autres publications engagement et activisme actionnarial Gouvernance

BIS Research Paper : en savoir plus sur la chaîne de détention des actions

Ivan Tchotourian 18 janvier 2016

Le dernier BIS Research Paper se révèle intéressant sur la chaîne de détention d’actions (et sa complexité) : Exploring the intermediated shareholding model – BIS research paper 261 (BIS/16/20).

Many shareholders now hold shares indirectly through an intermediary, rather than directly with a company.

This research looks at the UK’s intermediated shareholding model in order to gain a better understanding of the existing model and to identify any weaknesses.

À la prochaine…

Ivan Tchotourian

autres publications Gouvernance Nouvelles diverses

FTSE350 : revue annuelle de la gouvernance par Grant Thornton

Ivan Tchotourian 29 décembre 2015

Bonjour à toutes et à tous, Grant Thornton a publié récemment l’édition 2015 de sa revue annuelle de gouvernance basée sur l’analyse des rapports annuels des entreprises britanniques du FTSE350 : « Trust and Integrity – Loud and Clear? ».

Quelques faits saillants :

The 2015 figures show a slight drop in the number of FTSE 350 companies who complied with all but one or two Code provisions (90% compared to last year’s 93.5%). And overall the level of full compliance for the FTSE 350 has decreased slightly from 61% to 57%. However this is offset by an improvement in the quality of explanations, with 69.4% providing good quality explanations against 59.3% last year.

The principal area of non-compliance is board independence.

55% quality shareholder engagement falls from 64%

Only 54% of companies make a passing reference to culture and values, more FTSE 350 chairmen discussed culture in their primary statements.

À la prochaine…

Ivan Tchotourian

mission et composition du conseil d'administration

Qu’attend-t-on d’un CA ? Réponse d’Andrew Bailey

Ivan Tchotourian 15 novembre 2015

Andrew Bailey, haut responable de la Prudential Regulation Authority britannique, s’est exprimé le 3 novembre 2015 devant la Banque d’Angleterre sur le thème suivant : « Governance and the role of Boards« . Je résume en quelques mots : rendre simple ce qui est complexe !

Morceau choisi :

The PRA has close contact with many Boards, so as supervisors what do we expect of Boards? Three things stand out for me:-

1. we expect Boards to exercise good judgment in overseeing the running of the firm and to do so on a forward-looking basis;

2. that judgement is improved by good constructive challenge from Non-Executives. A firm’s culture should promote discussion, debate and honest challenge. The alarm bells ring for us when we are told that the CEO or other Senior Executives are very sensitive to challenge;

3. so we as supervisors depend on Non-Executives, under the leadership of the Chair, to challenge the Executive in all aspects of the firm’s strategy, which includes the viability and sustainability of the business model and the establishment, maintenance and use of the risk appetite and management framework. We also of course rely on the Non-Executives to mentor and coach the Executives and balancing this with the essential ability to challenge is a vital component of an effective Board.

(…) So, let me put forward a proposition for Boards. It is the job of the Executive to be able to explain in simple and transparent terms these complex matters to Non-Executives. In doing so, you should understand the uncertainty around judgements, in what circumstances they could be wrong, and how there can reasonably be different ways to measure things like liquidity. Non-Executives should not be left to find the answers for themselves, and they should not feel that they have to do so out of a lack of sufficient confidence in what they are being told. In other words, they should not be pointed towards the haystack with warm wishes for the search ahead.

À la prochaine…

Ivan Tchotourian

mission et composition du conseil d'administration

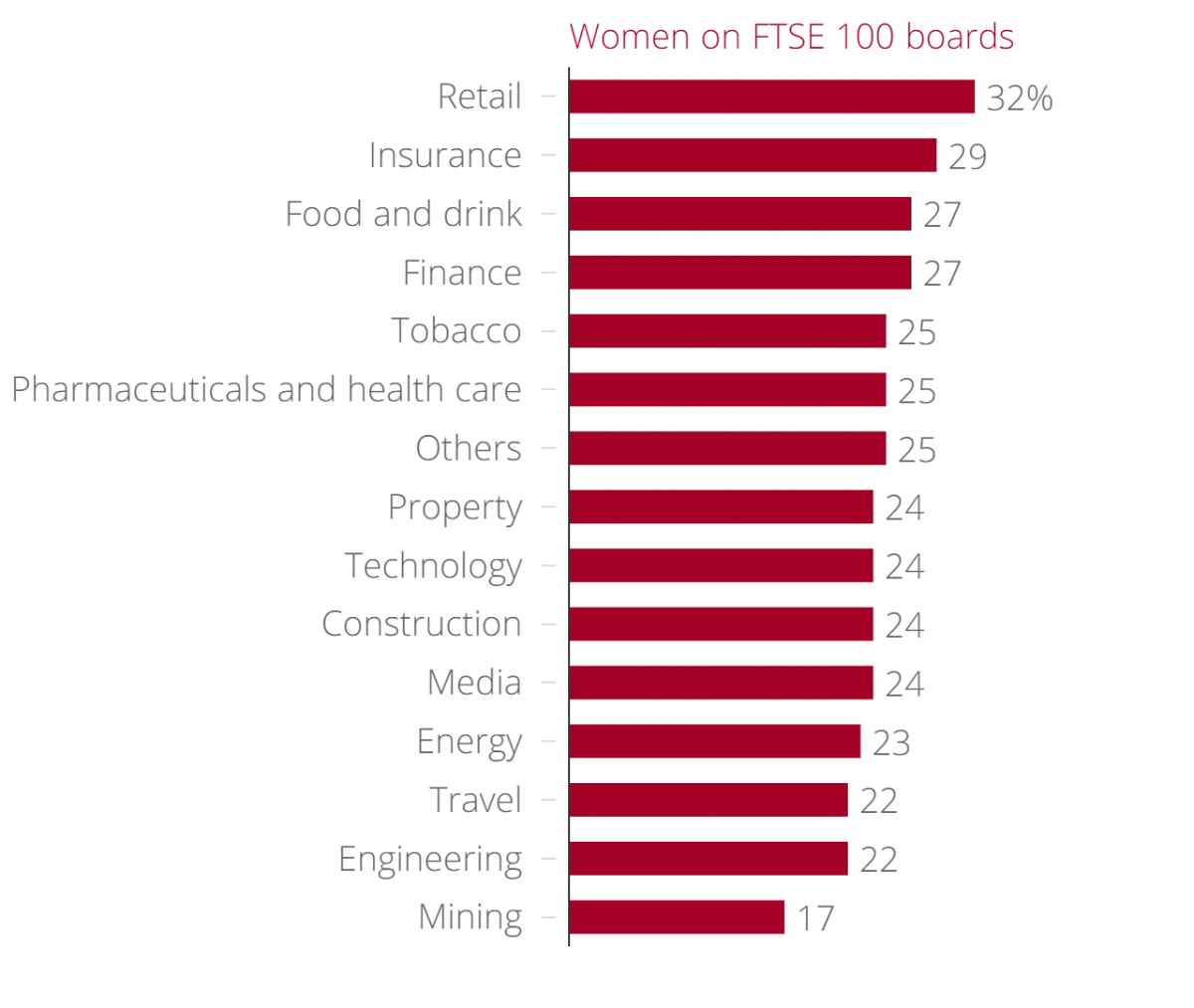

Les pires secteurs de la féminisation des CA

Ivan Tchotourian 1 octobre 2015

Vous êtes curieux de savoir quels sont les pires secteurs d’activité pour la féminisation des CA ? Je vous renvoie à cet article de Clara Guibourg du journal londonien CityA.M. : « Worst sectors for boardroom diversity: Women joining FTSE 100 boards but mining lags far behind retail industry as Conservatives push to end gender pay gapp ».

More women are joining the boards of Britain’s most powerful companies, but there’s a big difference between different industries, a breakdown by sector reveals. In a bid to end the gender pay gap « in a generation”, Prime Minister David Cameron announced plans today to require UK firms to publish gender pay audits. But progress is being made: last week FTSE 100 companies reached their target of 25 per cent female directors. But while retail companies have one-third female boards, mining companies land at just over half that, with 17 per cent women.

À la prochaine…

Ivan Tchotourian

normes de droit rémunération

Un ratio sur le salaire entre hommes et femmes ?

Ivan Tchotourian 24 septembre 2015

En voilà une nouvelle venue de Grande-Bretagne ! Le gouvernement britannique s’apprêterait à faire voter une loi visant les entreprise de plus de 250 employés destinée à rendre public la différence de rémunération entre les hommes et les femmes travaillant dans les équipes dirigeantes.

David Cameron has announced that large firms will be forced to publish the pay difference between men and women from next year in a bid to eliminate the gender pay gap “within a generation”.

“I’m announcing a really big move: we will make every single company with 250 employees or more publish the gap between average female earnings and average male earnings,” says Cameron. “That will cast sunlight on the discrepancies and create the pressure we need for change, driving women’s wages up.”

The Institute of Directors says it shares the government’s aims to get rid of the gender pay gap, but has some concerns: “Making companies publish average pay differences could produce misleading information,” says IoD chief economist James Sproule.

Pour en savoir plus, rendez sur le site IoD Director pour lire « David Cameron to force big companies to reveal gender pay gap ».

À la prochaine…

Ivan Tchotourian