rémunération Structures juridiques

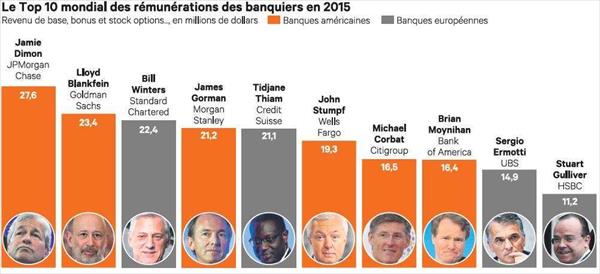

Top 10 mondial des rémunérations des banquiers en 2015

Ivan Tchotourian 31 août 2016

IlBoursa relaie cette intéressante étude (ici) : une analyse menée par la base de données Equilar pour le « Financial Times » sur les 20 plus grandes banques en Europe, en Amérique du Nord et en Australie, les patrons de banques américaines touchent en moyenne deux fois plus que leurs homologues européens. En 2015, six des dix patrons les mieux rémunérés étaient à la tête de maisons américaines, rapporte Les Echos.

La rémunération moyenne (incluant salaire, bonus et stock-option) des dirigeants des six plus grandes banques américaines a atteint l’an dernier 20,7 millions de dollars (+10%), contre 10,4 millions pour les onze plus grandes banques européennes.

À la prochaine…

Ivan Tchotourian

rémunération Structures juridiques Valeur actionnariale vs. sociétale

Changer la conception de la société par actions

Ivan Tchotourian 25 juin 2016

Bonjour à toutes et à tous, voici un très bel article de Susan Holmberg et Mark Schmitt accessible en ligne : « The Milton Friedman Doctrine Is Wrong. Here’s How to Rethink the Corporation » (Evonomics, 9 juin 2016).

The compensation of American executives—CEOs and their “C-suite” colleagues—has long been a matter of controversy, especially recently, as the wages of average workers have stagnated and economic inequality has moved to the center of the national debate. Just about every spring, the season of corporate proxy votes, we see the rankings of the highest-paid CEOs, topped by men (they’re all men until number 21) like David Cote of Honeywell, who in 2013 took home $16 million in salary and bonus, and another $9 million in stock options.

(…)

The problem isn’t that the political system doesn’t want to deal with excessive CEO pay. There have been any number of formal efforts to rein in executive pay, involving a host of direct regulation and tax changes. But most of the specific efforts to reduce executive pay—through major policies such as a limit on the tax deductibility of high salaries, as well as more modest accounting and disclosure legislation—have fallen short. That’s because the story of skyrocketing executive pay is a story about our conception of the corporation and its responsibilities. And until we rethink our deepest assumptions about the corporation, we won’t be able to master the challenge of excessive CEO pay, or the inequality it generates. Is the CEO simply the agent of the company’s shareholders? Is the corporation’s only obligation to return short-term gains to shareholders? Or can we begin to think of the corporation in terms of the interests of all those who have a stake in its success—its customers, its community, and all of its employees? If we take the latter view, the challenge of CEO pay will become clearer and more manageable.

À la prochaine…

Ivan Tchotourian

rémunération Structures juridiques

Autorité bancaire européenne : rapport sur les pratiques de rémunération

Ivan Tchotourian 1 avril 2016

L’Autorité bancaire européenne vient de publier son rapport sur les pratiques de rémunération : « Report on Benchmarking of Remuneration and High Earners 2014 ».

Quel bilan ?

The number of high-earners in the EU increased significantly, from 3 178 in 2013 to 3 865 in 2014, corresponding to a 21.6% increase on the previous year. The percentage of those high-earners who are identified staff, i.e. those who have a potential impact on institutions’ risk profiles, also increased significantly from 59% in 2013 to 87% in 2014; and the absolute number of identified staff went up from 34 060 in 2013 to 62 787 in 2014. of « high-earners » and benchmarking data for « identified staff ».

The introduction of the so-called ‘bonus cap’ – the limitation of the ratio between the variable and the fixed components of remuneration to 100% (200% with shareholders’ approval) which is applicable since 2014 – had an impact on remuneration practices; EU banking institutions shifted the remuneration for their identified staff towards the fixed component, bringing the ratio in line with what is prescribed by EU legislation. As a result, the average ratio between the variable and fixed salary paid to identified staff was 65.48% in 2014, down from 104.27% in 2013. At the same time, the average ratio between the variable and fixed remuneration paid to high earners dropped from 317% in 2013 to 127% in 2014.

The introduction of the bonus cap was found to have no significant effect on institutions’ financial stability and cost flexibility. For most institutions, the fixed salary of identified staff accounted for less than 1% of their own funds; and on average accounted for only 3.12% of the institutions’ administrative costs. This small increase in the fixed remuneration for identified staff is not material compared to the administrative costs of institutions.

À la prochaine…

Ivan Tchotourian