Un CA engagé ne doit pas négliger la stratégie… ce qui est souvent le cas !

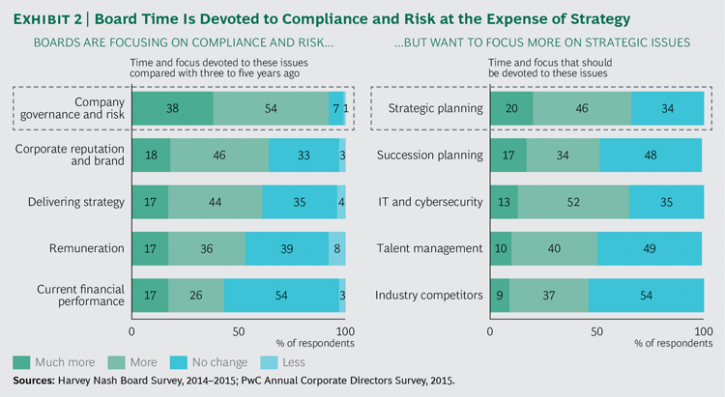

bcg.perspectives publie un excellent article qui insiste sur le déséquilibre de l’investissement des membres du CA : conformité et risques sont priorisés au détriment de la stratégie (« Looking for Smoke Under the Door: The Case for an Actively Engaged Board »).

Voici la synthèse :

An actively engaged board provides the building blocks of good governance. Directors with deep knowledge of the business and the external environment are better equipped to offer advice, challenge management, and spot any warning signs. But creating a more engaged board is neither easy nor without risk. While an actively engaged board can be a great benefit to a company, an engaged board that is dysfunctional can be destructive. If the board’s operating model is not right, and if the directors are not aligned, the board can undermine management and create confusion.Chair, CEO, and NEDs all have a role to play.

The rules and practices of corporate governance impose on the board many constraints and competing demands. In the finite time available to deliberate and make decisions, the board’s agenda naturally gravitates toward the essential issues of the day: governance, regulation, compliance, and near-term decisions. Often the board’s attention to the long term is relegated to its participation in determining annual strategy. In many companies, this is a flawed process.

Notwithstanding the packed schedule of most board meetings, the experience and detachment of board members position the board to be an actively engaged catalyst for change. Such a board will be able to identify, interpret, and act upon weak signals inside and outside the business that indicate the need for change; it will be adaptable, changing its composition and operations to meet evolving needs; and it will balance the independence of position and mind required for oversight with the active engagement necessary to provide management with the benefit of its members’ experience.

À la prochaine…

Ivan Tchotourian