Gouvernance Normes d'encadrement normes de marché Nouvelles diverses Responsabilité sociale des entreprises

Un risque de « social washing » avec la COVID-19 ?

Ivan Tchotourian 20 avril 2020

Financial Advisor publie une synthèse pertinente à l’heure de la COVID-19 : « ‘Social Washing’ Is Becoming Growing Headache For ESG Investors » (par Alastair Marsh, 10 avril 2020).

Extrait :

ESG investors face a new threat in the age of coronavirus: “social washing.”

Much like the greenwashing that exaggerates or misrepresents the environmental credentials of a project or a company, social washing can occur when the impact of an investment on labor rights or human rights are falsely overstated, said Arthur Krebbers, head of sustainable finance for corporates at Royal Bank of Scotland Group Plc’s NatWest Markets unit. And it’s a growing risk as investors focus more attention on social issues.

In the past six weeks, NatWest has seen a significant increase in inquiries from clients on issues such as sick leave for workers and the rights of contract workers.

The coronavirus outbreak is awakening fund managers who consider environmental, social and governance issues when investing to blind spots in their analysis of companies. While fighting climate change has been the top priority for many ESG funds, the spreading pandemic is prompting investors to put a greater emphasis on the “S” of ESG and consider how companies treat employees during the pandemic.

Krebbers’s comments followed the Principles for Responsible Investment, the biggest network of responsible investment firms, which said last month that ESG investors must up their game to hold companies accountable for social issues. The PRI emphasized how the lack of paid sick leave or benefits has left many workers in precarious positions during coronavirus lockdowns.

“The big challenge with social is the data,” Krebbers said. “The reporting tends to be more localized and it’s harder to define, especially when you compare to environmental issues where the carbon footprint provides for a well-understood, comparable metric. A lot more thought and analysis is required if we are to avoid ‘social washing’ situations.”

À la prochaine…

Gouvernance mission et composition du conseil d'administration

Un CA engagé ne doit pas négliger la stratégie… ce qui est souvent le cas !

Ivan Tchotourian 10 septembre 2016

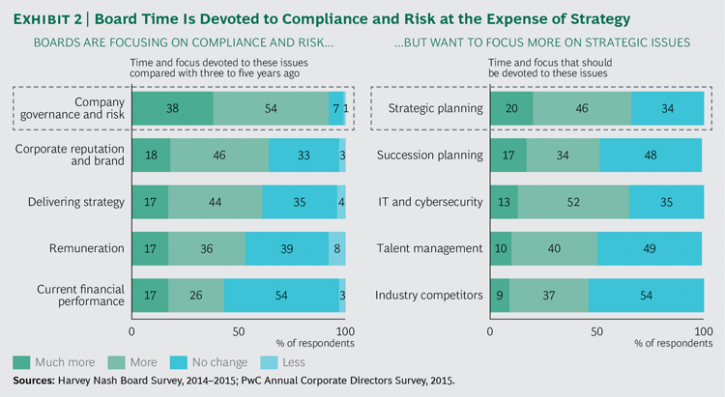

bcg.perspectives publie un excellent article qui insiste sur le déséquilibre de l’investissement des membres du CA : conformité et risques sont priorisés au détriment de la stratégie (« Looking for Smoke Under the Door: The Case for an Actively Engaged Board »).

Voici la synthèse :

An actively engaged board provides the building blocks of good governance. Directors with deep knowledge of the business and the external environment are better equipped to offer advice, challenge management, and spot any warning signs. But creating a more engaged board is neither easy nor without risk. While an actively engaged board can be a great benefit to a company, an engaged board that is dysfunctional can be destructive. If the board’s operating model is not right, and if the directors are not aligned, the board can undermine management and create confusion.Chair, CEO, and NEDs all have a role to play.

The rules and practices of corporate governance impose on the board many constraints and competing demands. In the finite time available to deliberate and make decisions, the board’s agenda naturally gravitates toward the essential issues of the day: governance, regulation, compliance, and near-term decisions. Often the board’s attention to the long term is relegated to its participation in determining annual strategy. In many companies, this is a flawed process.

Notwithstanding the packed schedule of most board meetings, the experience and detachment of board members position the board to be an actively engaged catalyst for change. Such a board will be able to identify, interpret, and act upon weak signals inside and outside the business that indicate the need for change; it will be adaptable, changing its composition and operations to meet evolving needs; and it will balance the independence of position and mind required for oversight with the active engagement necessary to provide management with the benefit of its members’ experience.

À la prochaine…

Ivan Tchotourian

mission et composition du conseil d'administration rémunération

Siéger sur un comité de rémunération : de plus en plus risqué !

Ivan Tchotourian 22 mai 2016

Siéger sur un comité de rémunération serait-il risqué ? Oui et de plus en plus selon un article du Financial Times : « Executive pay committee chair in the hot seat » (2 mai 2016). Les actionnaires semblent en effet tourner leur grogne touchant la rémunération vers les membres du comité,

In the most high-profile shareholder protests seen in the UK for four years, investors have been directing their anger squarely at company bosses for their multimillion pound pay packets. (…)

With pay protests set to continue in the coming weeks, some are now turning their sights on the people who determine the bumper awards, rather than the recipients. This puts the chairs of remuneration committees directly in the line of fire — an unusual position for the holders of these generally low-profile posts. Few, if any, remuneration committee chairs are household names. But, in conjunction with their committee members, they wield immense power. Not only do they decide the fixed salary of the boss, but they also determine the bonus structures that provides the lion’s share of a pay package.

À la prochaine…

Ivan Tchotourian

Gouvernance Normes d'encadrement

Menace sur les big four

Ivan Tchotourian 8 avril 2016

L’audit occupe un rôle central dans la gouvernance des entreprises. Sur la base d’une entrevue avec Jim Peterson, voilà qu’un risque d’écroulement serait présent : « Quand les « Big Four » s’écrouleront ». Scénario catastrophe ou réaliste ?

Derrière ses allures policées, son message est pourtant explosif. Lui qui a longtemps été un homme du système, qui a connu de l’intérieur tous les rouages de la comptabilité des grandes multinationales, tire la sonnette d’alarme : les « Big Four », ces quatre grands cabinets d’audit internationaux (PwC, Deloitte, KPMG, Ernst & Young) risquent de s’effondrer à tout moment. « Ils sont plus fragiles qu’Arthur Andersen en 2002 », nous expliquait-il lors d’un récent passage à Londres, faisant référence à la faillite retentissante de l’ancien cabinet d’audit.

À la prochaine…

Ivan Tchotourian