Divulgation divulgation extra-financière Gouvernance Normes d'encadrement normes de droit

Reporting extra-financier, AMF et ESMA

Ivan Tchotourian 20 novembre 2023 Ivan Tchotourian

En matière de reporting extra-financier, l’AMF encourage les sociétés cotées à mettre en oeuvre les recommandations de l’ESMA (ici). Le communiqué de presse du 8 novembre 2023 est clair :

Pour le reporting extra-financier, les superviseurs européens se sont accordés cette année sur trois grandes priorités de supervision communes :

- priorité 1 : les informations à fournir en application de l’article 8 du règlement Taxonomie. L’ESMA rappelle que les sociétés doivent analyser l’alignement de leurs activités sur les différents objectifs de la taxonomie pour lesquels des critères d’examen sont définis et préciser, le cas échéant, comment le double comptage a été évité. Une analyse des plans de dépenses d’investissement (CapEx) liés au développement des activités durables est par ailleurs nécessaire pour rendre compte des efforts de transition des sociétés. L’ESMA insiste également sur l’utilisation fidèle des nouveaux modèles de tableaux de reporting et sur l’importance des informations contextuelles qui accompagnent les indicateurs clés de performance (ICP) en matière de taxonomie (transparence accrue sur la méthodologie d’analyse, sur les plans CapEx, sur les éléments de variations des indicateurs, etc.). Enfin, après un rappel des prochaines obligations de reporting taxonomie applicables à compter du 1er janvier 2024, l’ESMA encourage fortement les sociétés à se référer aux foires aux questions (FAQ) de la Commission européenne sur l’interprétation et la mise en œuvre des obligations Taxonomie.

- priorité 2 : les enjeux liés à la publication d’objectifs relatifs au climat, et en particulier les objectifs de réduction de gaz à effet de serre (GES) et les objectifs soutenant les trajectoires de transition. Il est important pour l’ESMA que les émetteurs communiquent des objectifs climatiques assortis d’échéances, en précisant les conséquences attendues pour l’entreprise et son environnement et les liens avec d’autres objectifs publics ou fixés par l’entreprise (par exemple, le lien avec l’objectif de 1,5°C de réchauffement climatique planétaire pour les objectifs de réduction des GES). L’ESMA insiste également sur le lien avec la stratégie globale de l’entreprise, les actions plus spécifiques mises en place pour atteindre ces cibles et leur financement (par exemple, les leviers de décarbonation pour réduire les émissions de GES). L’ESMA appelle aussi à une transparence accrue sur la méthodologie et les hypothèses retenues pour fixer ces objectifs (par exemple, préciser les périmètres (scopes) d’émissions de GES couverts). Enfin, il est essentiel que les émetteurs décrivent les progrès accomplis dans la réalisation de ces objectifs et expliquent comment ces derniers sont suivis et revus.

- priorité 3 : la publication des émissions de gaz à effet de serre indirectes de scope 3. Compte-tenu de l’importance de ce poste d’émissions chez certaines sociétés et de la prise en compte par les investisseurs de cette information dans leurs décisions en matière d’investissement durable, l’ESMA rappelle certains aspects importants en termes de transparence : l’appréciation du caractère complet du reporting des émissions de GES en cas d’absence du scope 3, le périmètre et la méthodologie de calcul des émissions de scope 3, la présentation des données brutes d’émissions de GES séparément des émissions séquestrées ou compensées le cas échéant. L’ESMA porte une attention particulière au libellé d’indicateur de scope 3 qui doit pouvoir refléter son caractère partiel en cas d’exclusions significatives par rapport à la méthodologie de reporting suivie.

A l’instar des années précédentes, l’AMF encourage les sociétés cotées établissant une déclaration de performance extra-financière et celles redevables d’un reporting taxonomie à appliquer ces recommandations.

L’ESMA a également souhaité sensibiliser les émetteurs sur la nécessité de se préparer à l’entrée en vigueur le 1er janvier 2024 de la directive sur le reporting de durabilité (Corparate sustainability reporting directive ou CSRD) sur la publication d’informations en matière de durabilité par les entreprises. L’ESMA indique la mise en place par l’EFRAG d’une plateforme dédiée aux questions techniques en vue de faciliter l’application des normes européennes d’information en matière de durabilité (« normes ESRS »).

À la prochaine…

Divulgation divulgation extra-financière Normes d'encadrement normes de droit Responsabilité sociale des entreprises

IFRS : deux nouvelles normes en discussion sur le climat et la durabilité

Ivan Tchotourian 29 avril 2022 Ivan Tchotourian

La Fondation IFRS a créé un nouveau conseil d’établissement de normes – l’International Sustainability Standards Board (ISSB) – qui va émettre des normes sur la communication de l’information ESG. Or, l’ISSB vient de publier deux nouvelles normes qu’elle soumet à consultation :

• IFRS S1 – General Requirements for Disclosure of Sustainability-related Financial Information (the General Requirements Standard)

• IFRS S2 – Climate-related Disclosures (the Climate Standard)

Pour en savoir plus : cliquez ici

The International Sustainability Standards Board expects on 31 March 2022 to publish:

- Exposure Draft Proposed IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information; and

- Exposure Draft Proposed IFRS S2 Climate-related Disclosures.

The documents will be available to download from the Open for comment section and from their project pages, General Sustainability-related Disclosures and Climate-related Disclosures. To comment on the Exposure Drafts you will need to have an IFRS Foundation account, which can be created here.

À la prochaine…

Divulgation divulgation extra-financière Gouvernance normes de droit Responsabilité sociale des entreprises

Changement climatique : proposition de la SEC

Ivan Tchotourian 21 mars 2022 Ivan Tchotourian

L’autorité boursière étatsunienne vient de publier sa proposition en mati`ère de transparence du risque climatique : « The Enhancement and Standardization of Climate-Related Disclosures for Investors ».

Résumé

The Securities and Exchange Commission (“Commission”) is proposing for public comment amendments to its rules under the Securities Act of 1933 (“Securities Act”) and Securities Exchange Act of 1934 (“Exchange Act”) that would require registrants to provide certain climate-related information in their registration statements and annual reports. The proposed rules would require information about a registrant’s climate-related risks that are reasonably likely to have a material impact on its business, results of operations, or financial condition. The required information about climate-related risks would also include disclosure of a registrant’s greenhouse gas emissions, which have become a commonly used metric to assess a registrant’s exposure to such risks. In addition, under the proposed rules, certain climate-related financial metrics would be required in a registrant’s audited financial statements.

À la prochaine…

actualités internationales Divulgation divulgation extra-financière normes de droit Responsabilité sociale des entreprises

Proposal for a Corporate Sustainability Reporting Directive (CSRD)

Ivan Tchotourian 29 avril 2021 Ivan Tchotourian

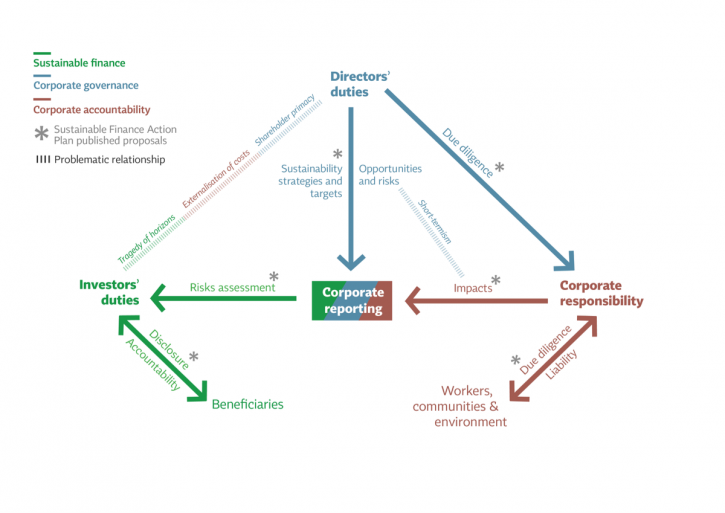

Le 21 avril 2021, l’Union européenne a publié une série de mesures touchant la taxonomie, le reporting extra-financier et les devoirs des investisseurs institutionnels.

Éléments essentiels :

The Commission adopted a proposal for a Corporate Sustainability Reporting Directive (CSRD), which would amend the existing reporting requirements of the NFRD. The proposal

- extends the scope to all large companies and all companies listed on regulated markets (except listed micro-enterprises)

- requires the audit (assurance) of reported information

- introduces more detailed reporting requirements, and a requirement to report according to mandatory EU sustainability reporting standards

- requires companies to digitally ‘tag’ the reported information, so it is machine readable and feeds into the European single access point envisaged in the capital markets union action plan

À la prochaine…

actualités internationales Divulgation divulgation extra-financière Gouvernance normes de droit

Les adieux au reporting extra-financier… vraiment ?

Ivan Tchotourian 29 avril 2021 Ivan Tchotourian

Blogging for sustainability offre un beau billet sur la construction européenne du reporting extra-financier : « Goodbye, non-financial reporting! A first look at the EU proposal for corporate sustainability reporting » (David Monciardini et Jukka Mähönen, 26 April 2021). Les auteurs soulignent la dernière position de l’Union européenne (celle du 21 avril 2021 qui modifie le cadre réglementaire du reporting extra-financier) et explique pourquoi celle-ci est pertinente. Du mieux certes, mais encore des critiques !

Extrait :

A breakthrough in the long struggle for corporate accountability?

Compared to the NFRD, the new proposal contains several positive developments.

First, the concept of ‘non-financial reporting’, a misnomer that was widely criticised as obscure, meaningless or even misleading, has been abandoned. Finally we can talk about mandatory sustainability reporting, as it should be.

Second, the Commission is introducing sustainability reporting standards, as a common European framework to ensure comparable information. This is a major breakthrough compared to the NFRD that took a generic and principle-based approach. The proposal requires to develop both generic and sector specific mandatory sustainability reporting standards. However, the devil is in the details. The Commission foresees that the development of the new corporate sustainability standards will be undertaken by the European Financial Reporting Advisory Group (EFRAG), a private organisation dominated by the large accounting firms and industry associations. As we discuss below, the most important issue is to prevent the risks of regulatory capture and privatization of EU norms. What is a step forward, though, is the companies’ duty to report on plans to ensure the compatibility of their business models and strategies with the transition towards a zero-emissions economy in line with the Paris Agreement.

Third, the scope of the proposed CSRD is extended to include ‘all large companies’, not only ‘public interest entities’ (listed companies, banks, and insurance companies). According to the Commission, companies covered by the rules would more than triple from 11,000 to around 49,000. However, only listed small and medium-sized enterprises (SMEs) are included in the proposal. This is a major flaw in the proposal as the negative social and environmental impacts of some SMEs’ activities can be very substantial. Large subsidiaries are thereby excluded from the scope, which also is a major weakness. Besides, instead of scaling the general standards to the complexity and size of all undertakings, the Commission proposes a two-tier regime, running the risk of creating a ‘double standard’ that is less stringent for SMEs.

Fourth, of the most welcomed proposals, however, is strengthening a ‘double materiality’ principle for standards (making it ‘enshrined’, according to the Commission), to cover not only just the risks of unsustainability to companies themselves but also the impacts of companies on society and the environment. Similarly, it is positive that the Commission maintains a multi-stakeholder approach, whereas some of the international initiatives in place privilege the information needs of capital providers over other stakeholders (e.g. IIRC; CDP; and more recently the IFRS).

Fifth, a step forward is the compulsory digitalisation of corporate disclosure whereby information is ‘tagged’ according to a categorisation system that will facilitate a wider access to data.

Finally, the proposal introduces for the first time a general EU-wide audit requirement for reported sustainability information, to ensure it is accurate and reliable. However, the proposal is watered down by the introduction of a ‘limited’ assurance requirement instead of a ‘reasonable’ assurance requirement set to full audit. According to the Commission, full audit would require specific sustainability assurance standards they have not yet planned for. The Commission proposes also that the Member States allow firms other than auditors of financial information to assure sustainability information, without standardised assurance processes. Instead, the Commission could have follow on the successful experience of environmental audit schemes, such as EMAS, that employ specifically trained verifiers.

No time for another corporate reporting façade

As others have pointed out, the proposal is a long-overdue step in the right direction. Yet, the draft also has shortcomings, which will need to be remedied if genuine progress is to be made.

In terms of standard-setting governance, the draft directive specifies that standards should be developed through a multi-stakeholder process. However, we believe that such a process requires more than symbolic trade union and civil society involvement. EFRAG shall have its own dedicated budget and staff so to ensure adequate capacity to conduct independent research. Similarly, given the differences between sustainability and financial reporting standards, EFRAG shall permanently incorporate a balanced representation of trade unions, investors, civil society and companies and their organisations, in line with a multi-stakeholder approach.

The proposal is ambiguous in relation to the role of private market-driven initiatives and interest groups. It is crucial that the standards are aligned to the sustainability principles that are written in the EU Treaties and informed by a comprehensive science-based understanding of sustainability. The announcement in January 2020 of the development of EU sustainability reporting standards has been followed by the sudden move by international accounting body the IFRS Foundation to create a global standard setting structure, focusing only on financially material climate-related disclosures. In the months to come, we can expect enormous pressure on EU policy-makers to adopt this privatised and narrower approach, widely criticised by the academic community.

Furthermore, the proposal still represents silo thinking, separating sustainability disclosure from the need to review and reform financial accounting rules (that remain untouched). It still emphasises transparency over governance. Albeit it includes a requirement for companies to report on sustainability due diligence and actual and potential adverse impacts connected with the company’s value chain, it lacks policy coherence. The proposal’s link with DG Justice upcoming legislation on the boards’ sustainability due diligence duties later this year is still tenuous.

After decades of struggles for mandatory high-quality corporate sustainability disclosure, we cannot afford another corporate reporting façade. It is time for real progress towards corporate accountability.

À la prochaine…

Divulgation divulgation extra-financière Gouvernance Normes d'encadrement normes de droit normes de marché Responsabilité sociale des entreprises

La SEC consulte sur le changement climatique

Ivan Tchotourian 14 avril 2021 Ivan Tchotourian

La SEC a publié récemment une nouvelle sur son site indiquant qu’elle chercher l’avis du public sur sa réglementation dans le domaine du changement climatique : « Public Input Welcomed on Climate Change Disclosures » (15 mars 2021). C’est le moment de vous exprimer !

La SEC bouge en ce domaine comme cet extrait du message de la SEC le résume bien : Since 2010, investor demand for, and company disclosure of information about, climate change risks, impacts, and opportunities has grown dramatically. Consequently, questions arise about whether climate change disclosures adequately inform investors about known material risks, uncertainties, impacts, and opportunities, and whether greater consistency could be achieved. In May 2020, the SEC Investor Advisory Committee approved recommendations urging the Commission to begin an effort to update reporting requirements for issuers to include material, decision-useful environmental, social, and governance, or ESG factors. In December 2020, the ESG Subcommittee of the SEC Asset Management Advisory Committee issued a preliminary recommendation that the Commission require the adoption of standards by which corporate issuers disclose material ESG risks.

Extrait :

Questions for Consideration

- How can the Commission best regulate, monitor, review, and guide climate change disclosures in order to provide more consistent, comparable, and reliable information for investors while also providing greater clarity to registrants as to what is expected of them? Where and how should such disclosures be provided? Should any such disclosures be included in annual reports, other periodic filings, or otherwise be furnished?

- What information related to climate risks can be quantified and measured? How are markets currently using quantified information? Are there specific metrics on which all registrants should report (such as, for example, scopes 1, 2, and 3 greenhouse gas emissions, and greenhouse gas reduction goals)? What quantified and measured information or metrics should be disclosed because it may be material to an investment or voting decision? Should disclosures be tiered or scaled based on the size and/or type of registrant)? If so, how? Should disclosures be phased in over time? If so, how? How are markets evaluating and pricing externalities of contributions to climate change? Do climate change related impacts affect the cost of capital, and if so, how and in what ways? How have registrants or investors analyzed risks and costs associated with climate change? What are registrants doing internally to evaluate or project climate scenarios, and what information from or about such internal evaluations should be disclosed to investors to inform investment and voting decisions? How does the absence or presence of robust carbon markets impact firms’ analysis of the risks and costs associated with climate change?

- What are the advantages and disadvantages of permitting investors, registrants, and other industry participants to develop disclosure standards mutually agreed by them? Should those standards satisfy minimum disclosure requirements established by the Commission? How should such a system work? What minimum disclosure requirements should the Commission establish if it were to allow industry-led disclosure standards? What level of granularity should be used to define industries (e.g., two-digit SIC, four-digit SIC, etc.)?

- What are the advantages and disadvantages of establishing different climate change reporting standards for different industries, such as the financial sector, oil and gas, transportation, etc.? How should any such industry-focused standards be developed and implemented?

- What are the advantages and disadvantages of rules that incorporate or draw on existing frameworks, such as, for example, those developed by the Task Force on Climate-Related Financial Disclosures (TCFD), the Sustainability Accounting Standards Board (SASB), and the Climate Disclosure Standards Board (CDSB)?[7] Are there any specific frameworks that the Commission should consider? If so, which frameworks and why?

- How should any disclosure requirements be updated, improved, augmented, or otherwise changed over time? Should the Commission itself carry out these tasks, or should it adopt or identify criteria for identifying other organization(s) to do so? If the latter, what organization(s) should be responsible for doing so, and what role should the Commission play in governance or funding? Should the Commission designate a climate or ESG disclosure standard setter? If so, what should the characteristics of such a standard setter be? Is there an existing climate disclosure standard setter that the Commission should consider?

- What is the best approach for requiring climate-related disclosures? For example, should any such disclosures be incorporated into existing rules such as Regulation S-K or Regulation S-X, or should a new regulation devoted entirely to climate risks, opportunities, and impacts be promulgated? Should any such disclosures be filed with or furnished to the Commission?

- How, if at all, should registrants disclose their internal governance and oversight of climate-related issues? For example, what are the advantages and disadvantages of requiring disclosure concerning the connection between executive or employee compensation and climate change risks and impacts?

- What are the advantages and disadvantages of developing a single set of global standards applicable to companies around the world, including registrants under the Commission’s rules, versus multiple standard setters and standards? If there were to be a single standard setter and set of standards, which one should it be? What are the advantages and disadvantages of establishing a minimum global set of standards as a baseline that individual jurisdictions could build on versus a comprehensive set of standards? If there are multiple standard setters, how can standards be aligned to enhance comparability and reliability? What should be the interaction between any global standard and Commission requirements? If the Commission were to endorse or incorporate a global standard, what are the advantages and disadvantages of having mandatory compliance?

- How should disclosures under any such standards be enforced or assessed? For example, what are the advantages and disadvantages of making disclosures subject to audit or another form of assurance? If there is an audit or assurance process or requirement, what organization(s) should perform such tasks? What relationship should the Commission or other existing bodies have to such tasks? What assurance framework should the Commission consider requiring or permitting?

- Should the Commission consider other measures to ensure the reliability of climate-related disclosures? Should the Commission, for example, consider whether management’s annual report on internal control over financial reporting and related requirements should be updated to ensure sufficient analysis of controls around climate reporting? Should the Commission consider requiring a certification by the CEO, CFO, or other corporate officer relating to climate disclosures?

- What are the advantages and disadvantages of a “comply or explain” framework for climate change that would permit registrants to either comply with, or if they do not comply, explain why they have not complied with the disclosure rules? How should this work? Should “comply or explain” apply to all climate change disclosures or just select ones, and why?

- How should the Commission craft rules that elicit meaningful discussion of the registrant’s views on its climate-related risks and opportunities? What are the advantages and disadvantages of requiring disclosed metrics to be accompanied with a sustainability disclosure and analysis section similar to the current Management’s Discussion and Analysis of Financial Condition and Results of Operations?

- What climate-related information is available with respect to private companies, and how should the Commission’s rules address private companies’ climate disclosures, such as through exempt offerings, or its oversight of certain investment advisers and funds?

- In addition to climate-related disclosure, the staff is evaluating a range of disclosure issues under the heading of environmental, social, and governance, or ESG, matters. Should climate-related requirements be one component of a broader ESG disclosure framework? How should the Commission craft climate-related disclosure requirements that would complement a broader ESG disclosure standard? How do climate-related disclosure issues relate to the broader spectrum of ESG disclosure issues?

À la prochaine…