Maximisation de la valeur actionnariale : une belle critique

Bonsoir à toutes et à tous, dans « Resisting The Lure Of Short-Termism: Kill ‘The World’s Dumbest Idea' » publié dans Forbes, Steve Denning revient sur une belle critique de la maximisation de la valeur actionnariale comme objectif des entreprises.

When pressures are mounting to deliver short-term results, how do successful CEOs resist those pressures and achieve long-term growth? The issue is pressing: low global economic growth is putting stress on the political and social fabric in Europe and the Americas and populist leaders are mobilizing widespread unrest. “By succumbing to false solutions, born of disillusion and rage,” writes Martin Wolf in the Financial Times this week, “the west might even destroy the intellectual and institutional pillars on which the postwar global economic and political order has rested.”

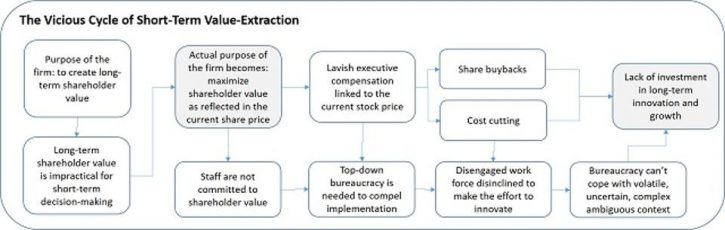

The first step in resisting the pressures of short-termism is to correctly identify their source. The root cause is remarkably simple—the view, which is widely held both inside and outside the firm, that the very purpose of a corporation is to maximize shareholder value as reflected in the current stock price (MSV). This notion, which even Jack Welch has called “the dumbest idea in the world,” got going in the 1980s, particularly in the U.S., and is now regarded in much of the business world, the stock market and government as an almost-immutable truth of the universe. As The Economist even declared in March 2016, MSV is now “the biggest idea in business.”

À la prochaine…

Ivan Tchotourian