actualités internationales | Page 2

actualités internationales Gouvernance mission et composition du conseil d'administration

What The Director Of The Future Will Need To Succeed

Ivan Tchotourian 8 juillet 2020 Ivan Tchotourian

Board Member vient de publier une étude sur les CA du futur : « What The Director Of The Future Will Need To Succeed ». Intéressant dans le monde post COVID-19.

Merci à Louise Champoux-Paillé de l’information !

Extrait :

“The future of business will be different,” surmised a director on a recent virtual board roundtable hosted by RSR Partners, “in ways we can’t anticipate in this moment. Our board is focused on assessing whether all our directors are truly ready for what’s coming.”

Over the past few months, RSR Partners hosted more than a dozen roundtables for sitting directors, providing a forum for the participants to share what their boards are learning as they navigate the current crisis and pivot into the “new normal.” While tackling topics as diverse as commercial strategy, operations, health and safety, and the future of business, one theme was pervasive throughout the discussions: leadership and stakeholders will be looking to the boardroom for guidance, and board members not only need to have the requisite experience and skills to confidently provide direction, but the leadership characteristics that will allow them to be effective.

Fundamentally, the global business disruption and current uncertainty has created a need for a higher level of involvement from board members. “This is a time to have board members who have experienced really tough issues, such as major ecessions, difficult mergers, major cost cutting, insolvency and bankruptcy, and top management departures, along with experience in reinventing companies, including supply chain, product engineering and simplification, digital transformation, offshore manufacturing and procurement, sale of subsidiaries, and comprehensive refinancing,” stated Edward A. Kangas, former Chairman and CEO of Deloitte Touche. “This is not a time for deep thinking. It’s time for people with real experience who know how to oversee and support management in a time of crisis and reinvention.” (Mr. Kangas currently serves on the following boards: Deutsche Bank USA Corp., Intelsat SA, VIVUS, Inc., and Hovnanian Enterprises, Inc.).

Characteristics of Directors Who Succeed in the “New Normal”

From a practical perspective, there is now a higher premium placed on a director’s proven ability to navigate a business through a crisis while mitigating risk and understanding how and when to pull the levers that will impact balance sheets. The demand to optimize results, sustain business, and adapt to changes in a regional and global market has increased alongside the time commitment and attention to detail required of directors to address these issues. Normal requirements for sound governance, audit oversight, compensation strategies, business performance goals, and succession of key leadership have continued to be paramount during the crisis. However, what the current crisis has forced boards to recognize is that a combination of specialized and diversified skillsets and characteristics will produce good corporate governance in and after 2020.

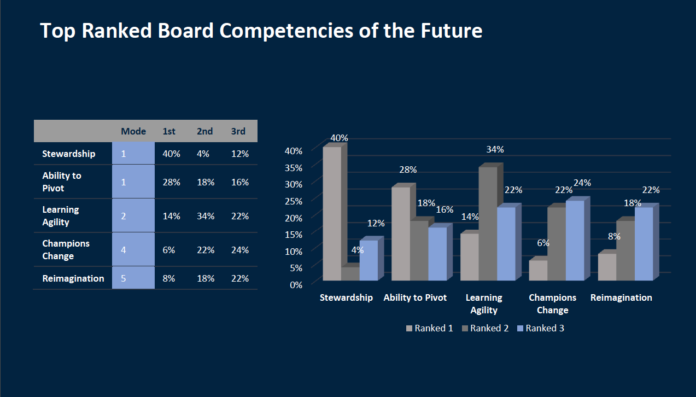

In addition to listening to the characteristics discussed in the recent roundtables, RSR Partners polled more than 250 public company board members of Fortune 50-1000 companies to identify the traits they hope to see emerge in this generation of board members. The results indicated that stewardship, the ability to pivot and learn agility, to be a champion of change, and to be capable of reimagination will be most needed by the directors charged with steering their boards in the “new normal.”

1. Stewardship

2. Ability to Pivot

3. Learning Agility

4. Champions of Change

5. Reimagination

À la prochaine…

actualités internationales Gouvernance Nouvelles diverses Responsabilité sociale des entreprises

Corporate Social Responsibility in the Times of Covid

Ivan Tchotourian 3 juin 2020 Ivan Tchotourian

Bonjour à toutes et à tous, petite lecture tirée du Oxford Business Law Blog : « Corporate Social Responsibility in the Times of Covid » de Akshaya Kamalnath (12 mai 2020).

Extrait :

Corporate social responsibility (CSR) is a concept that notoriously evades definition. Some have said that companies should act in socially responsible ways in their daily operations while charitable donations have historically been brought under this umbrella. The former understanding of CSR is often preferred because simply making charitable donations while doing business in an irresponsible manner causing harm to various stakeholders is clearly undesirable.

India’s company law has a CSR provision requiring companies to donate 2% of their profits from the preceding three years on activities designated by the government. (You can read a detailed analysis of the law in an article by Sandeep Gopalan and me here.) One criticism of such an understanding of CSR is that the meaning restricts itself to charitable donations without venturing into how companies conduct their day to day business.

The coronavirus has given us an unpleasant jolt with which to test if companies are happy to simply comply with the CSR provision and do nothing else to accommodate various stakeholders that are suffering in this crisis. Yet many big businesses in India (Bajaj Auto, Tata Sons, Vedanta Group) promised not to cut salaries of staff during the pandemic. Instead, some companies suggested that they were considering a pay cut for CEOs and other members of the promoter group (the controlling shareholder group in India, typically a family).

(…) When viewed from the perspective of the epidemic, charitable contribution seems like a perfectly valid form of CSR. This is not only because the company is addressing an urgent need at the moment but also because the initiatives have come from individual companies rather than as a response to a forced government mandate of requiring a certain amount of expenditure on CSR activities. The Ministry of Corporate Affairs (MCA) issued an order stating that companies’ responses to the covid crisis could be classified as CSR. The companies Act only allows spending on designated categories to be classified as CSR. Since one of the designated categories is ‘combating human immunodeficiency virus, acquired immune deficiency syndrome, malaria and other diseases’, the order from the MCA was not too surprising. Obviously, India’s rigid definition of CSR means that innovative responses from companies that offered their resorts to be used as temporary care facilities will not be considered CSR.

The lesson to take beyond the pandemic is for the Indian government to resist the urge to intervene in how companies comply with the CSR provision in the law. Allowing companies to be creative and using their CSR activities to gain reputational capital is not a bad idea. In fact, this should be further encouraged by letting companies disclose their social activities along with the CSR disclosures (relating to the required spending) required by the law.

À la prochaine…

actualités internationales Gouvernance Nouvelles diverses

COVID-19 et risques : rapport du Forum économique mondial

Ivan Tchotourian 3 juin 2020 Ivan Tchotourian

Le Forum économique mondial vient de publier son nouveau rapport sur les risques globaux : « COVID-19 Risks Outlook – A Preliminary Mapping and Its Implications ».

Extrait :

Based on the perceptions of 350 of the world’s top risk professionals, a thorough analysis of early evidence and trends, and the collective knowledge of the Global Risks team and its partners (Marsh & McLennan and Zurich Insurance Group), the report identifies four key areas of concern:

- Economic Shifts: Emerging Risks from Structural Change

- Sustainability Setbacks: Emerging Risks from Stalling Progress

- Societal Anxieties: Emerging Risks from Social Disruptions

- Technology Dependence: Emerging Risks from Abrupt Adoption

Unsurprisingly, economic risks are regarded as the most challenging fallout from the pandemic, dominating companies’ risks perceptions. A prolonged global recession tops the list of most feared risks, closely followed by bankruptcy, industry consolidation, failure of industries to recover and a disruption of supply chains.

Alongside this, geopolitical disruption to business, in the form of policies that exploit COVID-19 to restrict the movement of people and goods, is another greatly feared risk. Couple these with concern of another infectious disease outbreak, an increase in cybercrime and the breakdown of IT infrastructure and networks, and the outlook fuels pessimism.

À la prochaine…

actualités internationales Nouvelles diverses Responsabilité sociale des entreprises

Covid-19 : la Plateforme RSE donne la parole à ses membres

Ivan Tchotourian 3 juin 2020 Ivan Tchotourian

Très intéressant ce qu’offre la plateforme RSE en France. Dans la période exceptionnelle de la crise du Covid-19, la Plateforme RSE a invité ses membres à faire part de leurs réflexions sur l’impact de la crise : Quels sont les défis auxquels fait face votre organisation ? Quelles sont les problématiques que soulève la crise pour votre organisation ? Quelles sont les réflexions portées par votre organisation dans ce contexte ? Quelle peut être la contribution de votre organisation à la résolution de la crise ?

Je vous laisse découvrir les contributions ici !

À la prochaine…

actualités internationales Gouvernance Nouvelles diverses Responsabilité sociale des entreprises

COVID-19 : repenser la RSE

Ivan Tchotourian 2 juin 2020 Ivan Tchotourian

Intéressante entrevue de Jérôme Bédier (Président d’Equalogy, ancien Secrétaire Général et Directeur Général délégué du groupe Carrefour) surtout sur la partie RSE. Un message clair est souligné : « La crise du Covid-19 conduit à revisiter en profondeur la RSE » (Confinews, 26 mai 2020).

Extrait :

La crise du Covid-19 conduit à revisiter en profondeur la RSE. Cette crise affirme la pertinence et l’importance de la RSE dans le paysage et elle donne finalement toute une série d’éléments et d’indications qui vont faire bouger les choses. Prenons un exemple, l’exemple le plus criant de cette réflexion à mener : celui de la relation managériale, la relation de travail et l’organisation de l’entreprise. L’explosion du télétravail, le lien entre le contrat de travail, l’entreprise et les collaborateurs, les sujétions particulières de présence, la façon de relier les collaborateurs à l’entreprise, tout cela se conjuguant avec l’impératif de plus en plus exigé d’équilibre entre la vie professionnelle et la vie privée, tout cela va conduire à des modes managériaux différents. Tout ne sera plus basé sur la présence physique en entreprise, comme cela était le cas jusqu’à présent.

La satisfaction des collaborateurs va devenir très importante : on parle du bien-être au travail, du « caring », cela aboutit à une remise en question des modes d’organisation. On repense l’efficacité des modes de travail, l’épanouissement des collaborateurs, la diminution des sujétions de toute nature. De grands Groupes ont commencé à le dire dans la presse, avec des prises de position assez fortes, concernant par exemple le fait de ne plus avoir de locaux et de faire du télétravail une forme de norme. Il va également y avoir une évolution des comportements sociaux dans l’entreprise : quelles seront les formes de relation ? Quid de la distanciation ? Comment allons-nous manifester notre sympathie et notre empathie ? Comment va se faire désormais l’organisation des voyages, des réunions, des modes de management des entreprises à réseau ? Toute cette partie-là du management, qui était installée dans des habitudes, va être remis en cause. La première conséquence de cette crise va donc être l’innovation dans les modes de management et l’importance apportée à la satisfaction des collaborateurs. Plus ils seront satisfaits et plus ils seront efficaces et productifs pour l’entreprise. Dans ces réflexions, dans ces changements, il faudra accorder un soin particulier à ceux dont la présence physique est indispensable (les personnels de services, les commerçants, les ouvriers, ceux qui travaillent dans l’hôtellerie ou la restauration, etc.). Ils doivent être pris en compte dans ce mouvement. Pour moi, cela constitue l’élément-clef de la RSE.

À la prochaine…

actualités internationales Gouvernance Nouvelles diverses Responsabilité sociale des entreprises

Réponses des multinationales du CAC 40 à la crise

Ivan Tchotourian 9 mai 2020 Ivan Tchotourian

The Conversation publie un article sur la COVID-19 sur la réponse des multinationales à la crise : Sabine Urban et Ulrike Mayrhofer, « La grande disparité des réponses des multinationales du CAC 40 à la crise« , 4 mai 2020.

Extrait :

L’analyse des données collectées met en relief la diversité des réponses qui sont apportées par les multinationales du CAC 40. Nous avons identifié quatre groupes de multinationales :

- Les multinationales « citoyennes » faisant preuve de générosité (15 entreprises) ;

- Les multinationales tournées vers la continuité de l’activité (10 entreprises) ;

- Les multinationales orientées vers l’innovation (5 entreprises)

- Les multinationales n’ayant pas annoncé de mesures spécifiques face au Covid-19 (10 entreprises).

Plusieurs enseignements peuvent être tirés des réactions observées. Notre travail révèle que la plupart des multinationales s’adaptent à la nouvelle situation et font preuve de flexibilité et de responsabilité.

De manière surprenante, certaines multinationales n’ont pas annoncé de mesures spécifiques par rapport à la pandémie et il serait pertinent de s’interroger sur les raisons de ce choix.

Il ressort de notre analyse que la crise sanitaire mondiale provoquée par le Covid-19 entraîne de nombreux changements pour les multinationales du CAC 40, notamment au niveau des stratégies empruntées, des modes d’organisation et des relations avec les parties prenantes et la société.

À la prochaine…

actualités internationales Gouvernance Normes d'encadrement normes de droit Nouvelles diverses

COVID-19 et réformes en matière de droit des sociétés par actions : tendances et questions

Ivan Tchotourian 7 mai 2020 Ivan Tchotourian

Bonjour à toutes et à tous, je signale cette intéressante étude : Zetzsche, Dirk Andreas and Anker-Sørensen, Linn and Consiglio, Roberta and Yeboah-Smith, Miko, « The COVID-19-Crisis and Company Law – Towards Virtual Shareholder Meetings », 15 avril 2020, University of Luxembourg Faculty of Law, Economics & Finance, WPS 2020-007.

Extrait :

Regulators and Parliaments around the world have responded to the COVID-19 epidemic by amending company law. This crisis legislation allows us to examine how, and to what effect, the corporate governance framework can be amended in times of crisis. In fact, almost all leading industrialized nations have already enacted crisis legislation in the field of company law.

In our recent working paper, ‘The COVID-19-Crisis and Company Law – Towards Virtual Shareholder Meetings’, we have sought to (1) document the respective crisis legislation; (2) assist countries looking for solutions to respond rapidly and efficiently to the crisis; (3) exchange experiences of crisis measures; and (4) spur academic discussion on the extent to which the crisis legislation can function as a blueprint for general corporate governance reform.

Countries considered in full or in part include Australia, Austria, Belgium, Canada, China, France, Germany, Hong Kong, Italy, Luxembourg, the Netherlands, Norway, Portugal, Singapore, South Korea, Spain, Switzerland, Thailand, the United Kingdom, and the United States. Readers are encouraged to highlight any inaccuracies in our presentation of the respective laws, and to bring further crisis-related legislation not considered in this working draft to the attention of the authors. Moreover, readers are invited to indicate where there is room for improvement therein, and/or to signal the need for policy reform.

Drawing on the analysis of these more than twenty countries, we note five fields in which legislators have been particularly active. First, the extension of filing periods for annual and quarterly reports to reflect the practical difficulties regarding the collection of numbers and the auditing of financial statements. Second, company law requires shareholders to take decisions in meetings—and these meetings were for the most part in-person gatherings. However, since the gathering of individuals in one location is now at odds with the measures being implemented to contain the virus, legislators have generally allowed for virtual-only meetings, online-only proxy voting and voting-by-mail, and granted relief to various formalities aimed at protecting shareholders (including fixed meeting and notice periods). Third, provisions requiring physical attendance of board members, including provisions on signing corporate documents, have been temporarily lifted for board matters. Fourth, parliaments have enacted changes to allow for more flexible and speedy capital measures, including the disbursement of dividends and the recapitalization of firms, having accepted that the crisis impairs a company’s equity. Fifth and finally, some countries have implemented temporary changes to insolvency law to delay companies’ petitioning for insolvency as a result of the liquidity shock prompted by the imposition of overnight lockdowns.

The legislation passed in response to the COVID-19 crisis provides for an interesting case study through which to examine what can be done to modernize the corporate governance framework with a view to furthering digitalization. Given the difficulties or indeed the impossibility of conducting in-person meetings currently, the overall trajectory of company law reforms has been to allow for digitalization of corporate governance, and ensuring the permissibility of virtual shareholder meetings (VSM), in particular.

In this respect, it is safe to assume that the rules on VSM will have model character. While the details of the modus operandi of VSM will require careful adjustment, to ensure that shareholders will be afforded the same rights and opportunities to participate as they would at an in-person meeting (including Q&A), the experimental phase during the crisis will feed into the policy discussion, with some more successful and some less successful examples providing food for thought. Yet, it is safe to say that the COVID-19 pandemic has unveiled the need for virtual-only shareholder meetings, and that some types of VSM will stay for good long after the current crisis has subsided.

À la prochaine…