rémunération

4 Big Bank CEOs Ranked by 2016 Compensation

Ivan Tchotourian 28 mars 2017

Voilà quelques statistiques complémentaires sur la rémunération des hauts-dirigeants de banques… « 4 Big Bank CEOs Ranked by 2016 Compensation ».

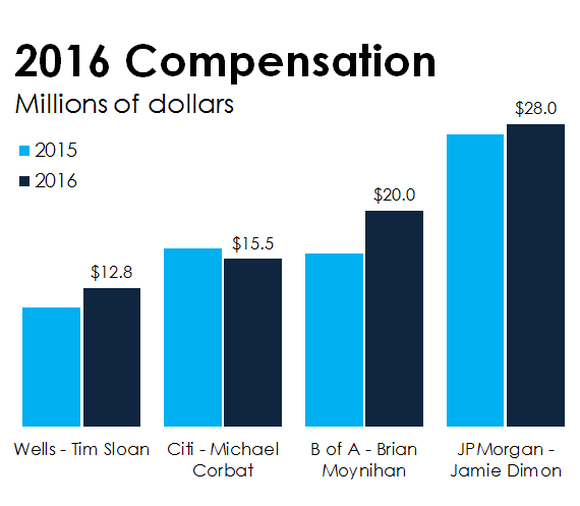

It’s that time of year when publicly traded companies file their proxy reports, which disclose how much they paid their top executives the previous year. Now that all four of the nation’s megabanks have done so, we can compare the compensation of the heads of JPMorgan Chase(NYSE:JPM), Bank of America(NYSE:BAC), Wells Fargo(NYSE:WFC), and Citigroup(NYSE:C).

Three out of these four CEOs got raises last year. Bank of America’s Brian Moynihan got the biggest raise, at 25%. All told, the 57-year-old executive earned $20 million last year. That ranks the Bank of America CEO second when it comes to total 2016 compensation.

À la prochaine…

Ivan Tchotourian

Gouvernance rémunération

The 100 Most Overpaid CEOs: Are Fund Managers Asleep at the Wheel?

Ivan Tchotourian 15 mars 2017

Bonjour à toutes et à tous, un article intitulé « The 100 Most Overpaid CEOs: Are Fund Managers Asleep at the Wheel? » expose la synthèse du 3e rapport de l’agence As You Know. Quel bilan dresse-t-elle ? Rien de surprenant si j’osais le dire !

According to the Economic Policy Institute, “CEO pay grew an astounding 943% over the past 37 years, greatly outpacing the

growth in the cost of living, the productivity of the economy, and the stock market, disproving the claim that the growth in CEO pay reflects the ‘performance’ of the company, the value of its stock, or the ability of the CEO to do anything but disproportionately raise the amount of his pay.”

For the past two years we have highlighted the 100 most overpaid CEOs of S&P 500 companies, and the votes of large shareholders, including mutual funds and pension funds on their pay packages.

What has changed since the first report? Not much. Executive pay has continued to increase. Although mutual funds and pension funds are doing better at exercising their fiduciary responsibility by more frequently voting their proxies against some of the most outrageous CEO pay packages. Of the mutual funds with the largest changes in voting habits from last year, all of them opposed more of the pay packages than they had the prior year.

As we noted in our prior reports, the system in place to govern corporations has failed in the area of executive compensation. Like all the best governance systems, corporate governance relies on a balance of power. That system envisions directors representing shareholders and guarding the company’s assets from waste. It also envisions shareholders holding companies and executives accountable.

Point essentiel à souligner :

KEY FINDINGS

Of the top 25 most overpaid CEOs, 15 made the list for the second year in a row, and 10 have been on the list for the third time. These rankings are based on a statistical analysis of company financial performance with a regression to identify predicted pay, as well as an innovative index developed by As You Sow that considers more than 30 additional factors.

The companies we listed in first report on overpaid CEOs has markedly underperformed the S&P 500 since that time. The 10 companies we identified as the most overpaid firms as a group underperformed the S&P 500 index by a gaping 10.5% and actually demolished shareholder value as a group with –5.7% financial returns. In summary, the most overpaid CEO firms destroyed shareholder value since our first report.

Many of the overpaid CEOs are insulated from shareholder votes, suggesting that shareholder scrutiny can be an important deterrent to outrageous pay packages. A number of the most overpaid CEOs are at companies with unequal voting structures and/or triennial votes, so shareholders did not have the opportunity to vote this year on the extraordinary packages. While the Say-on-Pay law allows less frequent votes, and shareholders can decide if they prefer to vote every one, two, or three years, the vast majority of companies hold annual votes on pay. We believe that the fact that our list of the top 25 overpaid CEOs includes several companies that do not hold annual votes on pay implies that such insulated companies are more willing to flaunt best practices on pay and performance.

The most overpaid CEOs represent an extraordinary misallocation of assets. Regression analysis showed 14 companies whose CEOs received compensation at least $20 million more 2015 than they would have garnered if their pay had been aligned with performance.

Shareholder votes on pay are wide-ranging and inconsistent, with pension funds engaging in more quantitative analysis. This report, representing the broadest survey of institutional voting ever done on the topic, shows that pension funds are more likely to vote against overpaid packages than mutual funds. Using various state disclosure laws, we were able to collect data from over 30 pension funds. The data shows some pension funds approving just 18% of these overpaid CEO pay packages, to others approving as many as 93% of them.

Mutual funds, on the other hand, are far more likely approve of these overpaid CEO pay packages even though among mutual funds there is wide variation. Of the mutual funds with the largest changes in voting habits from last year, all of them opposed more of the pay packages than they had the prior year. In addition to the trending votes, several funds have indicated that, at a minimum, they will be reviewing pay more closely. Of the largest mutual funds, Dimensional Fund Advisors opposed 53% of these packages, while Blackrock opposed only 7% of them. Some funds seem to routinely rubber stamp management pay practices, enabling the worst offenders and failing in their fiduciary duty. TIAA-CREF, the leading retirement provider for teachers and college professors, is more likely to approve high-pay packages than almost any other institution of its size with support level of 90%.

Directors, who should be acting as stewards of shareholder interests, should be held individually accountable for overseeing egregious pay practices. A number of directors serve on two or more overpaid S&P 500 compensation committees. We list the companies that over-paying directors serve on, and identify individuals who serve on two or more ‘overpaid’ S&P 500 compensation committees.

A primary goal of the report is to focus on mutual fund voting data. This data is disclosed on an annual basis according to a proxy season that covers shareholder meetings held from July 1 of the previous year to June 30 of the present year.

Pour accéder au rapport complet : cliquez ici.

À la prochaine…

Ivan Tchotourian

Gouvernance Nouvelles diverses rémunération

Trop payés les P-DG ? Quelle place pour la chance ?

Ivan Tchotourian 8 mars 2017

Olivier Schmouker propose un billet qui risque d’en faire réagir plus d’un autour d’une question simple : « Les PDG sont-ils vraiment trop payés? » (Les affaires.com, 8 mars 2017). Je partage pleinement les mots de l’auteur (et notamment la place centrale de la chance dans la problématique de la rémunération) et ne peux m’empêcher de partager avec vous plusieurs extraits…

Morceaux choisis :

Les PDG sont-ils trop payés?» La question est récurrente, et soulève à chaque fois les passions. C’est que le travail effectué par un PDG est difficilement palpable – il ne fabrique rien, par exemple –, et donc, difficilement estimable. D’où le débat sans fin entre ceux qui sont convaincus que leurs rémunérations sont «pharaoniques» et ceux qui sont persuadés qu’elles sont «légitimes».

En conséquence, les PDG ne sont pas rémunérés à la performance, comme ils prétendent pourtant l’être. Leur rémunération apparaît même irrationnelle, et donc, inappropriée si l’on considère qu’il s’agit là d’un transfert de richesse des investisseurs – rappelons que le conseil d’administration a notamment pour fonction de représenter les investisseurs – vers la haute-direction de l’entreprise

Qu’est-ce à dire, au juste? Eh bien, que les PDG sont de plus en plus payés en fonction de critères ne figurant pas parmi les principes comptables généralement admis. Oui, vous avez bien lu : on trouve différents biais pour « justifier » d’un point de vue comptable une rémunération qui ne colle plus à la performance réelle de l’entreprise qu’ils pilotent.

C’est que – tenez-vous bien! – le succès d’un PDG ne résulte pas de l’exercice de ses talents, mais de… la chance! Je me permets de le souligner: de la chance.

À la prochaine…

Ivan Tchotourian

engagement et activisme actionnarial Gouvernance normes de droit Nouvelles diverses rémunération

Futures assemblées annuelles : que va changer le say on pay ?

Ivan Tchotourian 26 janvier 2017

Dans un article de Le Revenu (24 janvier 2017), Alain Chaigneau propose une intéressante synthèse des implications du vote de la loi Sapin II sur la rémunération des hauts dirigeants (et l’adoption du fameux say on pay) : « Un contrôle encore plus serré de la rémunération des dirigeants ».

Cette année, lors des assemblées générales, le contrôle de la rémunération des entreprises cotées en Bourse va encore se durcir. Les actionnaires avaient déjà leur mot à dire en la matière, sous forme du fameux « say on pay ».

Mais la loi dite Sapin 2 (transparence, lutte contre la corruption, modernisation de l’économie), adoptée dans sa forme définitive le 8 novembre dernier, va encore resserrer les mailles du filet.

La place attend avec impatience les décrets d’application de ces textes, d’ici la fin mars. Mais l’essentiel du nouveau dispositif est maintenant connu, comme l’a écrit Stéphanie de Robert Hautequere, avocat expert au cabinet Fidal : « Avec la loi Sapin 2, tant le mode de calcul que le montant des rémunérations des dirigeants seront désormais soumis à un vote contraignant – et non plus simplement consultatif – des actionnaires. Ce double vote s’appliquera à toutes les entreprises cotées sur Euronext ».

À la prochaine…

Ivan Tchotourian

Normes d'encadrement normes de droit normes de marché rémunération

Rémunération des hauts dirigeants : on n’en sort pas !

Ivan Tchotourian 20 janvier 2017

Le Forum Économique Mondial a publié sur son site le 4 janvier un texte de Stefan Stern (directeur du High Pay Centre) qui aborde la problématique de la rémunération des hauts dirigeants « Today’s CEO earns 130 times the average salary. We need to talk about this ». L’auteur a le mérite de rappeler une chose fondamentale : la législation ne peut régler le problème à elle seule et c’est une approche holistique qu’il faut adopter.

We will find out in the coming months and years whether these appeals to voters were more than campaign rhetoric. But we should be in no doubt: business is vulnerable to the charge that the gap in pay between those at the top and the rest has grown too large. This attack has potency. It can shift voter sentiment and determine the results of important elections.

A recent study from the ILO, the Global Wage Report, found that the top 10% of highest paid workers in Europe together earn almost as much as the bottom 50%. “The payment of extremely high wages by a few enterprises to a few individuals leads to a ‘pyramid’ of highly unequally distributed wages,” the report said. Figures from the FTSE100 index of companies reveal a similar story. Whereas 20 years ago the average CEO was getting around 45 times the pay of the average worker in the business, today that ratio is around 130 times.

(…) But ultimately legislation can only do so much. Out-of-control pay at the top is a systemic, cultural problem. It requires all participants to change their behaviour. And those changes will be more effective and long-lasting if people choose to act differently, rather than being forced to do so.

À la prochaine…

Ivan Tchotourian

Nouvelles diverses rémunération

Rémunération des dirigeants canadiens : le rapport alarmant du CCPA

Ivan Tchotourian 3 janvier 2017

Le Centre canadien des politiques alternatives qui a suivi le salaire des PDG du pays sur10 ans affirme que ce groupe aura empoché le salaire moyen annuel d’un Canadien travaillant à temps plein vers 11h47 mardi, le premier jour de travail de l’année pour la majorité des gens.

Selon un rapport intitulé « Throwing Money at the Problem 10 Years of Executive Compensation » :

Despite public outrage over exorbitantly high compensation packages, CEO pay has continued unabated, weathering all kinds of economic storms, and soaring to new highs. This year’s report finds that Canada’s highest paid 100 CEOs have set a new record: their total compensation in 2015 hit a new high at $9.5 million, or 193 times more than someone earning an average wage. They earn the average Canadian wage ($49,510) by 11:47 a.m. on January 3—the first working day of the year.

3 recommandations sont faites :

- One line of attack would be to take compensation decisions out of the hands of the board of directors entirely, by making shareholder votes on pay mandatory rather than advisory.

- A second, less dramatic, change would be to change the accountability of compensation advisors to make them accountable to shareholders rather than to the board, like auditors.

- In the absence of corporate board leadership, it falls to government.

Pour une synthèse, vous pourrez lire l’article suivant sur La presse.ca.

À la prochaine…

Ivan Tchotourian

rémunération

Rémunération des dirigeants : le fantôme de Ghosn

Ivan Tchotourian 2 janvier 2017

Belle année qui s’annonce avec déjà cette actualité brûlante en matière de rémunération des dirigeants : « Carlos Ghosn, PDG de Renault, pourrait toucher une plus-value de 6 millions d’euros » (Le Monde, 27 décembre 2016).

Le PDG de Renault, Carlos Ghosn, a exercé des options d’achat d’actions, ou stock-options, attribuées au titre de sa rémunération variable, qui pourraient lui permettre d’empocher plus de six millions d’euros de plus-value, selon un document consulté mardi 27 décembre par l’AFP.

Dans une déclaration à l’Autorité des marchés financiers (AMF), publiée par ce « gendarme de la Bourse », le dirigeant indique avoir acquis, le 16 décembre, 132 720 actions de sa société au prix unitaire contractuel de 37,43 euros. Or, le cours de l’action Renault Paris était, mardi après-midi, de 85,34 euros, soit une plus-value potentielle de 6,36 millions d’euros pour M. Ghosn, s’il revendait ces titres à ce prix.

À la prochaine…

Ivan Tchotourian