axé sur le long terme, le CA doit s’impliquer totalement, tant dans l’exercice de la définition de la raison d’être que dans celui du plan stratégique. Il doit choisir et décider. L’équipe de direction doit opérationnaliser les choix, ce qui est tout un défi d’agilité et de résilience.

Cette vision d’un CA compétent et impliqué, centrée sur la raison d’être et la stratégie, débouche logiquement sur une séparation des pouvoirs entre la présidence du conseil et la direction générale. Cela semble d’ailleurs devenir la règle. En effet, près de 60% des entreprises américaines inscrites et cotées à l’indice Standard and Poor’s appliquent cette séparation des pouvoirs.

Les deux instances se complètent en termes d’horizon. Le CA n’a clairement pas à s’immiscer dans la gestion quotidienne. Son rôle «n’est pas de gérer, mais bien de formuler une vision de l’avenir», selon Michel Nadeau, cofondateur de l’Institut sur la gouvernance d’organisations publiques et privées.

À la prochaine…

Gouvernance Nouvelles diverses parties prenantes Responsabilité sociale des entreprises

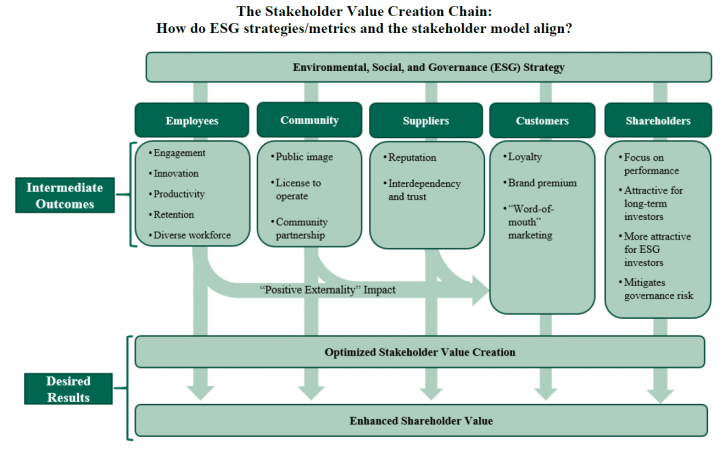

The Stakeholder Model and ESG

Ivan Tchotourian 17 septembre 2020 Ivan Tchotourian

Intéressant article sur l’Harvard Law School Forum on Corporate Governance consacré au modèle partie prenante et à ses liens avec les critères ESG : « The Stakeholder Model and ESG » (Ira Kay, Chris Brindisi et Blaine Martin, 14 septembre 2020).

Extrait :

Is your company ready to set or disclose ESG incentive goals?

ESG incentive metrics are like any other incentive metric: they should support and reinforce strategy rather than lead it. Companies considering ESG incentive metrics should align planning with the company’s social responsibility and environmental strategies, reporting, and goals. Another essential factor in determining readiness is the measurability/quantification of the specific ESG issue.

Companies will generally fall along a spectrum of readiness to consider adopting and disclosing ESG incentive metrics and goals:

- Companies Ready to Set Quantitative ESG Goals: Companies with robust environmental, sustainability, and/or social responsibility strategies including quantifiable metrics and goals (e.g., carbon reduction goals, net zero carbon emissions commitments, Diversity and Inclusion metrics, employee and environmental safety metrics, customer satisfaction, etc.).

- Companies Ready to Set Qualitative Goals: Companies with evolving formalized tracking and reporting but for which ESG matters have been identified as important factors to customers, employees, or other These companies likely already have plans or goals around ESG factors (e.g., LEED [Leadership in Energy and Environmental Design]-certified office space, Diversity and Inclusion initiatives, renewable power and emissions goals, etc.).

- Companies Developing an ESG Strategy: Some companies are at an early stage of developing overall ESG/stakeholder strategies. These companies may be best served to focus on developing a strategy for environmental and social impact before considering linking incentive pay to these priorities.

We note it is critically important that these ESG/stakeholder metrics and goals be chosen and set with rigor in the same manner as financial metrics to ensure that the attainment of the ESG goals will enhance stakeholder value and not serve simply as “window dressing” or “greenwashing.” [9] Implementing ESG metrics is a company-specific design process. For example, some companies may choose to implement qualitative ESG incentive goals even if they have rigorous ESG factor data and reporting.

Will ESG metrics and goals contribute to the company’s value-creation?

The business case for using ESG incentive metrics is to provide line-of-sight for the management team to drive the implementation of initiatives that create significant differentiated value for the company or align with current or emerging stakeholder expectations. Companies must first assess which metrics or initiatives will most benefit the company’s business and for which stakeholders. They must also develop challenging goals for these metrics to increase the likelihood of overall value creation. For example:

- Employees: Are employees and the competitive talent market driving the need for differentiated environmental or social initiatives? Will initiatives related to overall company sustainability (building sustainability, renewable energy use, net zero carbon emissions) contribute to the company being a “best in class” employer? Diversity and inclusion and pay equity initiatives have company and social benefits, such as ensuring fair and equitable opportunities to participate and thrive in the corporate system.

- Customers: Are customer preferences driving the need to differentiate on sustainable supply chains, social justice initiatives, and/or the product/company’s environmental footprint?

- Long-Term Sustainability: Are long-term macro environmental factors (carbon emissions, carbon intensity of product, etc.) critical to the Company’s ability to operate in the long term?

- Brand Image: Does a company want to be viewed by all constituencies, including those with no direct economic linkage, as a positive social and economic contributor to society?

There is no one-size-fits-all approach to ESG metrics, and companies fall across a spectrum of needs and drivers that affect the type of ESG factors that are relevant to short- and long-term business value depending on scale, industry, and stakeholder drivers. Most companies have addressed, or will need to address, how to implement ESG/stakeholder considerations in their operating strategy.

Conceptual Design Parameters for Structuring Incentive Goals

For those companies moving to implement stakeholder/ESG incentive goals for the first time, the design parameters range widely, which is not different than the design process for implementing any incentive metric. For these companies, considering the following questions can help move the prospect of an ESG incentive metric from an idea to a tangible goal with the potential to create value for the company:

- Quantitative goals versus qualitative milestones. The availability and quality of data from sustainability or social responsibility reports will generally determine whether a company can set a defined quantitative goal. For other companies, lack of available ESG data/goals or the company’s specific pay philosophy may mean ESG initiatives are best measured by setting annual milestones tailored to selected goals.

- Selecting metrics aligned with value creation. Unlike financial metrics, for which robust statistical analyses can help guide the metric selection process (e.g., financial correlation analysis), the link between ESG metrics and company value creation is more nuanced and significantly impacted by industry, operating model, customer and employee perceptions and preferences, etc. Given this, companies should generally apply a principles-based approach to assess the most appropriate metrics for the company as a whole (e.g., assessing significance to the organization, measurability, achievability, etc.) Appendix 1 provides a list of common ESG metrics with illustrative mapping to typical stakeholder impact.

- Determining employee participation. Generally, stakeholder/ESG-focused metrics would be implemented for officer/executive level roles, as this is the employee group that sets company-wide policy impacting the achievement of quantitative ESG goals or qualitative milestones. Alternatively, some companies may choose to implement firm-wide ESG incentive metrics to reinforce the positive employee engagement benefits of the company’s ESG strategy or to drive a whole-team approach to achieving goals.

- Determining the range of metric weightings for stakeholder/ESG goals. Historically, US companies with existing environmental, employee safety, and customer service goals as well as other stakeholder metrics have been concentrated in the extractive, industrial, and utility industries; metric weightings on these goals have ranged from 5% to 20% of annual incentive scorecards. We expect that this weighting range would continue to apply, with the remaining 80%+ of annual incentive weighting focused on financial metrics. Further, we expect that proxy advisors and shareholders may react adversely to non-financial metrics weighted more than 10% to 20% of annual incentive scorecards.

- Considering whether to implement stakeholder/ESG goals in annual versus long-term incentive plans. As noted above, most ESG incentive goals to date have been implemented as weighted metrics in balanced scorecard annual incentive plans for several reasons. However, we have observed increased discussion of whether some goals (particularly greenhouse gas emission goals) may be better suited to long-term incentives. [10] There is no right answer to this question—some milestone and quantitative goals are best set on an annual basis given emerging industry, technology, and company developments; other companies may have a robust long-term plan for which longer-term incentives are a better fit.

- Considering how to operationalize ESG metrics into long-term plans. For companies determining that sustainability or social responsibility goals fit best into the framework of a long-term incentive, those companies will need to consider which vehicles are best to incentivize achievement of strategically important ESG goals. While companies may choose to dedicate a portion of a 3-year performance share unit plan to an ESG metric (e.g., weighting a plan 40% relative total shareholder return [TSR], 40% revenue growth, and 20% greenhouse gas reduction), there may be concerns for shareholders and/or participants in diluting the financial and shareholder-value focus of these incentives. As an alternative, companies could grant performance restricted stock units, vesting at the end of a period of time (e.g., 3 or 4 years) contingent upon achievement of a long-term, rigorous ESG performance milestone. This approach would not “dilute” the percentage of relative TSR and financial-based long-term incentives, which will remain important to shareholders and proxy advisors.

Conclusion

As priorities of stakeholders continue to evolve, and addressing these becomes a strategic imperative, companies may look to include some stakeholder metrics in their compensation programs to emphasize these priorities. As companies and Compensation Committees discuss stakeholder and ESG-focused incentive metrics, each organization must consider its unique industry environment, business model, and cultural context. We interpret the BRT’s updated statement of business purpose as a more nuanced perspective on how to create value for all stakeholders, inclusive of shareholders. While optimizing profits will remain the business purpose of corporations, the BRT’s statement provides support for prioritizing the needs of all stakeholders in driving long-term, sustainable success for the business. For some companies, implementing incentive metrics aligned with this broader context can be an important tool to drive these efforts in both the short and long term. That said, appropriate timing, design, and communication will be critical to ensure effective implementation.

À la prochaine…

actualités internationales Gouvernance Normes d'encadrement parties prenantes Responsabilité sociale des entreprises

Pour un comité social et éthique en matière de gouvernance

Ivan Tchotourian 17 septembre 2020 Ivan Tchotourian

Dans BoardAgenda, Gavin Hinks propose une solution pour que les parties prenantes soient mieux pris en compte : la création d’un comité social et éthique (déjà en fonction en Afrique du Sud) : « Companies ‘need new mechanism’ to integrate stakeholder interests » (4 septembre 2020).

Extrait :

While section 172 of the Companies Act—the key law governing directors’ duties—has been sufficiently flexible to enable companies to re-align themselves with stakeholders so far, it provides no guarantee they will maintain that disposition.

In their recent paper, MacNeil and Esser argue more regulation is needed and in particular a mandatory committee drawing key stakeholder issues to the board and then reporting on them to shareholders.

Known as the “social and ethics committee” in South Africa, a similar mandatory committee in the UK considering ESG (environmental, social and governance) issues “will provide a level playing field for stakeholder engagement,” write MacNeil and Esser.

Recent evidence, they concede, suggests the committees in South Africa are still evolving, but there are advantages, with the committee “uniquely placed with direct access to the main board and a mandate to reach into the depths of the business”.

“As a result, it is capable of having a strong influence on the way a company heads down the path of sustained value creation.”

Will stakeholderism stick?

The issue of making “stakeholder” capitalism stick has vexed others too. The issue was a dominant agenda item at the World Economic Forum’s Davos conference this year, as well as becoming a key element in the presidential campaign of Democrat candidate Joe Biden.

Others worry that stakeholderism is a talking point only, prompting no real change in some companies. Indeed, when academics examined the practical policy outcomes from the now famous 2019 pledge by the Business Roundtable—a group of US multinationals—to shift their focus from shareholders to stakeholders, they found the companies wanting.

In the UK, at least, some are taking the issue very seriously. The Institute of Directors recently launched a new governance centre with its first agenda item being how stakeholderism can be integrated into current governance structures.

Further back the Royal Academy, an august British research institution, issued its own principles for becoming a “purposeful business”, another idea closely associated with stakeholderism.

The stakeholder debate has a long way to run. If the idea is to gain traction it will undoubtedly need a stronger commitment in regulation than it currently has, or companies could easily wander from the path. That may depend on public demand and political will. But Esser and MacNeil may have at least indicated one way forward.

À la prochaine…

Gouvernance Nouvelles diverses parties prenantes

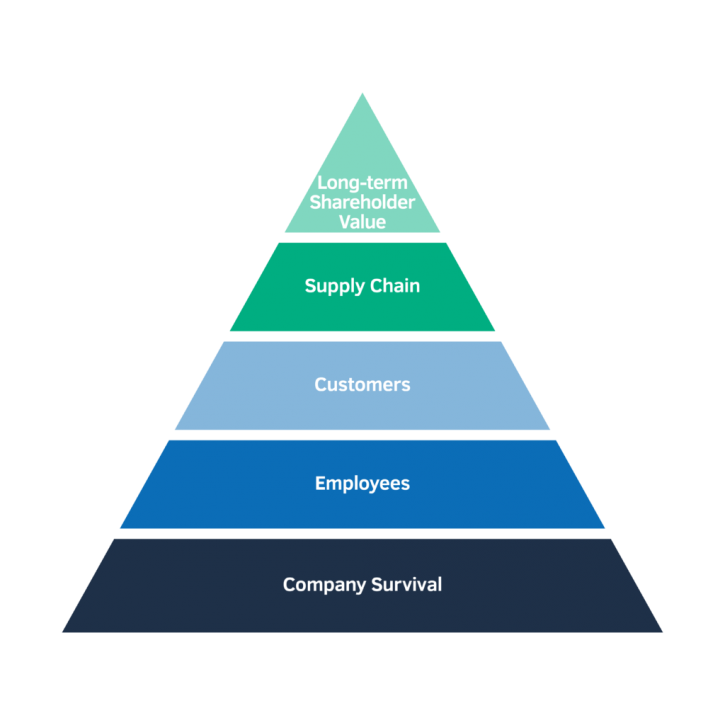

Hiérarchiser les parties prenantes : comment ?

Ivan Tchotourian 14 juillet 2020 Ivan Tchotourian

Dans l’Harvard Law School Forum on Corporate Governance, un article intéressant – et court – apporte un bel éclairage sur la gestion des parties prenantes : « A Hierarchy of Stakeholder Needs » (de Sarah Keohane Williamson, FCLTGlobal, 22 juin 2020).

Extrait :

Amid the extraordinary circumstances and economic difficulties brought on by COVID-19, companies in 2020 are faced with decisions on how to best serve the many stakeholders that rely on them—customers, investors, suppliers, employees, and so on. Each group has its own distinct needs and contributions to the company’s overall success, and companies recognize that these groups build on each other to serve their purpose.

(…) Survival for the company itself represents the basic need of the hierarchy. A company’s first priority has to be ensuring it is resilient (and liquid) enough to outlast the crisis. If this need is not met, there are no employees, customers, or other stakeholders to serve. Hard decisions may have to be made to ensure the long-term survival of the enterprise that will affect other tiers of needs—closing stores, furloughing employees, or postponing dividends to investors. Once the basic need is met, however, and the company is a going concern, the company can reorient its focus.

Employees look to their employer for security in more ways than one—financial, to be sure, but also physical. Many companies addressed this area first in its response to COVID-19—89% of respondents to a recent FCLTGlobal survey indicated that employee health and safety was its top priority. (…)

Once the house is in order, customers’ needs can follow. Just as customers depend on a company’s products, the company relies on a consistent, repeatable client base to stay in operation. Like before, this tier is dependent on the one that precedes it—if there were no company, or no employees to keep it running, there would be no customers to serve.

(…) Once customers’ needs are met and business can continue, the supply chain must be maintained. COVID-19 has presented a real challenge in terms of supply for many companies, particularly when sourcing products from countries that are in strict lockdowns.

(…) Then, finally, the company is able to achieve long-term value for its shareholders. Meeting the preceding needs—viability through liquidity, employee wellbeing, extraordinary customer care, and supply chain continuity—may have resulted in near-term shortfalls for shareholders by way of lower earnings or a temporary pause in issuing dividends.

À la prochaine…

actualités internationales Gouvernance normes de droit parties prenantes place des salariés Responsabilité sociale des entreprises

Bulletin Joly Travail : deux articles à lire

Ivan Tchotourian 7 juillet 2020 Ivan Tchotourian

Dans le dossier Droit du travail et droit des sociétés : questions d’actualité réalisé sous la coordination scientifique de Jérôme Chacornac et Grégoire Duchange, je signale deux articles intéressants touchant les thématiques du blogue :

À la prochaine…

actualités internationales Gouvernance parties prenantes Responsabilité sociale des entreprises

Time to Rethink the S in ESG

Ivan Tchotourian 4 juillet 2020 Ivan Tchotourian

Intéressant billet sur le Harvard Law School Forum on Corporate Governance mettant en avant l’importance prise par le « S » des critères ESG : « Time to Rethink the S in ESG » (Jonathan Neilan, Peter Reilly, et Glenn Fitzpatrick, 28 juin 2020).

Extrait :

In advising companies on protecting and enhancing corporate reputation—through good and bad times—our guiding principle is to ‘do the right thing’. Simple as it sounds, it is reflected in the adage that ‘good PR starts with good behaviour’. This guiding principle also translates to building your ‘S’ credentials. While the various ESG criteria of the reporting frameworks and ratings agencies are a useful guide, our consistent approach in advising companies is for them to take the steps they believe are genuinely in the best interest of the company and its wider stakeholders. Not every decision will meet the expectations of every stakeholder; but it’s a good place to start.

As the wider sustainability agenda also drives more rapid and fundamental change in global markets and technology innovation, properly considering the pressure from public policy and evolving legal requirements, as well as the needs of key stakeholders, is key to understanding what is (and will be seen as) ‘good behaviour’.

As the focus on the ‘S’ grows, companies will need to shift from a reactive to a proactive position. While governance and environmental data is readily available for most companies, the same is not true of the ‘S’. The leeway companies have been afforded on the ‘S’ in the past is unlikely to continue; and, expectations of (and measurement by) rating agencies and investors will continue to increase.

In light of the economic shocks and social upheaval across the globe, demands from stakeholders—most pressingly investors and Governments—will reach a crescendo over the coming six months. As the sole arbiter of much of the information needed to value the ‘S’ in ESG, companies have an opportunity to demonstrate a willingness to shift levels of transparency before they are forced to do so. Companies understandably tend to highlight the efforts they make, often through their corporate social responsibility or communications departments, rather than the higher-cost, higher-risk analysis of the effectiveness of those efforts. Fundamentally, hastened by the emergence of a global pandemic, the world recognises the significance of the risk that failure to address stakeholder interests and expectations represents to business. That shift can be identified as demand for evidence of positive outcomes as opposed to simply efforts or policies.

As we noted in our 2019 Paper, ESG will never replace financial performance as the primary driver of company valuations. Increasingly, however, it is proving to drive the cost of capital down for companies while playing a hugely important role in companies’ risk management frameworks. Most immediately, companies should get a firm handle on how comprehensive their policies, procedures and data are in the five areas listed through a candid audit, as well as other factors material to their businesses’ long-term success. However, this is just a first step and companies must build a narrative and strategy around disclosure for all future annual reports and, where appropriate, market communications. Investors of all sizes are increasingly driving this factor home to Boards and management. In just one week at the end of April, human capital management proposals from As You Sow, a non-for-profit foundation, received 61% and 79% support at two S&P 500 companies, Fastenal and Genuine Parts, respectively. The two companies must now prepare reports on diversity and inclusion, and describe the company’s policies, performance, and improvement targets related to material human capital risks and opportunities as designed by a small shareholder—as opposed to crafting an approach and associated disclosure themselves.

What has become clear over the past three months is that a host of stakeholders, including many investors, will expect a sea-change in their access to information and company practices. While there is no requirement to be the first mover on this, those that are laggards will face avoidable challenges and a rising threat to their ‘licence to operate’.

À la prochaine…

actualités internationales Gouvernance Normes d'encadrement normes de droit objectifs de l'entreprise parties prenantes Responsabilité sociale des entreprises Structures juridiques

Intéressantes dispositions du Code civil chinois

Ivan Tchotourian 11 juin 2020 Ivan Tchotourian

Le Code civil chinois a été adopté le 28 mai 2020. Il ne rentrera en vigueur qu’au 1er janvier 2021. Deux articles ont attirés mon attention dans une perspective de responsabilité sociétale, articles qui concerne le régime des For-Profit Legal Person (section 2). En substances, voici ce que précisent lesdits articles :

Les actionnaires ne doivent pas intenter à l’intérêt de la personne morale ou à celui des créanciers.

Les entreprises assument une responsabilité sociale.

Order of the President of the People’s Republic of China (No. 45)

The Civil Code of the People’s Republic of China, as adopted at the 3rd Session of the Thirteenth National People’s Congress of the People’s Republic of China on May 28, 2020, is hereby issued, and shall come into force on January 1, 2021.

President of the People’s Republic of China: Xi Jinping

May 28, 2020

Civil Code of the People’s Republic of China

(Adopted at the 3rd Session of the Thirteenth National People’s Congress of the People’s Republic of China on May 28, 2020)

Extrait :

An investor of a for-profit legal person shall not damage the interests of the legal person or any other investor by abusing the rights of an investor. If the investor abuses the rights of an investor, causing any loss to the legal person or any other investor, the investor shall assume civil liability in accordance with the law.

An investor of a for-profit legal person shall not damage the interests of a creditor of the legal person by abusing the independent status of the legal person and the limited liability of the investor. If the investor abuses the legal person’s independent status or the investor’s limited liability to evade debts, causing serious damage to the interests of a creditor of the legal person, the investor shall be jointly and severally liable for the legal person’s debts.

In business activities, a for-profit legal person shall comply with business ethics, maintain the safety of transactions, receive government supervision and public scrutiny, and assume social responsibilities.

Merci à mon collègue, le professeur Bjarne Melkevik, de cette information.

À la prochaine…