Norwegian oil fund attacks VW corporate governance

Une action de groupe est en cours contre l’entreprise allemande Volkswagen comme l’annonce le Financial Times. Ce qui est intéressant dans cet article (« Norwegian oil fund attacks VW corporate governance ») est qu’un des gros investisseurs de cette entreprise (et des entreprises européennes en général) fait partie de ceux qui agissent.

Norway’s $8sobn oil fund does not like commenting about individual companies it owns shares in. It usually goes out of its way to avoid saying anything about any of its more than 9,000 investments. But Volkswagen is starting to become the exception that proves the rule. The world’s largest sovereign wealth fund has become increasingly open in its distaste for the German carmaker, culminating in it confirming to the Financial Times that it would take legal action against VWover its emissions scandal.

The decision to sue VW as part of a class-action lawsuit in the German courts is merely the latest sign of the oil fund’s growing willingness to criticise the carmaker.

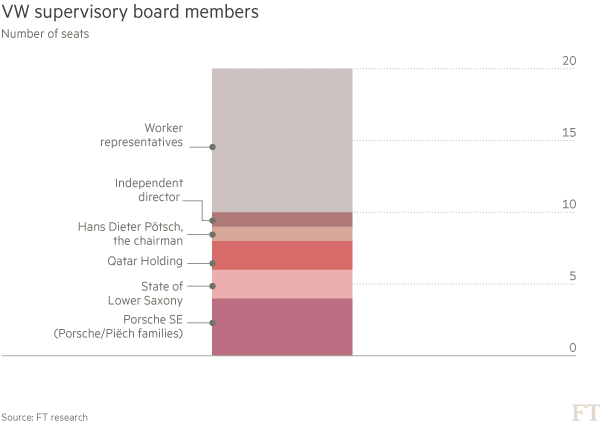

Comme le rappelle cet article, la composition du conseil de surveillance est au cœur des critiques ! « The concerns centre around VW’s supervisory board. Several investors and governance experts question whether, after three scandals at VW in 20 years, the board has the authority and independence to hold management to account. Out of the 10 shareholder representatives on the board, eight represent the three largest investors: the Porsche and Piëch families, the state government of Lower Saxony, and Qatar Holding, an arm of Qatar’s sovereign wealth fund. The ninth is VW’s former finance director, Hans Dieter Pötsch, who is now the board chairman. Only the tenth, Annika Falkengren, chief executive of Swedish bank SEB, is viewed as being independent ».

À la prochaine…

Ivan Tchotourian