Normes d'encadrement rémunération Valeur actionnariale vs. sociétale

The role of executive pay in promoting responsible business

Ivan Tchotourian 28 août 2017

Dans Lexology, RPC propose une synthèse intéressante qui rappelle une évidence : la rémunération des hauts-dirigeants a un rôle à jouer dans la pérennité à long-terme des entrepris. Un article synthétique à lire qui revient sur le projet de réforme britannique de gouvernance d’entreprise : « The role of executive pay in promoting responsible business » (24 mars 2017).

Executive pay is a thorny issue. Well-structured remuneration packages can help to ensure that companies are run responsibly for the benefit of shareholders, employees, customers, and wider society. However, when improperly designed, executive pay packages can encourage short-term and risky behaviour which dents public confidence in business.

(…)

The ultimate aim for businesses is to attract and retain top talent whilst ensuring that those individuals are motivated to achieve sustainable, long-term value creation for the company. Where there is a perception that ever more generous remuneration packages are necessary in order to achieve those objectives, we are unlikely to see any reversal in current pay trends, with or without reform.

À la prochaine…

Ivan Tchotourian

devoirs des administrateurs engagement et activisme actionnarial Gouvernance mission et composition du conseil d'administration normes de droit objectifs de l'entreprise Valeur actionnariale vs. sociétale

Le rendement à court-terme, une menace pour nos entreprises

Ivan Tchotourian 14 mars 2017

Bel article du Journal de Montréal : « Le rendement à court-terme, une menace pour nos entreprises » (22 novembre 2016). Une occasion de discuter gouvernance d’entreprise en se concentrant sur la situation actuelle caractérisée par une omniprésence des investisseurs institutionnels !

Auparavant, les petits investisseurs québécois conservaient leurs actions en bourse en moyenne 10 ans. Aujourd’hui, à peine quatre mois. Quelque chose a changé dans notre rapport aux entreprises. Et pas pour le mieux, dit Gaétan Morin, président et chef de la direction du Fonds de solidarité FTQ.

À la prochaine…

Ivan Tchotourian

devoirs des administrateurs Gouvernance objectifs de l'entreprise Valeur actionnariale vs. sociétale

Maximisation de la valeur actionnariale : une belle critique

Ivan Tchotourian 6 février 2017

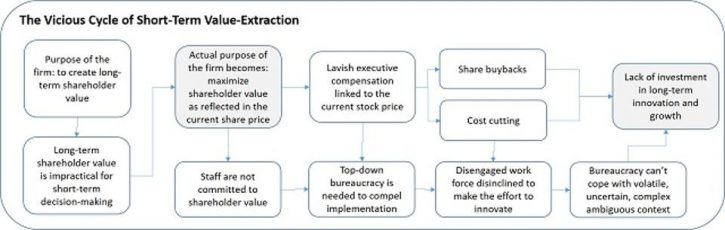

Bonsoir à toutes et à tous, dans « Resisting The Lure Of Short-Termism: Kill ‘The World’s Dumbest Idea' » publié dans Forbes, Steve Denning revient sur une belle critique de la maximisation de la valeur actionnariale comme objectif des entreprises.

When pressures are mounting to deliver short-term results, how do successful CEOs resist those pressures and achieve long-term growth? The issue is pressing: low global economic growth is putting stress on the political and social fabric in Europe and the Americas and populist leaders are mobilizing widespread unrest. “By succumbing to false solutions, born of disillusion and rage,” writes Martin Wolf in the Financial Times this week, “the west might even destroy the intellectual and institutional pillars on which the postwar global economic and political order has rested.”

The first step in resisting the pressures of short-termism is to correctly identify their source. The root cause is remarkably simple—the view, which is widely held both inside and outside the firm, that the very purpose of a corporation is to maximize shareholder value as reflected in the current stock price (MSV). This notion, which even Jack Welch has called “the dumbest idea in the world,” got going in the 1980s, particularly in the U.S., and is now regarded in much of the business world, the stock market and government as an almost-immutable truth of the universe. As The Economist even declared in March 2016, MSV is now “the biggest idea in business.”

À la prochaine…

Ivan Tchotourian

Gouvernance normes de droit Valeur actionnariale vs. sociétale

5 mythes sur la gouvernance d’entreprise – 1re partie

Ivan Tchotourian 26 janvier 2017

« 5 mythes sur la gouvernance d’entreprise (1re partie) » est mon dernier de blogue sur Contact. À cette occasion, je repense certains facteurs économiques fondamentaux de la gouvernance d’entreprise. Ces facteurs s’appuient sur une série de présupposés issus des sciences économiques, financières, de la gestion et juridiques. Ces présupposés sont ancrés dans une culture anglo-américaine, mais ils ont largement été véhiculés dans le monde. Ils relèvent à mon sens d’une mythologie qu’il est temps de dénoncer.

Voici les 5 présupposés autour desquels s’articule cette mythologie:

1. La société par actions est un simple contrat.

2. Les actionnaires sont les propriétaires de la société par actions.

3. Les actionnaires sont les seuls créanciers résiduels.

4. Les actionnaires dotés de nouveaux pouvoirs s’investissent activement et positivement dans la gouvernance.

5. L’objectif de la gouvernance d’entreprise est de satisfaire l’intérêt des actionnaires.

Je reviens sur chacun de ces présupposés pour démontrer qu’ils appartiennent à une mythologie qui ne saurait justifier une remise en question du mouvement grandissant de responsabilisation des entreprises.

À la prochaine…

Ivan Tchotourian

autres publications Nouvelles diverses Valeur actionnariale vs. sociétale

Socially Responsible Firms : une RSE non antinomique à la maximisation des profits

Ivan Tchotourian 20 janvier 2017

Bonjour à toutes et à tous, c’est un beau papier que proposé sur SSRN et au titre accrocheur « Socially Responsible Firms » (Ferrell, Allen and Liang, Hao and Renneboog, Luc, Socially Responsible Firms (August 2016). European Corporate Governance Institute (ECGI) – Finance Working Paper No. 432/2014). Principale enseignement de cette étude : la problématique de la responsabilité sociétale ne serait pas antinomique avec la primauté de la valeur actionnariale.

The desirability for corporations to engage in socially responsible behavior has long been hotly debated among economists, lawyers, and business experts. Back in the 1930s, two American lawyers, Adolf A. Berle, Jr., and E. Merrick Dodd, Jr., had a famous public debate addressing the question: to whom are corporations accountable? Berle argued that the management of a corporation should be held accountable only to shareholders for their actions, and Dodd argued that corporations were accountable to both the society in which they operated and their shareholders. The lasting interest in this debate reflects the fact that the issues it raises touch on the basic role and function of corporations in a capitalist society.

(…) In our paper, ‘Socially Responsible Firms’, we take a comprehensive look at the CSR agency and good governance views around the globe. By means of a rich and partly proprietary CSR data set with global coverage across a large number of countries and composed of thousands of the largest companies, we test these two views by examining whether traditional corporate finance proxies for firm agency problems, such as capital spending cash flows, managerial compensation arrangements, ownership structures, and country-level investor protection laws, account for firms’ CSR activities. While other studies using a within-country quasi-experimental approach focus on the marginal effect of variation in agency problems, our data and empirical setting enable us to examine its average effect. Based on this comprehensive analysis, we fail to find evidence that CSR conduct in general is a function of firm agency problems. Instead, consistent with the good governance view, well-governed firms, as represented by lower cash hoarding and capital spending, higher payout and leverage ratio, and stronger pay-for-performance, are more likely to be socially responsible and have higher CSR ratings. In addition, CSR is higher in countries with better legal protection of shareholder rights and in firms with smaller excess voting power held by controlling shareholders. Moreover, a higher CSR rating moderates the negative association between a firm’s managerial entrenchment and value. All these findings lend support to the good governance view and suggest that CSR in general is not inconsistent with shareholder wealth maximization.

À la prochaine…

Ivan Tchotourian

normes de droit Nouvelles diverses objectifs de l'entreprise Valeur actionnariale vs. sociétale

Primauté actionnariale et Benefit corporation

Ivan Tchotourian 9 janvier 2017

Le Harvard Law School Forum on Corporate Governance and Financial Regulation propose un bel article sous la plume de Frederick Alexander : « Moving Beyond Shareholder Primacy: Can Mammoth Corporations Like ExxonMobil Benefit Everyone? ». Une belle occasion de revenir sur le thème de la Benefit Corporation et de la remise en cause de la primauté actionnariale dont elle peut être la cause…

The New York Times recently took issue with Rex Tillerson, the President-elect’s nominee for Secretary of State, and the current CEO of ExxonMobil. Why? “Tillerson Put Company’s Needs Over U.S. Interests,” accused the front page headline. The article details how the company puts shareholders’ interests before the interests of the United States and of impoverished citizens of countries around the world.

In response, a company spokesman insisted that all laws were followed, and that “‘[a]bsent a law prohibiting something, we evaluate it on a business case basis.’” As one oil business journalist puts it in the article: “‘They are really all about business and doing what is best for shareholders.’” Thus, as long as a decision improves return to shareholders, its effect on citizens, workers, communities or the environment just doesn’t rank.

Unfortunately, this idea—evaluate the “business” case, without regard to collateral damage, permeates the global capital system. Corporations are fueled by financial capital, which ultimately comes from our bank accounts, pension plans, insurance premiums and mutual funds, and from foundations and endowments created for public benefit—in other words, our money. And yet when that capital is invested in companies that ignore societal and environmental costs, we all suffer: Corporations use our savings to drive climate change, increase political instability, and risk our future in myriad ways.

The good news is that structures like “benefit corporations” can help us repair our broken system of capital allocation—but the clock is ticking.

À la prochaine…

Ivan Tchotourian

Gouvernance Nouvelles diverses Valeur actionnariale vs. sociétale

Court-termisme : les propositions de The Aspen Institute

Ivan Tchotourian 2 janvier 2017

The Aspen Institute (par l’intermédiaire de The American Prosperity Project Working Group) vient de publier un rapport proposant de contrer le court-termisme qui gangrène les entreprises américaines. Dans « The American Prosperity Project: Policy Framework », le groupe de travail propose 3 pistes de solutions qui sont les suivantes :

- Focus government investment on recognized drivers of long-term productivity growth and global competitiveness—namely, infrastructure, basic science research, private R&D, and skills training—in order to close the decades-long investment shortfall in America’s future. Building this foundation will support good jobs and new business formation, support workers affected by globalization and technology, and better position America to address the national debt through long-term economic growth.

- Unlock business investment by modernizing our corporate tax system to achieve one that is simpler, fair to businesses across the spectrum of size and industry, and supportive of both productivity growth and job creation. Changes to the corporate tax system could reduce the federal corporate statutory tax rate (at 35%, the highest in the world), broaden the base of corporate tax payers, bring off-shore capital back to the US, and reward long-term investment, and help provide revenues to assure that America’s long-term goals can be met.

- Align public policy and corporate governance protocols to facilitate companies’ and investors’ focus on long-term investment. Complex layers of market pressures, governance regulations, and business norms encourage short-term thinking in business and finance. The goal is a better environment for long-term investing by business leaders and investors, and to provide better outcomes for society.

Pour une synthèse de ce rapport de travail, vous pourrez lire cet excellent article d’Alana Semuels dans The Atlantic « How to Stop Short-Term Thinking at America’s Companies » (30 décembre 2016).

There was a time, half a century ago, when what was good for many American corporations tended to also be good for America. Companies invested in their workers and new technologies, and as a result, they prospered and their employees did too.

Now, a growing group of business leaders is worried that companies are too concerned with short-term profits, focused only on making money for shareholders. As a result, they’re not investing in their workers, in research, or in technology—short-term costs that would reduce profits temporarily. And this, the business leaders say, may be creating long-term problems for the nation.

“Too many CEOs play the quarterly game and manage their businesses accordingly,” Paul Polman, the CEO of the British-Dutch conglomerate Unilever, told me. “But many of the world’s challenges can not be addressed with a quarterly mindset.”

Polman is one of a group of CEOs and business leaders that have signed onto the American Prosperity Project, an initiative spearheaded by the Aspen Institute, to encourage companies and the nation to engage in more long-term thinking. The group, which includes CEOs such as Chip Bergh of Levi Strauss and Ian Read of Pfizer, board directors such as Janet Hill of Wendy’s and Stanley Bergman of Henry Schein, Inc., and labor leaders such as Damon Silvers of the AFL-CIO, have issued a report encouraging the government to make it easier for companies to think in the long-term by investing in infrastructure and changing both the tax code and corporate governance laws.

À la prochaine…

Ivan Tchotourian