engagement et activisme actionnarial Gouvernance Normes d'encadrement normes de droit normes de marché Nouvelles diverses

Code de gouvernance en Allemagne : la responsabilité des investisseurs réaffirmée

Ivan Tchotourian 20 mars 2017

Le Code de gouvernance allemand vient d’être réformé récemment : « Germany corp gov code to emphasise investor responsibility » (Susanna Rust, IPE, 15 février 2017). Vous trouverez dans cet article une belle synthèse de cette réforme.

Germany’s corporate governance code is being amended to emphasise that institutional investors have a responsibility to exercise their ownership rights.

The amendments follow a six-week consultation period that generated a strong response, both positive and critical, according to the government-appointed commission responsible for the code. The commission decided on changes to the code itself and the preamble, which sets out the spirit behind the code.

The preamble has been extended to argue that good corporate governance requires companies and their directors to conduct business ethically and take responsibility for their behaviour. The German word used by the commission for the latter is “Eigenverantwortung” – literally translated as “self-responsibility” or “own-responsibility”.

The guiding principle of an “honourable businessperson” (“ehrbarer Kaufmann”) was introduced to the preamble to reflect this.

À la prochaine…

Ivan Tchotourian

Gouvernance Normes d'encadrement normes de marché Nouvelles diverses

L’ISR a le vent en poupe au Canada !

Ivan Tchotourian 16 mars 2017

L’ISR prendrait de plus en plus d’ampleur selon un article de Finance et investissement : « L’investissement responsable change le monde de la finance ».

L’investissement responsable (IR) occupe une place de plus en plus importante dans le monde, au point de « changer la donne sur le marché de la finance », rapporte Le Devoir. Le quotidien a rencontré Corinne Gendron, professeure à l’École des sciences de la gestion de l’UQAM, pour l’interroger sur ce qui est en passe de devenir un véritable phénomène de société.

Les plus récentes données de l’Association canadienne pour l’investissement responsable montrent qu’en 2014, les actifs sous gestion de ce secteur au pays représentaient quelque 1 000 milliards de dollars, soit une progression de 68 % en l’espace de deux ans. À l’époque, l’IR représentait 31 % des actifs sous gestion dans le secteur canadien des placements

À la prochaine…

Ivan Tchotourian

engagement et activisme actionnarial Gouvernance normes de droit normes de marché

Le temps de l’activisme… sociétalement responsable ?

Ivan Tchotourian 14 mars 2017

Dans GreenBiz, Keith Larsen revient sur l’activisme actionnariale sous un angle particulier : le fait que cet activisme s’oriente en faveur de la RSE et que cette tendance va connaître une croissance les temps prochains (« It looks like this year will be big for investor activism », 14 mars 2017).

Amid unprecedented uncertainty about the Trump administration’s commitment to environmental and social issues, investors are relying more heavily than ever on companies to take action on initiatives such as addressing climate change, conserving water or reducing waste.

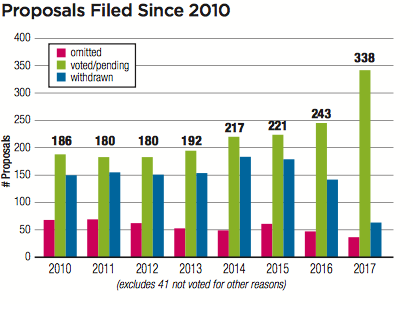

So far in 2017, shareholder resolutions specifically related to social and environmental issues have increased to 430 from 370 resolutions last year, according to As You Sow’s annual Proxy Preview.

According to the report, resolutions related to climate change and political activity underlie much of the shareholder activist sentiment thus far in 2017. Overall, environmental policies were the subject of 26 percent of the proposals filed, while corporate disclosures related to political activity accounted for 21 percent of the proposals filed. Suggestions related to human rights (18 percent), sustainability programs (12 percent) and diversity (11 percent) rounded out the top five.

The Proxy Preview provides an overview of environmental, social and sustainable governance resolutions filed in 2017 in preparation for « proxy season, » when shareholders of public companies vote on new boards and a range of issues during annual meetings.

(…) A rise in investor activism

Shareholder resolutions, also known as shareholder proposals, are part of a larger trend of shareholder activism in ESG issues.

A recent study by Harvard University found that about 40 percent of shareholder proposals on the Russell 3000, an index that is a benchmark for the entire U.S stock market, are related to ESG issues, a 60 percent increase since 2003.

While the study found that most of these ESG proposals fail to receive majority support, it also found that these resolutions nonetheless can improve a company’s attention and performance on the ESG issue in question.

À la prochaine…

Ivan Tchotourian

Gouvernance normes de marché

Vidéo sur l’investissement éthique et ses questions

Ivan Tchotourian 21 février 2017

Bonjour à toutes et à tous, vous trouverez une capsule-vidéo proposée par Les affaires.com portant sur l’investissement éthique et ses zones grises : « des investissements éthiques, vraiment? ».

Il arrive fréquemment que des épargnants rencontre leur planificateur financier avec la volonté d’investir dans des fonds éthiques. Toutefois, en regardant de plus près un indice de référence dans le secteur, on trouve quelques mauvaises surprises, souligne Vincent Fournier, gestionnaire de portefeuille chez Claret. Entrevue.

À la prochaine…

Ivan Tchotourian

autres publications Gouvernance Normes d'encadrement normes de droit normes de marché

Governance goes green : à lire !

Ivan Tchotourian 6 juillet 2016

Beau rapport du cabinet Weil, Gotshal & Manges LLP qui montre que la RSE ne peut plus être ignoré par les entreprises : « Governance Goes Green ».

It’s not just us tree-huggers. Increasingly, institutional investors, pension plans and regulators are calling for (and in some cases requiring) companies to assess and report on the sustainability of their business operations and investments. Climate change and other environmental concerns are at the forefront of these calls. Institutional investors are focusing on sustainable business practices – a broad category in which environmental and social risks, costs and opportunities of doing business are analyzed alongside conventional economic considerations – as a key factor in long-term financial performance. Sustainability proponents are looking to boards of directors and management to integrate these considerations into their companies’ long-term business strategies.

Éléments essentiels à retenir :

- Institutional investors increasingly regard environmental and other sustainability issues as strategic matters for companies.

- Shareholders continue to submit environmental and other sustainability proposals, successfully garnering attention and prompting companies to make changes, despite their failure to win majority votes.

- Independent organizations are developing standards for sustainability and environmental reporting to provide investors with consistent metrics for assessing and comparing the sustainability of companies’ practices.

- Sustainability and environmental reporting remains in the SEC’s sights as it evaluates the effectiveness of current disclosure requirements and considers changes for the future.

À la prochaine…

Ivan Tchotourian

autres publications Gouvernance normes de droit normes de marché Structures juridiques Valeur actionnariale vs. sociétale

Pourquoi les entreprises deviendraient-elles des B Corp ?

Ivan Tchotourian 20 juin 2016

En voilà une question allez-vous me répondre et pourtant… Un récent article du Harvard Business Review de Suntae Kim, Matthew Karlesky, Christopher Myers et Todd Schifeling intitulé « Why Companies Are Becoming B Corporations » aborde la question de face.

2 raisons essentielles sont identifiées :

- First, as large established firms have ramped up their corporate social responsibility efforts, small businesses that have long been committed to social and environmental causes want to prove that they are more genuine, authentic advocates of stakeholder benefits.

- The qualitative evidence, gathered from firms’ B corporation application materials, revealed that certifying firms believed “the major crises of our time are a result of the way we conduct business,” and they became a B Corporation to “join the movement of creating a new economy with a new set of rules” and “redefine the way people perceive success in the business world.”

So why do certain firms (and not others) choose to identify as B Corporations? Individual leaders are partly why some organizations broaden their purpose beyond maximizing shareholder value. We might look to Sir Richard Branson, who in 2013 co-launched the “B Team,” publicly decrying corporations’ sole focus on short-term profits and calling for a reprioritization of people- and planet-focused performance. We might also consider leaders of firms like Ben & Jerry’s or Patagonia (both B Corporations) that have prioritized societal and environmental agendas.

Clearly, such leaders can be important catalysts of social change. However, the explosive growth of B Corporations seems also to be driven by broader trends and changes in the corporate landscape that cannot be explained by individuals’ actions alone.

Two of us (Suntae Kim and Todd Schifeling) conducted research to build a more robust understanding of the rise of B corporations. By qualitatively examining the internal motives of firms in the process of becoming a B corporation, and quantitatively testing key factors in these firms’ external industry environment – including the shareholder- and stakeholder-focused behaviors of their corporate competitors – we found that there are at least two major underlying reasons why firms choose to seek B Corporation certification.

À la prochaine…

Ivan Tchotourian

autres publications Gouvernance normes de marché rémunération

« How incentives for long-term management backfire » : cela fait réfléchir !

Ivan Tchotourian 16 mai 2016

Le Harvard Business Review propose un article intitulé : « How incentives for long-term management backfire” qui prend le contrepied de la croyance voulant que les plans incitatifs basés sur la performance à long terme seraient une cause du court-termisme de la direction des entreprises.

In the five years since the advent of Dodd-Frank regulation, corporate governance groups, with their policies requiring at least half of long-term incentives to be “performance-based,” have pushed companies to replace options with multi-year, performance plans. How could anyone object to such an effort? Hardly anyone, except here is the rub: Performance plans require performance targets, and in most companies, planning works in three-year cycles. The logical performance period for long-term incentives is one that matches those cycles. Three years has thus become the standard performance window for measuring achievement.

So a three-year horizon — not even a presidential term — has inexorably become the norm for investing hundreds of billions of dollars of money aimed at creating “long term” value. With the best of intentions, many proxy advisors and long-term investors have widely blessed three years as appropriate, adopting three-year pay for performance as their standard comparison. Today, four out of five S&P 500 companies use a three-year performance period in their long-term incentives. But executives today, who are paid on this new “long term,” typically with equity based partly on earnings-per-share performance, naturally think twice about retaining earnings for projects beyond three years. Their measurements conflict with their managerial inclinations, encouraging them to use earnings booked today to immediately return cash to shareholders.

À la prochaine…

Ivan Tchotourian