devoirs des administrateurs Gouvernance objectifs de l'entreprise Valeur actionnariale vs. sociétale

Maximisation de la valeur actionnariale : une belle critique

Ivan Tchotourian 6 février 2017

Bonsoir à toutes et à tous, dans « Resisting The Lure Of Short-Termism: Kill ‘The World’s Dumbest Idea' » publié dans Forbes, Steve Denning revient sur une belle critique de la maximisation de la valeur actionnariale comme objectif des entreprises.

When pressures are mounting to deliver short-term results, how do successful CEOs resist those pressures and achieve long-term growth? The issue is pressing: low global economic growth is putting stress on the political and social fabric in Europe and the Americas and populist leaders are mobilizing widespread unrest. “By succumbing to false solutions, born of disillusion and rage,” writes Martin Wolf in the Financial Times this week, “the west might even destroy the intellectual and institutional pillars on which the postwar global economic and political order has rested.”

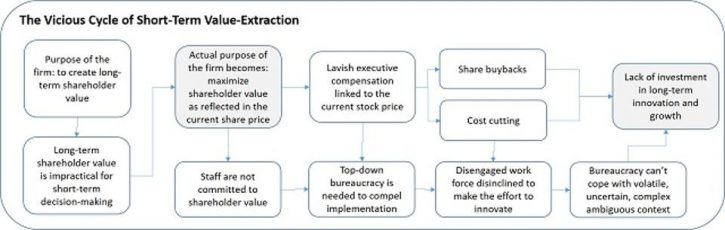

The first step in resisting the pressures of short-termism is to correctly identify their source. The root cause is remarkably simple—the view, which is widely held both inside and outside the firm, that the very purpose of a corporation is to maximize shareholder value as reflected in the current stock price (MSV). This notion, which even Jack Welch has called “the dumbest idea in the world,” got going in the 1980s, particularly in the U.S., and is now regarded in much of the business world, the stock market and government as an almost-immutable truth of the universe. As The Economist even declared in March 2016, MSV is now “the biggest idea in business.”

À la prochaine…

Ivan Tchotourian

devoirs des administrateurs Gouvernance Normes d'encadrement Nouvelles diverses

Prise en compte des parties prenantes par le CA : Leo Strine l’affirme

Ivan Tchotourian 3 février 2017

Bonjour à toutes et à tous, merci à Leo Strine de rappeler cette évidence : les CA doivent se préoccuper des parties prenantes ! Dans son article « Corporate Power is Corporate Purpose I: Evidence from My Hometown », Leo Strine s’appuie sur une analyse historique ô combien intéressante… À lire de toute urgence

Le message est clair (j’ai extrait deux phrases qui me semblent ne prêter guère le flanc à la critique) :

- This article is the first in a series considering a rather tired argument in corporate governance circles, that corporate laws that give only rights to stockholders somehow implicitly empower directors to regard other constituencies as equal ends in governance.

- DuPont’s board knew that only one corporate constituency — the stockholders — called the shots and that they were expected to make their end investors’ best interests, even if that meant hurting other constituencies. The DuPont saga isn’t a story about bad people, but a reminder to those with genuine concern for non-shareholder constituencies to face the truth and support changes in the power dynamics affecting corporate governance that make due regard for non-shareholder constituencies a required obligation for the conduct of business.

Using recent events in the corporate history of E. I. du Pont de Nemours and Company—more commonly referred to today as DuPont—as a case study, this article makes the point that the board of directors is elected by only one constituency—stockholders—and that core power structure translates into corporate purpose. DuPont is an American icon, creator of household names like Nylon and Mylar, which prided itself on its core values, which included commitments to the safety and health of the communities in which DuPont operated and to treat its employees with dignity and respect. But when an activist investor came, DuPont reacted by preemptively downsizing—cutting jobs, and spinning off assets. After winning the proxy fight, DuPont failed to meet the aggressive earnings it used in its campaign. More job cuts came, the CEO was replaced with a member of her proxy fight slate, and DuPont soon embraced a merger consistent with the activists’ goals. At the same time, DuPont demanded tax and other incentives from the affected community it had asked to rally around it in the proxy fight. It did all this even though at no time was there a threat of a lawsuit or judicial intervention from unhappy shareholders. The DuPont saga illustrates how power dictates purpose in our corporate governance system. DuPont’s board knew that only one corporate constituency—the stockholders—called the shots and that they were expected to make their end investors’ best interests, even if that meant hurting other constituencies. The DuPont saga isn’t a story about bad people, but a reminder to those with genuine concern for non-shareholder constituencies to face the truth and support changes in the power dynamics affecting corporate governance that make due regard for non-shareholder constituencies a required obligation for the conduct of business.

À la prochaine…

Ivan Tchotourian

devoirs des administrateurs Gouvernance mission et composition du conseil d'administration objectifs de l'entreprise Valeur actionnariale vs. sociétale

Les actionnaires ne sont pas les propriétaires de l’entreprise !

Ivan Tchotourian 13 novembre 2016

L’Afrique du Sud l’affirme et l’assume : la primauté actionnariale doit être remise en cause et la gouvernance d’entreprise doit s’ouvrir aux parties prenantes. Dans son dernier rapport de novembre 2016 (King IV Report on Corporate Governance), l’institut des administrateurs de sociétés sud-africaines ne dit pas autre chose !

Vous pourrez lire l’intéressante synthèse suivante : « King: Shareholders not owners of companies » (10 novembre 2016, Fin24 city press).

Shareholders are not the owners of a company – they are just one of the stakeholders, Prof Mervyn King said on Thursday at the 15th BEN-Africa Conference, which took place in Stellenbosch.

« I realised long ago that the primacy of shareholders could not be the basis in the rainbow nation, » said King. The corporate governance theory of shareholder primacy holds that shareholder interests should have first priority relative to all other corporate stakeholders.

He said when he started with his report on corporate governance the issue was that the majority of SA’s citizens were not in the mainstream of the economy. His guidelines on corporate governance, therefore, had to be for people who had never been in that mainstream of society.

The King Reports on Corporate Governance are regarded as ground-breaking guidelines for the governance structures and operation of companies in SA. The first was issued in 1994, the second in 2002, the third in 2009 and the fourth revision was released last week.

À la prochaine…

Ivan Tchotourian

devoirs des administrateurs Gouvernance Nouvelles diverses objectifs de l'entreprise Valeur actionnariale vs. sociétale

Retour sur le devoir fiduciaire : une excuse pour maximiser le retour des actionnaires ?

Ivan Tchotourian 24 octobre 2016

Intéressant ce que relaie le Time. Il y a un des candidats à l’élection présidentielle américaine a invoqué le devoir fiduciaire pour justifier les politiques d’évitement fiscales qu’il a mises en œuvre pendant de nombreuses années : « Donald Trump’s ‘Fiduciary Duty’ Excuse on Taxes Is Just Plain Wrong ». Qu’en penser ? Pour la journaliste Rana Foroohar, la réponse est claire : « The Donald and his surrogates say he has a legal responsibility to minimize tax payments for his shareholders. It’s not a good excuse ».

It’s hard to know what to say to the New York Times’ revelation that Donald Trump lost so much money running various casino and hotel businesses into the ground in the mid-1990s ($916 million to be exact) that he could have avoided paying taxes for a full 18 years as a result (which may account for why he hasn’t voluntarily released his returns—they would make him look like a failure).

But predictably, Trump did have a response – fiduciary duty made me do it. So, how does the excuse stack up? Does Donald Trump, or any taxpayer, have a “fiduciary duty,” or legal responsibility, to maximize his income or minimize his payments on his personal taxes? In a word, no. “His argument is legal nonsense,” says Cornell University corporate and business law professor Lynn Stout,

À la prochaine…

Ivan Tchotourian

devoirs des administrateurs Gouvernance normes de droit objectifs de l'entreprise Valeur actionnariale vs. sociétale

Primauté de la valeur actionnariale : l’ambivalence du droit britannique

Ivan Tchotourian 21 septembre 2016

Marc T. Moore offre un beau papier sur la place de la valeur actionnariale en Grande-Bretagne dans une perspective historique : « Shareholder Primacy, Labour and the Historic Ambivalence of UK Company Law » (Oxford University, 20 septembre 2016).

Most directors and senior managers of British companies would likely regard it as trite law that, in undertaking their functions, they are accountable first and foremost to their employer firm’s general body of shareholders. It follows that the interests of other corporate constituencies – and, in particular, those of employees – must ultimately cede to those of shareholders in the event of conflict. Although frequently taken for granted today, the lexical priority that the British company law framework affords to the interests of shareholders is remarkable, not least when viewed alongside the correspondingly disempowered corporate governance status of labour in the UK.

On first reflection, it is somewhat curious that the interests of employees have not figured more prominently within British company law, especially when one considers the general political disposition of the country in modern times. Throughout the course of the last century, the UK has witnessed 37 years of Labour government (or 42 years if one includes Labour’s participation in the wartime coalition government). And although the UK is acknowledged on the whole as having a more neo-liberal (ie right-wing) political orientation than many of its northern European counterparts, it nonetheless has a comparatively strong social-democratic (ie left-wing) political tradition in relation to other English-speaking and former-Commonwealth countries, at least since the Second World War. It is thus not unreasonable to expect that, at some point during the post-war era, democratic public policy measures might have been taken to effect the direct integration of worker interests into the heart of the British corporate legal structure.

Une de ses conclusion est intéressante :

However, whilst the centrality of shareholders’ interests to the doctrinal and normative fabric of contemporary UK company law is both manifest and incontrovertible, this has curiously not always been the case. With respect to the fundamental question of the proper corporate objective (that is, as to whose interest British company directors are expected to serve while carrying out their functions), UK company law up until 2006 adopted a highly ambiguous position. Moreover, British company law has in the fairly recent past come precariously close to adopting a radically different board representation model, in which worker interests would formally have shared centre-stage with those of shareholders in a similar vein to the traditional German corporate governance model.

À la prochaine…

Ivan Tchotourian

devoirs des administrateurs engagement et activisme actionnarial Gouvernance mission et composition du conseil d'administration

Contestation de Hecla : position des organismes de réglementation

Ivan Tchotourian 10 août 2016

Bonjour à toutes et à tous, merci au cabinet Osler de cette intéressante nouvelle portant sur les placements privés et leur rôle tactique comme moyen de défense dans le cadre du nouveau régime canadien d’offres publiques d’achat (« Les organismes de réglementation des valeurs mobilières rejettent la contestation de Hecla à l’encontre du placement privé de Dolly Varden »).

Dans une décision très attendue qui suit l’entrée en vigueur d’un nouveau régime canadien d’offres publiques d’achat plus tôt cette année, les organismes canadiens de réglementation des valeurs mobilières ont refusé de prononcer une interdiction d’opérations sur valeurs à l’encontre d’un placement privé d’actions par une société cible mis en œuvre à la suite de l’annonce d’une offre publique d’achat non sollicitée. Comme le sujet des tactiques de défense n’avait pas encore été abordé dans le nouveau régime d’offres publiques d’achat, cette décision (et, plus important encore, les motifs détaillés qui suivront) revêt un très grand intérêt pour les participants au marché qui lorgnent le paysage canadien des offres publiques d’achat.

À la prochaine…

Ivan Tchotourian

autres publications devoirs des administrateurs Gouvernance normes de droit Nouvelles diverses

Publication au Bulletin Joly Bourse : retour sur Theratechnologies

Ivan Tchotourian 7 juin 2016

Bonjour à toutes et à tous, je viens de publier au Bulletin Joly Bourse une analyse de la décision de la Cour suprême Theratechnologies inc. c. 121851 Canada inc. (2015 CSC 18). Sous le titre « Responsabilité civile sur le marché secondaire : premières précisions de la Cour suprême canadienne sur l’autorisation judiciaire préalable », je reviens sur les enseignements de cette importante décision d’avril 2015 en termes de protection des investisseurs par le biais des recours collectifs.

Rendue le 17 avril 2015, la décision de la Cour suprême canadienne Theratechnologies inc. c. 121851 Canada inc. apporte des précisions intéressantes sur le régime de responsabilité de nature civile relevant du droit des valeurs mobilières. Au travers de cet arrêt, la plus haute instance du pays se prononce pour la première fois sur les conditions d’autorisation de ce recours introduit en 2007.

À la prochaine…

Ivan Tchotourian