Gouvernance normes de droit Nouvelles diverses place des salariés

Beau cas de RSE avec Areva

Ivan Tchotourian 26 septembre 2016

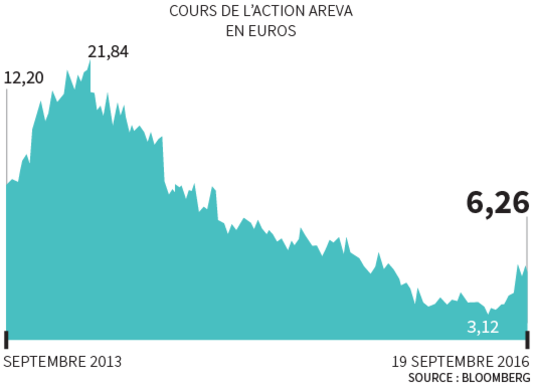

Bonjour à toutes et à tous, le quotidien Le Monde pose une belle question dans un article récent : « Les actionnaires salariés d’Areva ont-ils été abusés ? ». L’article aborde de plein fouet – outre la question de l’information financière et de sa communication – le thème de la responsabilité sociétale par son angle partie prenante. Si l’affaire était avérée et allait à son terme, en voilà une drôle de manière de traiter cette partie prenante de l’entreprise que sont les salariés !

Les dirigeants d’Areva ont-ils dissimulé aux salariés la situation réelle de l’entreprise au printemps 2013 alors qu’ils les incitaient fortement à souscrire au plan d’actionnariat salarié ? C’est le doute – voire la certitude – qu’ont un certain nombre d’entre eux, soutenus par la CFE-CGC.

Des centaines de plaintes ont été déposées depuis 2015 pour « délit de fausse information » et « tromperie ». Dans son édition du lundi 19 septembre, Le Parisien indique que le parquet national financier a ouvert une enquête préliminaire avant l’été, une information confirmée par Areva. Après analyse du dossier, la justice peut classer l’affaire sans suite ou la renvoyer devant le tribunal correctionnel.

À la prochaine…

Ivan Tchotourian

Gouvernance normes de droit Nouvelles diverses

Speech de la SEC : la dénonciation encensée

Ivan Tchotourian 20 septembre 2016

Bonjour à toutes et à tous, je vous informe qu’Andrew Ceresney (directeur de la division Enforcement à la SEC) s’est exprimé lors de la Sixteenth Annual Taxpayers Against Fraud Conference à Washington le 14 septembre 2016 (« The SEC’s Whistleblower Program: The Successful Early Years »). À cette occasion, M. Ceresney est revenu sur la dénonciation, son histoire et son succès actuel… ainsi que l’influence qu’a exercé le programme de dénonciation américain pour le Canada (Ontario et Québec) et l’Australie.

Whistleblowers provide an invaluable public service, often at great personal and professional sacrifice and peril. I cannot overstate the appreciation we have for the willingness of whistleblowers to come forward with evidence of potential securities law violations. I often speak of the transformative impact that the program has had on the Agency, both in terms of the detection of illegal conduct and in moving our investigations forward quicker and through the use of fewer resources.

Dans son allocution, M. Ceserney fournit des chiffres :

- The success of the program can be seen, in part, in the over $107 million we have paid to 33 whistleblowers for their valuable assistance, in cases with more than $500 million ordered in sanctions

- Since the inception of the program, the Office has received more than 14,000 tips from whistleblowers in every state in the United States and from over 95 foreign countries. What’s more, tips from whistleblowers increased from 3,001 in fiscal year 2012 — the first full fiscal year that the Commission’s Whistleblower Office was in operation — to nearly 4,000 last year, an approximately 30% increase. And we are on target to exceed that level this year. During fiscal year 2015, the Office returned over 2,800 phone calls from members of the public. By the end of fiscal year 2015, the Commission and Claims Review Staff had issued Final Orders and Preliminary Determinations with respect to over 390 claims for whistleblower awards.

À la prochaine…

Ivan Tchotourian

Gouvernance normes de droit parties prenantes Valeur actionnariale vs. sociétale

Parties prenantes : les droits anglais et indiens si protecteurs ?

Ivan Tchotourian 31 août 2016

Bonjour à toutes et à tous, Mhir Naniwadekar et Umakanth Varottil publient un billet sur le blog de l’Université Oxford sous le titre : « Directors’ Duties and Stakeholder Interests: Comparing India and the United Kingdom » (28 août 2016). Vraiment intéressant et qui montre toute l’incertitude de la protection des parties prenantes malgré les nouveaux articles 172 au Royaume-Uni et 166 en Inde !

La version longue de ce papier est à consulter sur SSRN : Mihir Naniwadekar et Umakanth Varottil, « The Stakeholder Approach Towards Directors’ Duties Under Indian Company Law: A Comparative Analysis » (August 11, 2016). NUS – Centre for Law & Business Working Paper No. 16/03; NUS Law Working Paper No. 2016/006.

Quelle conclusion ?

Our principal thesis in this paper is that while section 166(2) of the 2013 Act in India, at a superficial level, extensively encompasses the interests of non-shareholder constituencies in the context of directors’ duties and textually adheres to the pluralist stakeholder approach, a detailed analysis based on an interpretation of the section and the possible difficulties that may arise in its implementation substantially restricts the rights of stakeholders in Indian companies. Moreover, while the stated preference of the Indian Parliament veers towards the pluralist approach that recognizes the interests of shareholders and non-shareholder constituencies with equal weight, the functioning of the Companies Act, as well as the principles of common law relating to directors’ duties, make the Indian situation not altogether different from the ESV model followed in the UK. As such, proponents of the stakeholder theory in India should not declare victory with the enactment of section 166(2). Arguably, the magnanimity of its verbiage and rhetoric in favour of stakeholders merely pays lip service to them and obscures any real teeth or legal ammunition available to non-shareholder constituencies to assert those rights as a matter of law.

À la prochaine…

Ivan Tchotourian

divulgation financière Gouvernance normes de droit

Divulgation extra-financière : bilan mitigé des caisses de retraite

Ivan Tchotourian 26 août 2016

Pour appuyer la finance sociale, le Canada a proposé par le passé de mobiliser les actifs des caisses de retraite. Dans cette optique, le rapport de 2010 du Groupe de travail sur la finance sociale a encouragé les gouvernements fédéraux et provinciaux du Canada à exiger des caisses de retraite qu’elles divulguent leurs pratiques d’investissement responsable. Le 27 novembre 2014, le gouvernement de l’Ontario a déposé le Règlement de l’Ontario 235/14 (règlement modificatif) pris en vertu de la Loi sur les régimes de retraite de l’Ontario. Au travers ce règlement (ici), le Parlement ontarien a décidé de rendre obligatoire à compter du 1er janvier 2016 la divulgation de la prise en compte des questions environnementales, sociales et de gouvernance dans l’énoncé des politiques et procédures de placement des plans de retraite agréés. Le texte est rédigé comme suit : « A statement that the administrator of the pension plan must establish a statement of investment policies and procedures for the plan that contains, (i) the investment policies and procedures in respect of the plan’s portfolio of investments and loans, and (ii) information about whether environmental, social and governance factors are incorporated into the plan’s investment policies and procedures and, if so, how those factors are incorporated ».

Depuis mars 2016, les administrateurs des régimes de retraite déposent donc un énoncé des politiques et procédures de placement auprès du surintendant des services financiers contenant des renseignements précisant si des facteurs environnementaux, sociaux et de gouvernance sont intégrés dans l’énoncé des politiques et des procédures de placement du régime et, dans l’affirmative, comment ils le sont. Pour les relevés annuels remis aux participants actifs, le règlement modifié exige que tous les relevés annuels fournis depuis le 1erjuillet 2016 contiennent des renseignements sur l’énoncé des politiques et procédures de placement du régime, y compris des renseignements précisant si des facteurs environnementaux, sociaux et de gouvernance sont intégrés dans l’énoncé des politiques et des procédures de placement du régime et, dans l’affirmative, comment ils le sont.

Dans un article de Benefits Canada intitulé « Pension plans still grappling with ESG definition despite new rules », le constat de la pratique observée se montre critique :

Even with new rules implemented in Ontario this year, the issue of environmental, social and governance (ESG) factors remains a tricky question for Canada’s pension plans as they face a lack of perfect clarity around the definition of what they entail.

That was definitely the experience of RBC’s defined contribution pension team as it tried to wrap its head around Ontario’s new ESG requirement. Under new rules implemented this year, Ontario’s pension plan administrators need to mention in their statement of investment policies and procedures whether they’ve incorporated ESG factors into the investment process and, if so, how and if not, why not.

Even though these are “seemingly easy questions,” they really aren’t, said Angela Lin-Reeve, portfolio manager, pension investments, at RBC, during Benefits Canada’s 2016 Benefits and Pension Summit in Toronto on March 31. “We had to get educated because this wasn’t an angle we were used to in evaluating investments,” she said, adding that the small size of her team — just two full-time employees — made things even more difficult.

À la prochaine…

Ivan Tchotourian

autres publications Gouvernance place des salariés

Employee Participation in Corporate Governance and Corporate Social Responsibility : à découvrir !

Ivan Tchotourian 23 août 2016

Nouveau working paper de Martin Gelter pour le compte de l’ECGI intitulé : « Employee Participation in Corporate Governance and Corporate Social Responsibility » (Law Working Paper No. 322/2016, juillet 2016).

The chapter investigates the impact of employee participation on the board of directors or supervisory board (particularly codetermination) on corporate social responsibility (CSR).

Conceptually, it is important to distinguish between “internal” and “external” CSR. Internal CSR relates to practices of the firm regarding groups with which it is in a long-term contractual relationship such as employees. Employee participation systems serve to protect employees from shareholder opportunism and shift the balance in the distribution of corporate rents in favor of employees, which is why they clearly have an impact on internal CSR. The situation is much less clear for external CSR, which is concerned with effects of corporate activities that are externalities, for example pollution.

I argue that there may sometimes be a tradeoff between internal and external CSR: If a firm is more profitable because it scores badly in terms of external CSR (e.g. because it habitually pollutes), employees may benefit similarly as shareholders. In fact, the interests of shareholders and employees may be largely aligned in this respect, with both either benefiting or being harmed concurrently.

À la prochaine…

Ivan Tchotourian

autres publications Gouvernance Normes d'encadrement normes de droit normes de marché

Governance goes green : à lire !

Ivan Tchotourian 6 juillet 2016

Beau rapport du cabinet Weil, Gotshal & Manges LLP qui montre que la RSE ne peut plus être ignoré par les entreprises : « Governance Goes Green ».

It’s not just us tree-huggers. Increasingly, institutional investors, pension plans and regulators are calling for (and in some cases requiring) companies to assess and report on the sustainability of their business operations and investments. Climate change and other environmental concerns are at the forefront of these calls. Institutional investors are focusing on sustainable business practices – a broad category in which environmental and social risks, costs and opportunities of doing business are analyzed alongside conventional economic considerations – as a key factor in long-term financial performance. Sustainability proponents are looking to boards of directors and management to integrate these considerations into their companies’ long-term business strategies.

Éléments essentiels à retenir :

- Institutional investors increasingly regard environmental and other sustainability issues as strategic matters for companies.

- Shareholders continue to submit environmental and other sustainability proposals, successfully garnering attention and prompting companies to make changes, despite their failure to win majority votes.

- Independent organizations are developing standards for sustainability and environmental reporting to provide investors with consistent metrics for assessing and comparing the sustainability of companies’ practices.

- Sustainability and environmental reporting remains in the SEC’s sights as it evaluates the effectiveness of current disclosure requirements and considers changes for the future.

À la prochaine…

Ivan Tchotourian

Gouvernance normes de droit Structures juridiques

“Enterprise” and Lawyer’s view: By by Irresponsibility and Welcome in a New Area (à télécharger)

Ivan Tchotourian 25 juin 2016

Alors que le colloque du SASE va bientôt avoir lieu à Berkeley aux Etats-Unis, je reviens aujourd’hui sur ce que j’avais présenté au colloque qui s’était tenu en 2014 à Chicago : “Enterprise” and Lawyer’s view: By by Irresponsibility and Welcome in a New Area ».

Accédez au diaporama : PPT SASE 2014 version anglaise

Voici le résumé de cette intervention :

As institutions corporations and enterprises are the basis of capitalism and the subject of great interest for legal studies. Beyond regulation, the inherent nature of corporations raises sensitive legal questions, indeed, since its first appearance in the 18th century. Inspired by economic and financial sciences, legal theories incorporate corporations to contracts (referred to as “aggregate theory”), a private government (referred to as “artificial theory”) and an autonomous entity (“entity theory” or “doctrine de l’entreprise” in Continental Europe). It is indeed argued that incorporating corporations to a simple nexus of contracts has been the subject of great attention since the 1970s, provided that none of the above theories have definitely won unanimity in law, as seen by a comparative reading of the Canadian, American and European jurisprudence. Corporate governance rules clearly demonstrate such incorporation. In its essence, however, the contractual analysis regards the corporation as a means to serving private interests whereby the liability schemes are limited to protecting the supplier of capital. The contractual analysis’s vision is indeed restricted, and it summarizes its goals, to the sought-after maximization of the corporation’s shareholders value. At the heart of the corporation’s issues lies the financial aspect. Within this framework, non-financial concerns appear far away and are dealt with as simple externality that poses management problems. Nonetheless, the corporation’s activities are bearing an economic power that is today seen as ever increasingly significant and its financial and non-financial consequences should be the basis of further thinking. Yet, Canadian law has engaged into this pathway. On the one hand, Canadian corporate law has experienced a profound re-assessment through the Supreme Court of Canada’s decisions in Peoples (2004) and BCE (2008). Far from being a strict contractual reading of the corporation, these decisions have shed light on the importance of different paradigms such as corporate social responsibility and the stakeholders’ theory. Indeed, new incorporated corporate concepts have reshaped the way the corporation is perceived and its relationship with the environment. On the other hand, Canadian competition law attempts at integrating social concerns into its political sphere. In 2013, the Supreme Court of Canada has allowed the commencement of proceedings by indirect purchasers by way of a class action (see cases of Pros-sys, Sun-Rype and Infineon). Case law contemplates limiting the negative impact of anti-competition practices implemented by multinational corporations. The objective is to reinstate an economic balance as between corporations and its clients. The consumer is indeed called upon to play a protective role in the market in addition to the Canadian Competition authority’s competence. As affirmed by the Canadian Competition Tribunal in the decision of Visa/Master Card certain competition disputes between merchants are of common interest. Thus, the public should be made aware of the difficulties met by the businesses in the market. In light of the recent Canadian case law standpoint, it most certainly raises questions about the role that competition policies play within the corporation’s economic activities framework. This paper suggests showing the current legal positions of Canadian corporations and its competition law framework, in addition to putting them into perspective with their US and European counterparts. In addition to demonstrating their convergence in favor of a more social concern, we stand for the proposition that corporations, as has been defined by the jurist, does not only form a contract. Indeed, it is an institution that carries responsibilities as against its own environment.

À la prochaine…

Ivan Tchotourian