autres publications mission et composition du conseil d'administration Normes d'encadrement

Banque d’Angleterre : supervisory statement pour le CA

Ivan Tchotourian 19 mai 2016

L’Autorité prudentielle de la Banque d’Angleterre vient de publier un Supervisory Statement intitulé « Corporate governance: Board responsibilities » (SS5/16, mars 2016).

The Prudential Regulation Authority has published a policy statement and accompanying supervisory statement concerning the responsibilities of boards.

The purpose of this supervisory statement is to identify, for the boards1 of firms regulated by the Prudential Regulation Authority (PRA), those aspects of governance to which the PRA attaches particular importance and to which the PRA may devote particular attention in the course of its supervision. It is not intended to provide a comprehensive guide for boards of what constitutes good or effective governance. There are more general guidelines for that purpose, for example the UK Corporate Governance Code, published by the Financial Reporting Council.

À la prochaine…

Ivan Tchotourian

Gouvernance mission et composition du conseil d'administration normes de droit place des salariés Valeur actionnariale vs. sociétale

Proposition de loi britannique : partage des profits et composition des CA

Ivan Tchotourian 4 février 2016

Un projet de loi est en cours en Angleterre intitulé : The Profit-Sharing and Company Governance (Employees’ Participation) Bill 2015-16. Sa première lecture a été faite récemment, le 26 janvier 2016, à la Chambre des communes.

Même si le projet est assurément plus complet, il comporte deux éléments essentiels :

- Un partage du profit avec les salariés

- Une représentation des salariés au sein du CA

That leave be given to bring in a Bill to make provision about the entitlement of employees to benefit from profits made by their employers in certain circumstances; to require a company to allocate one seat on its board to an employee representative; and for connected purposes.

Pour suivre l’évolution législative du projet : cliquez ici.

À la prochaine…

Ivan Tchotourian

autres publications divulgation financière mission et composition du conseil d'administration Normes d'encadrement normes de droit

Divulgation extra-financière en Angleterre : quel bilan ?

Ivan Tchotourian 3 février 2016

Le Climate Disclosure Standards Board a publié un bilan de la divulgation extra-financière des entreprises dans les domaines environnemental et des gaz à effet de serre du FTSE500 (ici), suite à la réforme introduite au Company Act 2006 en 2013 (Companies Act 2006 (Strategic Report and Directors’ Report) Regulations 2013).

Voici quelques chiffres extraits de ce bilan :

Principal risks : 41% of companies consider environmental risks in their analysis of the principal risks to their company.

KPIs : 27% of companies make use of environmental KPIs. Of those that do, the majority use one of four main categories of KPIs based on: GHG emissions, energy, water or waste management (Figure 1).

Future development : 42% of companies identify environmental matters when considering the future development, performance or position of their company.

Environmental policies : 87% of companies disclosed environmental policies, 78% disclosed their policies and provided an indication of the effectiveness of those policies.

Environmental impacts : 90% of companies disclosed information regarding the environmental impacts of their business operations (Figure 2). Of the 10% that did not, 70% provided an explanation as to why that information was omitted.

GHG emissions : The Regulations require the disclosure of total annual GHG emissions (CO2e) for which a company is responsible. 90% of companies disclosed their total annual GHG emissions. 77% of companies disclosed the breakdown of both Scope 1 and 2 GHG emissions. 41% of companies disclosed omitted emission sources and explained the reasons for omission. Of the companies who explained omissions, the majority (44%) cited materiality as the main reason for omission (Figure 3). The sources of GHG emissions omitted by companies varied widely. Figure 4 shows the range of general categories of information omitted.

À la prochaine…

Ivan Tchotourian

mission et composition du conseil d'administration

Qu’attend-t-on d’un CA ? Réponse d’Andrew Bailey

Ivan Tchotourian 15 novembre 2015

Andrew Bailey, haut responable de la Prudential Regulation Authority britannique, s’est exprimé le 3 novembre 2015 devant la Banque d’Angleterre sur le thème suivant : « Governance and the role of Boards« . Je résume en quelques mots : rendre simple ce qui est complexe !

Morceau choisi :

The PRA has close contact with many Boards, so as supervisors what do we expect of Boards? Three things stand out for me:-

1. we expect Boards to exercise good judgment in overseeing the running of the firm and to do so on a forward-looking basis;

2. that judgement is improved by good constructive challenge from Non-Executives. A firm’s culture should promote discussion, debate and honest challenge. The alarm bells ring for us when we are told that the CEO or other Senior Executives are very sensitive to challenge;

3. so we as supervisors depend on Non-Executives, under the leadership of the Chair, to challenge the Executive in all aspects of the firm’s strategy, which includes the viability and sustainability of the business model and the establishment, maintenance and use of the risk appetite and management framework. We also of course rely on the Non-Executives to mentor and coach the Executives and balancing this with the essential ability to challenge is a vital component of an effective Board.

(…) So, let me put forward a proposition for Boards. It is the job of the Executive to be able to explain in simple and transparent terms these complex matters to Non-Executives. In doing so, you should understand the uncertainty around judgements, in what circumstances they could be wrong, and how there can reasonably be different ways to measure things like liquidity. Non-Executives should not be left to find the answers for themselves, and they should not feel that they have to do so out of a lack of sufficient confidence in what they are being told. In other words, they should not be pointed towards the haystack with warm wishes for the search ahead.

À la prochaine…

Ivan Tchotourian

mission et composition du conseil d'administration

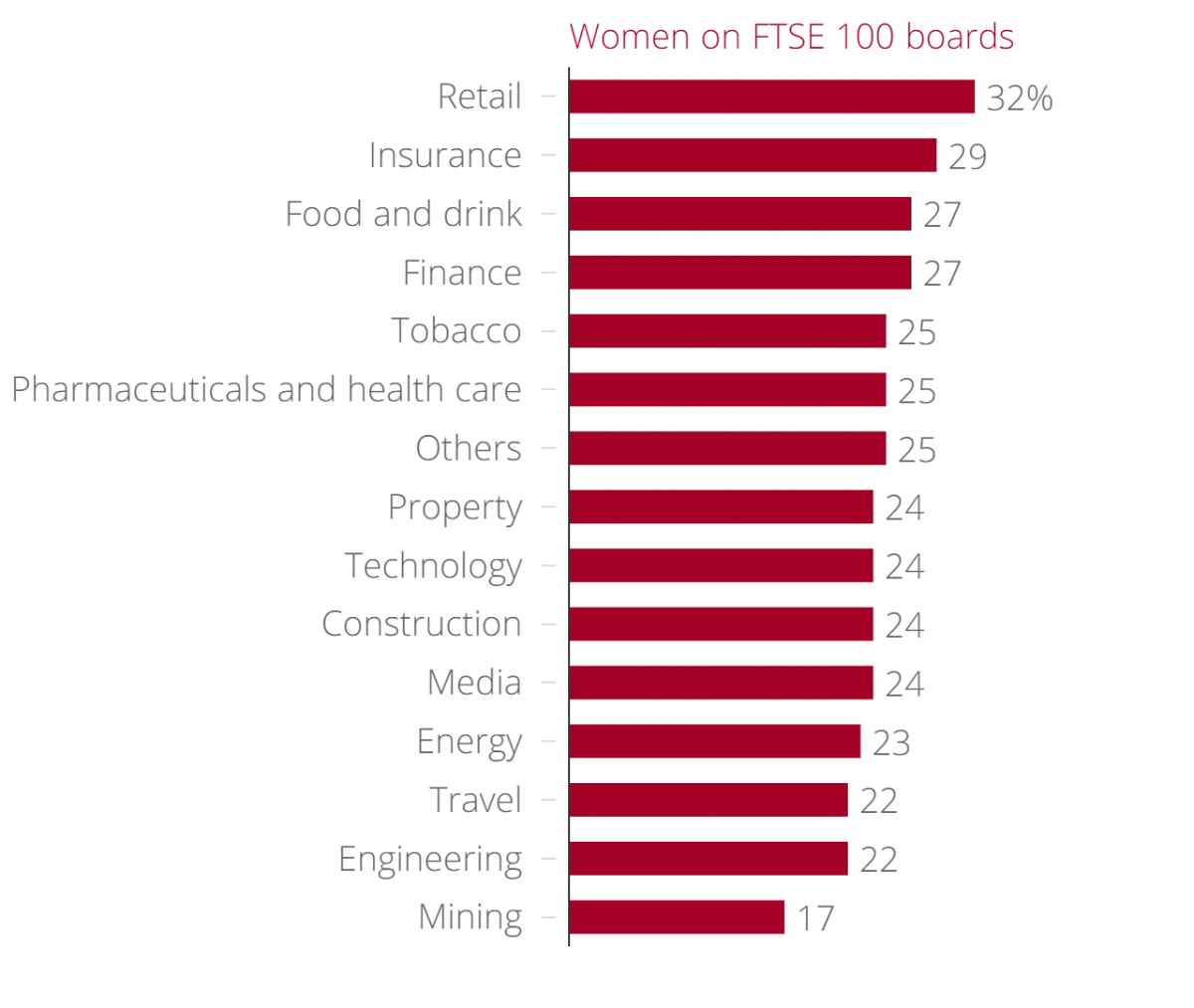

Les pires secteurs de la féminisation des CA

Ivan Tchotourian 1 octobre 2015

Vous êtes curieux de savoir quels sont les pires secteurs d’activité pour la féminisation des CA ? Je vous renvoie à cet article de Clara Guibourg du journal londonien CityA.M. : « Worst sectors for boardroom diversity: Women joining FTSE 100 boards but mining lags far behind retail industry as Conservatives push to end gender pay gapp ».

More women are joining the boards of Britain’s most powerful companies, but there’s a big difference between different industries, a breakdown by sector reveals. In a bid to end the gender pay gap « in a generation”, Prime Minister David Cameron announced plans today to require UK firms to publish gender pay audits. But progress is being made: last week FTSE 100 companies reached their target of 25 per cent female directors. But while retail companies have one-third female boards, mining companies land at just over half that, with 17 per cent women.

À la prochaine…

Ivan Tchotourian