autres publications | Page 2

autres publications mission et composition du conseil d'administration

Les femmes plus dans les comités du CA

Ivan Tchotourian 12 juin 2016

Selon une étude parue le 8 juin 2016 sur le blog de Harvard (« Women Directors and Participation on Key Committees »), la féminisation des CA progressent mais davantage dans les comités du CA.

Women corporate directors globally are showing greater proportional gains on occupying key board committees than on boards overall, according to a new analysis by leading governance and ESG data and analytics provider Institutional Shareholder Services.

Point intéressant sue le Canada :

Among markets outside Europe, boards of Australian companies showed the greatest proportional gains for overall female boardroom representation between 2014 and 2016 with a 4.9 percent increase, and with female directors now making up just under 21 percent of all directorships at those companies. Canadian companies analyzed saw the greatest growth outside of Europe in female representation on audit committees, jumping 5.6 percentage points during that same period.

À la prochaine…

Ivan Tchotourian

autres publications mission et composition du conseil d'administration normes de droit

Incertitudes sur les conséquences de la féminisation des CA

Ivan Tchotourian 31 mai 2016

ECGI publie un nouveau papier ECGI Finance Series 466/2016 consacré à la féminisation des CA intitulé : « Women on Boards: The Superheroes of Tomorrow? » (par Renée Adams).

Can female directors help save economies and the firms on whose boards they sit?

Policy makers seem to think so. Numerous countries have implemented boardroom gender policies because of business case arguments. While women may be the key to healthy economies, I argue that more research needs to be done to understand the benefits of board diversity. The literature faces three main challenges: data limitations, selection and causal inference. Recognizing and dealing with these challenges is important for developing informed research and policy. Negative stereotypes may be one reason women are underrepresented in management. It is not clear that promoting them on the basis of positive stereotypes does them, or society, a service.

À la prochaine…

Ivan Tchotourian

autres publications mission et composition du conseil d'administration Normes d'encadrement

Comité de nomination : un intéressant rapport britannique

Ivan Tchotourian 24 mai 2016

En mai 2016, l’Institute of Chartered Secretaries and Administrators (ICSA) a publié avec Ernst & Young un rapport sur le rôle du comité de nomination : « The Nomination Committee – Coming out of the Shadows ».

While its role may be less clearly defined than that of the audit committee, and its profile lower than that of the remuneration committee, it is arguably the most important of the three. It plays a pivotal role in appointing directors to the board and, if the board lacks the right balance, knowledge, skills and attributes, the likelihood of it and its committees operating effectively is greatly reduced.

Concernant sa mission et ses membres, il est précisé les points suivants :

-

What the appropriate role of the committee should be, e.g., whether the committee should look at executive talent if it does not already do so, and whether the board would benefit from combining the committee into a nomination and governance committee.

-

Whether the following processes are clearly linked: the discussion of current board composition and future composition in light of the company’s strategy, the executive and senior talent succession planning and company strategy, the outcome of the board evaluation exercise and board succession plans, and the link between board evaluations and development and training plans.

-

The existence of a two-pronged approach to identify succession plans in both emergency and steady-state situations.

À propos de la planification de la relève et la détection de talent, le rapport mentionne relativement au comité :

-

The extent to which nomination committee looks across the market and internally to identify four or five potential successors to the CEO.

-

How deeply into the organisation the committee should be looking to identify future talent.

-

The best way to develop the skills of future executive leaders in the business.

À la prochaine…

Ivan Tchotourian

autres publications mission et composition du conseil d'administration Normes d'encadrement responsabilisation à l'échelle internationale

Droits de l’homme et CA : un guide en 5 étapes

Ivan Tchotourian 24 mai 2016

L’EHRC vient de publier un guide « Business and human rights – A five-step guide for company boards » bien intéressant pour les CA. Comme le précise ce document : « We recommend that boards should follow five steps to ensure that their company is fulfilling its responsibility to respect human rights in a robust and coherent manner that meets the expectations of the UN Guiding Principles and UK statutory reporting obligations. Boards should be aware of the company’s salient, or most severe, human rights risks, and ensure ».

The following are the five steps that it is recommended boards should follow to ensure that their company is fulfilling its responsibility to meet human rights in a robust and coherent manner that meets the expectations of the UN Guiding Principles and UK statutory reporting obligations:

- the company should embed the responsibility to respect human rights into its culture, knowledge and practices;

- the company should identify and understands its salient, or most severe, risks to human rights;

- the company should systematically address its salient, or most severe, risks to human rights and provide for remedies when needed;

- the company should engage with stakeholders to inform its approach to addressing human rights risks; and

- the company should report on its salient, or most severe, human rights risks and meet regulatory reporting requirements.

Attention : encore une fois, tout cela n’est que du droit international et donc du droit « mou ». Ce guide l’exprime très bien en ces termes : « The Guiding Principles do not create any new international legal obligations on companies, but they can help boards to operate with respect for human rights and meet their legal responsibilities set out in domestic laws ».

À la prochaine…

Ivan Tchotourain

autres publications mission et composition du conseil d'administration Normes d'encadrement

Banque d’Angleterre : supervisory statement pour le CA

Ivan Tchotourian 19 mai 2016

L’Autorité prudentielle de la Banque d’Angleterre vient de publier un Supervisory Statement intitulé « Corporate governance: Board responsibilities » (SS5/16, mars 2016).

The Prudential Regulation Authority has published a policy statement and accompanying supervisory statement concerning the responsibilities of boards.

The purpose of this supervisory statement is to identify, for the boards1 of firms regulated by the Prudential Regulation Authority (PRA), those aspects of governance to which the PRA attaches particular importance and to which the PRA may devote particular attention in the course of its supervision. It is not intended to provide a comprehensive guide for boards of what constitutes good or effective governance. There are more general guidelines for that purpose, for example the UK Corporate Governance Code, published by the Financial Reporting Council.

À la prochaine…

Ivan Tchotourian

autres publications Gouvernance mission et composition du conseil d'administration Normes d'encadrement

Féminisation des CA : ça progresse !

Ivan Tchotourian 27 avril 2016

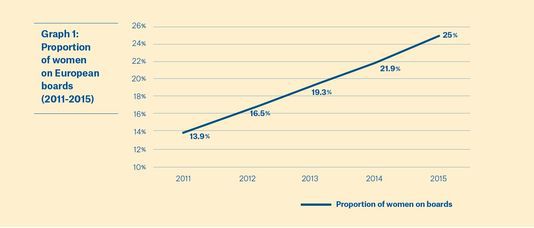

Bonjour à toutes et à tous, un article du journal Le Monde nous apprend que la féminisation des conseils d’administration augmente progressivement : « Les femmes sont plus présentes dans les conseils d’administration ».

Entre 2011 et 2015, la part des femmes dans les conseils d’administration des entreprises européennes a quasiment doublé pour passer de 13,9% à 25% en moyenne. C’est ce que révèle une enquête réalisée par le réseau européen de femmes EWoB (European Women on Boards) auprès de 600 entreprises (celles prises en compte dans l’indice boursier STOXX 600) de 12 pays et publiée ce mercredi 27 avril 2016.

On constate également de fortes disparités selon les pays : ainsi, la Suisse (16,1%) et l’ Espagne restent largement en retrait comparées à la Norvège, la Suède, la France et la Finlande qui ont dépassé le seuil des 30%. Le fruit notamment de l’adoption de quotas contraignants.

À la prochaine…

Ivan Tchotourian

autres publications engagement et activisme actionnarial mission et composition du conseil d'administration Normes d'encadrement

Besoin d’une réforme en gouvernance : le professeur Gordon s’exprime

Ivan Tchotourian 29 mars 2016

Jeffrey N. Gordon connu pour ses écrits dans le domaine de la gouvernance d’entreprise offre une belle tribune dans le Morning Consul du 22 mars 2016. Intitulé « Shareholder Activism, the Short-Termist Red-Herring, and the Need for Corporate Governance Reform », cet écrit revient sur l’activisme des hedge funds et la concentration dont ils font l’objet.

Jeffrey Gordon demande qu’une réforme de la gouvernance d’entreprise soit mise en place, non pour contrer l’activisme mais pour réformer le conseil d’administration et lui donner un rôle nouveau `s’assurer de la crédibilité de la haute direction.

It’s the attack of hedge funds, shareholder activists looking for short term gain even at the expense of investments that would produce higher returns over the long run, and, along the way, would lead to employment gains and then wage gains. What follows, then, is a prescription for changes in tax policy and legal rules that would hamper the activists, all to promote the “long run.” But this is a misdiagnosis, which fails to realize that the shareholders activists’ success reveals a major shortfall in corporate governance for large public corporations.

(…) Reform should move not in the direction of closing down the activists who are bringing the news about this design flaw. Rather we should develop a new role for the board: credibly evaluating and then verifying that management’s strategy is best for the company (or making changes if it is not). Boards need directors who will have that credibility, which is won through deep knowledge about the company and its industry and an appropriate time commitment.

À la prochaine…

Ivan Tchotourian