autres publications

autres publications Gouvernance normes de droit

Gouvernance d’entreprise : le Parlement britannique lance une consultation

Ivan Tchotourian 19 septembre 2016

En Grande-Bretagne, The Business, Innovation, and Skills (BIS) Committee vient de lancer une consultation publique sur la gouvernance d’entreprise : « Corporate Governance inquiry launched ».

The Business, Innovation, and Skills (BIS) Committee has today launched an inquiry on corporate governance, focussing on executive pay, directors duties, and the composition of boardrooms, including worker representation and gender balance in executive positions.

Les questions abordées sont très intéressantes :

Directors Duties

- Is company law sufficiently clear on the roles of directors and non-executive directors, and are those duties the right ones? If not, how should it be amended?

- Is the duty to promote the long-term success of the company clear and enforceable?

- How are the interests of shareholders, current and former employees best balanced?

- How best should the decisions of Boards be scrutinised and open to challenge?

- Should there be greater alignment between the rules governing public and private companies? What would be the consequences of this?

- Should additional duties be placed on companies to promote greater transparency, e.g. around the roles of advisors. If so, what should be published and why? What would the impact of this be on business behaviour and costs to business?

- How effectively have the provisions of the 1992 Cadbury report been embedded? How best can shareholders have confidence that Executives are subject to independent challenge?

- Should Government regulate or rely on guidance and professional bodies to ensure that Directors fulfil their duties effectively?

Executive pay

- What factors have influenced the steep rise in executive pay over the past 30 years relative to salaries of more junior employees?

- How should executive pay take account of companies’ long-term performance?

- Should executive pay reflect the value added by executives to companies relative to more junior employees? If so, how?

- What evidence is there that executive pay is too high? How, if at all, should Government seek to influence or control executive pay?

- Do recent high-profile shareholder actions demonstrate that the current framework for controlling executive pay is bedding in effectively? Should shareholders have a greater role?

Composition of Boards

- What evidence is there that more diverse company boards perform better?

- How should greater diversity of board membership be achieved? What should diversity include, e.g. gender, ethnicity, age, sexuality, disability, experience, socio-economic background?

- Should there be worker representation on boards and/or remuneration committees? If so, what form should this take?

- What more should be done to increase the number of women in Executive positions on boards?

Attention : la réponse est à envoyer pour le 26 octobre 2016 !

À la prochaine…

Ivan Tchotourian

autres publications mission et composition du conseil d'administration

Femmes, CA et Grande-Bretagne : « Women on boards: 5 year summary »

Ivan Tchotourian 2 novembre 2015

En 2011, Lord Davies avait publié des recommandations pour accroître la proportion des femmes au sein des CA des entreprises de l’indice FTSE100 avec un objectif d’au moins 25 % de femmes à l’horizon 2015. Quel est le bilan ?

Positif, pardi ! En effet, un rapport publié le 29 octobre 2015 (« Women on boards: 5 year summary (Davies Review) », Department for Business, Innovation & Skills) démontre que l’objectif a été atteint.

There are more women on FTSE 350 boards than ever before, with representation of women more than doubling since 2011 – now at 26.1% on FTSE 100 boards and 19.6% on FTSE 250 boards. We have also seen a dramatic reduction in the number of all-male boards. There were 152 in 2011. Today there are no all-male boards in the FTSE 100 and only 15 in the FTSE 250.

Parmi les 5 recommandations faites pour le futur, signalons :

- The national call for action and voluntary, business-led approach is continued for a further five year period, ensuring substantive and sustainable improvement in women’s representation on Boards of FTSE 350 companies into the future

- Increasing the voluntary target for women’s representation on Boards of FTSE 350 companies, to a minimum of 33% to be achieved in the next five years.

- All stakeholders to work together to ensure increasing numbers of women are appointed to the roles of Chair, Senior Independent Director and into Executive Director positions on Boards of FTSE 350 companies.

- All FTSE Listed companies now assess the gender balance on their Boards and take prompt action to address any shortfall

À la prochaine…

Ivan Tchotourian

autres publications mission et composition du conseil d'administration

Planifier la succession du CA : le FRC consulte

Ivan Tchotourian 29 octobre 2015

Le Financial reporting Council vient de publier un document de consultation : « UK Board Succession Planning » (ici). Voici ce qu’on peut y lire…

The FRC’s interest stems primarily from the fact that the quality of succession planning is one of the most frequent issues highlighted as a consequence of board evaluation. Stakeholders have suggested that we promote good practice to raise quality. The FRC also wishes to address the Parliamentary Commission on Banking Standards’ recommendations to the FRC on issues around director nomination, in which it commented that there is a ‘widespread perception that some “natural challengers” are sifted out by the nomination process. The nomination process greatly influences the behaviour of non-executive directors and their board careers.’

This paper is the result of discussions with a wide range of interested parties – individually and through group sessions – and analysis of other research. Our stakeholders have been extremely generous with their time and candid with their views, for which we are grateful. The aim of this paper is to look at the key issues, to identify suggestions for good practice and, more specifically, to examine how the nomination committee can play its role effectively. We are seeking to provoke discussion, and welcome your feedback on our approach and the issues and questions we have posed.

Issues explored in the paper include:

- how effective board succession planning is important to business strategy and culture;

- the role of the nomination committee;

- board evaluation and its contribution to board succession;

- identifying the internal and external ‘pipeline’ for executive and non-executive directors;

- ensuring diversity; and

- the role of institutional investors.

À la prochaine…

Ivan Tchotourian

autres publications Gouvernance

Détention des actions des entreprises britanniques : voulez-vous en savoir plus ?

Ivan Tchotourian 11 septembre 2015

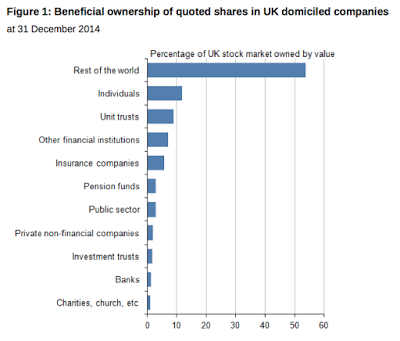

L’Office for National Statistics a publié le 2 septembre 2015 une étude très intéressante intitulée « Ownership of quoted shares for UK domiciled companies, 2014 ».

C’est effrayant de constater que la détention la plus importante (en termes de valeur des actions britanniques détenues) relève du reste du monde … « with 54% of the total at the end of 2014, similar to 2012 but higher than the 2010 level of 43%. Individuals owned the next largest proportion of shares at the end of 2014, with 12% of the total, higher than the estimated 10% they held in 2010 and 2012 ». Quant aux pays de provenance des détenteurs, notons que l’Amérique du Nord possède plus de 46 % des actions, suivie par l’Europe (26 %) et l’Asie (16 %).

La synthèse de cette étude est la suivante :

- The broad make-up of share ownership remained the same at the end of 2014 as it was in 2012, with rest of the world investors holding significantly more shares (in terms of value) than any other sector.

- Rest of the world ownership stood at an estimated 54% of the value of the UK stock market at the end of 2014. This was up from 31% in 1998 but unchanged from the 2012 estimate.

- UK individuals owned an estimated 12% of quoted UK shares by value at the end of 2014, an increase from the historic low of 10% in 2010 and 2012.

- Unit trusts held an estimated 9% by value at the end of 2014, slightly down from the 2012 level but still much higher than in 1998, when they only accounted for 2% of share ownership.

- Other financial institutions held an estimated 7% by value at the end of 2014, similar to 2012 but lower than the estimated 12% they held in 2010.

- Insurance companies held an estimated 6% and pension funds an estimated 3% by value at the end of 2014, continuing the downward trends in these sectors seen in recent years.

- The majority of shares by value are held in multiple-ownership pooled accounts, where the beneficial owner is not held centrally and must be established by means of a Companies Act 2006 Section 793 request. As in 2012, these accounted for over half (59%) of the total holdings by value at the end of 2014. Multiple ownership pooled accounts have been allocated to sectors using further analysis of share registers.

- This statistical bulletin provides estimates of holdings of ordinary shares in UK domiciled, quoted companies by sector of beneficial ownership, and also incorporates revisions to the 2012 data originally published in September 2013.

- The beneficial owner is the underlying owner; the person or body who receives the benefits of holding the shares, for example income through dividends (see Annex A for details). Companies included are those which are listed on the London Stock Exchange and are domiciled in the United Kingdom; that is, their country of incorporation is the UK. At the end of 2014, shares in quoted UK domiciled companies were valued at a total of £1.7 trillion.

Pour accéder au rapport en format pdf : cliquez ici.

À la prochaine…

Ivan Tchotourian