Gouvernance | Page 44

Gouvernance Normes d'encadrement

Corporate Use of Social Media

Ivan Tchotourian 4 juin 2016

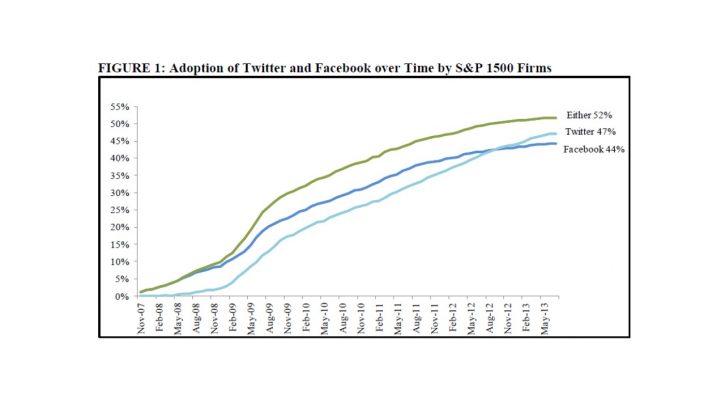

Intéressante étude sur l’utilisation des médias sociaux par les grandes entreprises américaines produite par Ahmed Tahoun, Clare Wang, James Naughton, Michael Jung sur le Harvard Law School Forum on Corporate Governance and Financial Regulation : « Corporate Use of Social Media ». Comme le montre le tableau que j’ai reproduit, la thématique est plus que d’actualité !

Social media has transformed communications in many sectors of the U.S. economy. It is now used for disaster preparation and emergency response, security at major events, and public agencies are researching new uses in geolocation, law enforcement, court decisions, and military intelligence. Internationally, social media is credited for organizing political protests across the Middle East and a revolution in Egypt. In the business world, social media is considered a revolutionary sales and marketing platform and a powerful recruiting and networking channel. Little research exists, however, on how firms use social media to communicate financial information to investors and how investors respond to investor disseminated through social media, despite firms devoting considerable effort to creating and managing social media presences directed at investors. Motivated by this lack of research, in our paper, Corporate Use of Social Media, which was recently made publicly available on SSRN, we provide early large-sample evidence on the corporate use of social media for investor communications. More specifically, we investigate why firms choose to disseminate investor communications through social media, whether investors and traditional media outlets respond to social media disclosures, and whether potential adverse consequences to the firm exist from the use of social media to disseminate investor communications.

À la prochaine…

Ivan Tchotourian

Gouvernance Normes d'encadrement responsabilisation à l'échelle internationale

Devoir de vigilance des grandes entreprises : il est temps !

Ivan Tchotourian 26 mai 2016

Dans un article du 10 mai 2016 au The Globe and Mail, Fred Pinto et Peter Chapman reviennent sur l’importance du devoir de vigilance pour les grandes entreprises : « Companies need to do due diligence on human rights abroad ».

Petit extrait :

New international instruments such as the United Nations Guiding Principles on Business and Human Rights as well as new reporting requirements under securities regulations are increasingly emphasizing the need for global businesses to assess their own human-rights risks, and to take steps to ensure that they are not contributing to rights violations.

In a globalized operation, failure to assess those risks in a trustworthy, transparent and effective manner is ultimately a failure of due diligence. And for a company’s investors, a failure of due diligence may lead to regulatory, legal, operational and reputational problems that could and should have been avoided.

Pour rappel, j’avais exprimé dans un billet publié sur le blogue de l’Université Laval Contact ici portant sur le devoir de vigilance des entreprises la nécessité de durcir le cadre réglementaire de la RSE en consacrant un tel devoir (ici).

À la prochaine…

Ivan Tchotourian

Gouvernance normes de droit

Paradis fiscaux : la réaction de Deloitte

Ivan Tchotourian 25 mai 2016

Droit-inc diffuse par le biais d’un billet une capsule-vidéo intéressante. Trois firmes comptables québécoises (Deloitte, PricewaterhouseCoopers et Ernst & Young) ont été citées à comparaître en commission parlementaire pour s’être montrées réticentes à aider les députés à comprendre les stratagèmes d’évasion fiscale qui peuvent exister.

Voici un extrait où le député Jean-François Lisée interroge les dirigeants de Deloitte. En un mot : édifiant !

À la prochaine…

Ivan Tchotourian

Gouvernance objectifs de l'entreprise

Les dividendes à tout prix : un risque

Ivan Tchotourian 18 mai 2016

Bonjour à toutes et à tous, le Financial Times apporte un regard critique sur les politiques de distribution des dividendes des entreprises : “Alarm grows as investors get bulk of listed groups’ profits” (9 mai 2016).

The world’s listed companies have paid out more than half their profits to shareholders in the form of dividends over the past year, an unusual situation that tends to occur only in periods of widespread economic weakness. “The implication is companies have kept paying out dividends even as earnings have fallen away, and the risk is companies are paying out dividends that are not sufficiently covered by their profits,” said Robert Buckland, global equity strategist for Citi Research…. Directors of public companies must balance demands from shareholders to receive an income from their ownership of a company against the need to reinvest profits in the cause of expansion and future growth.

À la prochaine…

Ivan Tchotourian

autres publications Gouvernance

Volkswagen : quelle leçon pour la gouvernance ?

Ivan Tchotourian 17 mai 2016

Le professeur John Armour offre une analyse synthétique des liens entre l’affaire Volkswagen et la gouvernance d’entreprise dans un billet de blog paru sur le site de l’Université d’Oxford : « Volkswagen’s Emissions Scandal: Lessons for Corporate Governance? (Part 1) ».

At this point, it remains unclear precisely how and why VW came to do this. US law firm Jones Day have been retained by VW to conduct an internal investigation, the results of which are due in the fourth quarter of 2016. VW’s official line is that this was the result of the actions of a few engineers and programmers. Let’s call this the ‘rogue technicians’ theory. However, with such a large number of vehicles, over a period of about seven years, it seems—as was argued in a recent post by J.S. Nelson—more plausible that senior management might have been aware of the scheme (or warning signs of it) at some point prior to its revelation. Let’s call this the ‘management inaction’ theory.

J’ai hâte de lire la partie 2 !

À la prochaine…

Ivan Tchotourian

autres publications Gouvernance normes de marché rémunération

« How incentives for long-term management backfire » : cela fait réfléchir !

Ivan Tchotourian 16 mai 2016

Le Harvard Business Review propose un article intitulé : « How incentives for long-term management backfire” qui prend le contrepied de la croyance voulant que les plans incitatifs basés sur la performance à long terme seraient une cause du court-termisme de la direction des entreprises.

In the five years since the advent of Dodd-Frank regulation, corporate governance groups, with their policies requiring at least half of long-term incentives to be “performance-based,” have pushed companies to replace options with multi-year, performance plans. How could anyone object to such an effort? Hardly anyone, except here is the rub: Performance plans require performance targets, and in most companies, planning works in three-year cycles. The logical performance period for long-term incentives is one that matches those cycles. Three years has thus become the standard performance window for measuring achievement.

So a three-year horizon — not even a presidential term — has inexorably become the norm for investing hundreds of billions of dollars of money aimed at creating “long term” value. With the best of intentions, many proxy advisors and long-term investors have widely blessed three years as appropriate, adopting three-year pay for performance as their standard comparison. Today, four out of five S&P 500 companies use a three-year performance period in their long-term incentives. But executives today, who are paid on this new “long term,” typically with equity based partly on earnings-per-share performance, naturally think twice about retaining earnings for projects beyond three years. Their measurements conflict with their managerial inclinations, encouraging them to use earnings booked today to immediately return cash to shareholders.

À la prochaine…

Ivan Tchotourian

Gouvernance rémunération

Publication du fondateur : réflexion sur la rémunération des dirigeants

Ivan Tchotourian 16 mai 2016

Bonjour à toutes et à tous, je viens de publier sur le blogue Contact de l’Université Laval un nouveau billet consacré à la rémunération des P-DG et à la place du droit : « Rémunération des PDG: l’orage gronde ». En pleine saison des assemblées annuelles, je ne pouvais faire autrement !

La saison des assemblées annuelles des grandes entreprises cotées en bourse bat son plein. Parmi les sujets qui font polémique et suscitent le débat: la rémunération des dirigeants. Attention, je ne parle pas ici de la rémunération des administrateurs, mais bien de celle des hauts directeurs qui sont aussi parfois présidents du conseil d’administration (CA), les fameux PDG (ou CEO en anglais). Au regard des enjeux en cause, le droit devrait-il intervenir?

Je vous laisse lire la suite ici.

À la prochaine…

Ivan Tchotourian