autres publications mission et composition du conseil d'administration Normes d'encadrement

Comité de nomination : un intéressant rapport britannique

Ivan Tchotourian 24 mai 2016

En mai 2016, l’Institute of Chartered Secretaries and Administrators (ICSA) a publié avec Ernst & Young un rapport sur le rôle du comité de nomination : « The Nomination Committee – Coming out of the Shadows ».

While its role may be less clearly defined than that of the audit committee, and its profile lower than that of the remuneration committee, it is arguably the most important of the three. It plays a pivotal role in appointing directors to the board and, if the board lacks the right balance, knowledge, skills and attributes, the likelihood of it and its committees operating effectively is greatly reduced.

Concernant sa mission et ses membres, il est précisé les points suivants :

-

What the appropriate role of the committee should be, e.g., whether the committee should look at executive talent if it does not already do so, and whether the board would benefit from combining the committee into a nomination and governance committee.

-

Whether the following processes are clearly linked: the discussion of current board composition and future composition in light of the company’s strategy, the executive and senior talent succession planning and company strategy, the outcome of the board evaluation exercise and board succession plans, and the link between board evaluations and development and training plans.

-

The existence of a two-pronged approach to identify succession plans in both emergency and steady-state situations.

À propos de la planification de la relève et la détection de talent, le rapport mentionne relativement au comité :

-

The extent to which nomination committee looks across the market and internally to identify four or five potential successors to the CEO.

-

How deeply into the organisation the committee should be looking to identify future talent.

-

The best way to develop the skills of future executive leaders in the business.

À la prochaine…

Ivan Tchotourian

mission et composition du conseil d'administration normes de droit

Proposition de loi américaine pour accroître la diversité dans les CA

Ivan Tchotourian 24 mai 2016

Le 7 mars 2016, a été introduit le projet H.R. 4718 Gender Diversity in Corporate Leadership Act of 2016 par Carolyn B. Maloney à la Chambre des représentants.

To require the Securities and Exchange Commission to establish a Gender Diversity Advisory Group to study and make recommendations on stratégies to increase gender diversity among the members of the board of directors of issuers, to amend the Securities Exchange Act of 1934 to require issuers to make disclosures to shareholders with respect to gender diversity, and for other purposes.

Pour suivre l’évolution législative de ce projet, cliquez ici.

À la prochaine…

Ivan Tchotourian

autres publications mission et composition du conseil d'administration Normes d'encadrement responsabilisation à l'échelle internationale

Droits de l’homme et CA : un guide en 5 étapes

Ivan Tchotourian 24 mai 2016

L’EHRC vient de publier un guide « Business and human rights – A five-step guide for company boards » bien intéressant pour les CA. Comme le précise ce document : « We recommend that boards should follow five steps to ensure that their company is fulfilling its responsibility to respect human rights in a robust and coherent manner that meets the expectations of the UN Guiding Principles and UK statutory reporting obligations. Boards should be aware of the company’s salient, or most severe, human rights risks, and ensure ».

The following are the five steps that it is recommended boards should follow to ensure that their company is fulfilling its responsibility to meet human rights in a robust and coherent manner that meets the expectations of the UN Guiding Principles and UK statutory reporting obligations:

- the company should embed the responsibility to respect human rights into its culture, knowledge and practices;

- the company should identify and understands its salient, or most severe, risks to human rights;

- the company should systematically address its salient, or most severe, risks to human rights and provide for remedies when needed;

- the company should engage with stakeholders to inform its approach to addressing human rights risks; and

- the company should report on its salient, or most severe, human rights risks and meet regulatory reporting requirements.

Attention : encore une fois, tout cela n’est que du droit international et donc du droit « mou ». Ce guide l’exprime très bien en ces termes : « The Guiding Principles do not create any new international legal obligations on companies, but they can help boards to operate with respect for human rights and meet their legal responsibilities set out in domestic laws ».

À la prochaine…

Ivan Tchotourain

autres publications mission et composition du conseil d'administration Normes d'encadrement

Banque d’Angleterre : supervisory statement pour le CA

Ivan Tchotourian 19 mai 2016

L’Autorité prudentielle de la Banque d’Angleterre vient de publier un Supervisory Statement intitulé « Corporate governance: Board responsibilities » (SS5/16, mars 2016).

The Prudential Regulation Authority has published a policy statement and accompanying supervisory statement concerning the responsibilities of boards.

The purpose of this supervisory statement is to identify, for the boards1 of firms regulated by the Prudential Regulation Authority (PRA), those aspects of governance to which the PRA attaches particular importance and to which the PRA may devote particular attention in the course of its supervision. It is not intended to provide a comprehensive guide for boards of what constitutes good or effective governance. There are more general guidelines for that purpose, for example the UK Corporate Governance Code, published by the Financial Reporting Council.

À la prochaine…

Ivan Tchotourian

autres publications Gouvernance mission et composition du conseil d'administration Normes d'encadrement

Féminisation des CA : ça progresse !

Ivan Tchotourian 27 avril 2016

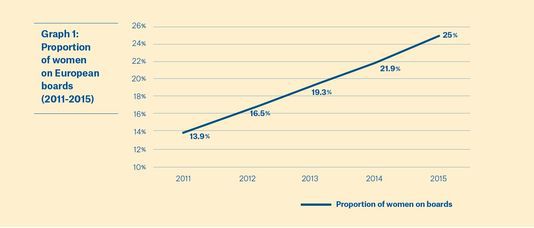

Bonjour à toutes et à tous, un article du journal Le Monde nous apprend que la féminisation des conseils d’administration augmente progressivement : « Les femmes sont plus présentes dans les conseils d’administration ».

Entre 2011 et 2015, la part des femmes dans les conseils d’administration des entreprises européennes a quasiment doublé pour passer de 13,9% à 25% en moyenne. C’est ce que révèle une enquête réalisée par le réseau européen de femmes EWoB (European Women on Boards) auprès de 600 entreprises (celles prises en compte dans l’indice boursier STOXX 600) de 12 pays et publiée ce mercredi 27 avril 2016.

On constate également de fortes disparités selon les pays : ainsi, la Suisse (16,1%) et l’ Espagne restent largement en retrait comparées à la Norvège, la Suède, la France et la Finlande qui ont dépassé le seuil des 30%. Le fruit notamment de l’adoption de quotas contraignants.

À la prochaine…

Ivan Tchotourian

engagement et activisme actionnarial Gouvernance mission et composition du conseil d'administration Normes d'encadrement Nouvelles diverses rémunération

Rémunération des dirigeants : le CA doit prendre ses responsabilités

Ivan Tchotourian 17 avril 2016

Belle réflexion offerte par le Financial Times sur le rôle que le conseil d’administration devrait assumer en matière de rémunération des dirigeants : « Boards are responsible for limiting excess pay » (Financial Times, 17 avril 2016).

Boards of directors are not appointed to rubber-stamp formulas devised by consultants, no matter what the result. If there appears to be something awry, they should be able to exercise their judgment and not be limited by employment contracts that deny them authority. BP’s remuneration committee failed this simple test and so found itself exposed to scorn.

Nothing absolves a board of its responsibility to limit the quantum of pay. Chief executives perform tough, demanding, responsible jobs and their decisions heavily affect the value of companies. But it is not obvious why some need to be paid double-digit millions to do their best when single-digit millions or less were accepted as sufficient financial rewards not so long ago.

Boards sometimes need to compete for talent, signing contracts that raise expectations and constrain their freedom to cap pay. As the tenure of CEOs has reduced, bosses want to get rich faster. Some argue that they could earn more in private equity, away from the unforgiving public spotlight.

À la prochaine…

Ivan Tchotourian

engagement et activisme actionnarial mission et composition du conseil d'administration Normes d'encadrement normes de droit

Vote majoritaire : un moyen de rendre le CA plus responsable ?

Ivan Tchotourian 5 avril 2016

Un peu de lecture pour ce matin ? Je vous renvoie à cet intéressant article : Stephen Choi, New York University Jill Fisch, University of Pennsylvania and ECGI Marcel Kahan, New York University and ECGI Edward Rock, University of Pennsylvania, « Does Majority Voting Improve Board Accountability? », Law Working Paper No. 310/2016, March 2016.

Directors have traditionally been elected by a plurality of the votes cast. This means that in uncontested elections, a candidate who receives even a single vote is elected. Proponents of “shareholder democracy” have advocated a shift to a majority voting rule in which a candidate must receive a majority of the votes cast to be elected. Over the past decade, they have been successful, and the shift to majority voting has been one of the most popular and successful governance reforms. Yet critics are skeptical as to whether majority voting improves board accountability. Tellingly, directors of companies with majority voting rarely fail to receive majority approval – even more rarely than directors of companies with plurality voting. Even when such directors fail to receive majority approval, they are unlikely to be forced to leave the board. This poses a puzzle: why do firms switch to majority voting and what effect does the switch have, if any, on director behavior?

We empirically examine the adoption and impact of a majority voting rule using a sample of uncontested director elections from 2007 to 2013. We test and find partial support for four hypotheses that could explain why directors of majority voting firms so rarely fail to receive majority support: selection; deterrence/accountability; electioneering by firms; and restraint by shareholders.

Our results further suggest that the reasons for and effects of adopting majority voting may differ between early and later adopters. We find that early adopters of majority voting were more shareholder-responsive than other firms even before they adopted majority voting. These firms seem to have adopted majority voting voluntarily, and the adoption of majority voting has made little difference in their responsiveness to shareholders responsiveness going forward. By contrast, for late adopters, we find no evidence that they were more shareholder-responsive than other firms before they adopted majority voting, but strong evidence that they became more responsive after adopting majority voting.

Differences between early and late adopters can have important implications for understanding the spread of corporate governance reforms and evaluating their effects on firms. Reform advocates, rather than targeting the firms that, by their measures, are most in need of reform, instead seem to have targeted the firms that are already most responsive. They may then have used the widespread adoption of majority voting to create pressure on the nonadopting firms.

Empirical studies of the effects of governance changes thus need to be sensitive to the possibility that early adopters and late adopters of reforms differ from each other and that the reforms may have different effects on these two groups of firms.

À la prochaine…

Ivan Tchotourian