Retour sur « le » cas canadien d’activisme : CP Rail

Yvan Allaire et François Dauphin reviennent sur l’intervention agressive d’activistes chez CP Rail dans un papier publié par l’IGOPP : « Pershing Square, Ackman and CP Rail: A Case of Successful ‘Activism’? » (28 novembre 2016). Si terribles ces activistes ?

Pershing Square Capital Management, an activist hedge fund owned and managed by William Ackman, began hostile maneuvers against the board of CP Rail in September 2011 and ended its association with CP in August 2016, having netted a profit of $2.6 billion for his fund. This Canadian saga, in many ways, an archetype of what hedge fund activism is all about, illustrates the dynamics of these campaigns and the reasons why this particular intervention turned out to be a spectacular success… thus far.

(…) In this day and age, the CP case teaches us that no matter its size or the nature of its business, a company is always at risk of being challenged by dissident shareholders, and most particularly by those funds which make a business of these sorts of operations, the activist hedge funds. Of course, a number of critical features of this saga can be singled out to explain the particular success of this intervention, but this is not the focal point of this post. After all, a widely held company with weak financial results and a stagnating stock price will inevitably attract the attention of these funds

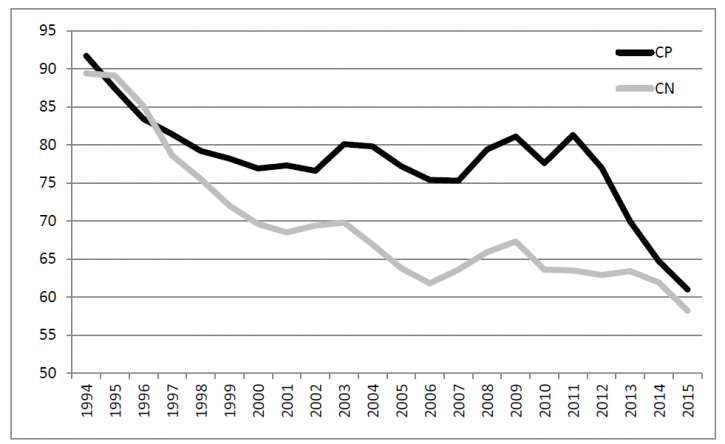

But the puzzling question and it is an unresolved dilemma of corporate governance remains: how come the board did not know earlier what became apparent very quickly after the Ackman/Harrison takeover? Why would the board not call on independent experts to assess management’s claim that structural differences made it impossible for CP to achieve a performance similar to that of other railroads? The gap in operating ratio between CP and CN had not always been as wide. In fact, as shown in Figure 1, CP had a lower operating ratio than CN during a period of time in the 1990s (Of course, CN was a Crown corporation at that time). The gap eventually widened, reaching unprecedented levels during Fred Green’s tenure (…)

How could the board have known that performances far superior to those targeted by the CEO could be swiftly achieved?

Lurking behind these questions is the fundamental flaw of corporate governance: the asymmetry of information, of knowledge and time invested between the governors and the governed, between the board of directors and management. In CP’s case, the directors, as per the norms of “good” fiduciary governance, relied on the information provided by management, believed the plans submitted by management to be adequate and challenging, and based the executives’ lavish compensation on the achievement of these plans. The Chairman, on behalf of the Board, did “extend our appreciation to Fred Green and his management team for aggressively and successfully implementing our Multi-Year plan and creating superior value for our shareholders and customers.” That form of governance is being challenged by activist investors of all stripes.

Their claim, a demonstrable one in the case of CP, is that with the massive amount of information now accessible about a publicly listed company and its competitors, it is possible for dedicated shareholders to spot poor strategies and call for drastic changes. If push comes to shove, these funds will make their case directly to other shareholders via a proxy contest for board membership.

Corporate boards of the future will have to act as “activists” in their quest for information and their ability to question strategies and performances.

À la prochaine…

Ivan Tchotourian