mission et composition du conseil d'administration

La féminisation : ça rapporte !

Ivan Tchotourian 22 octobre 2015

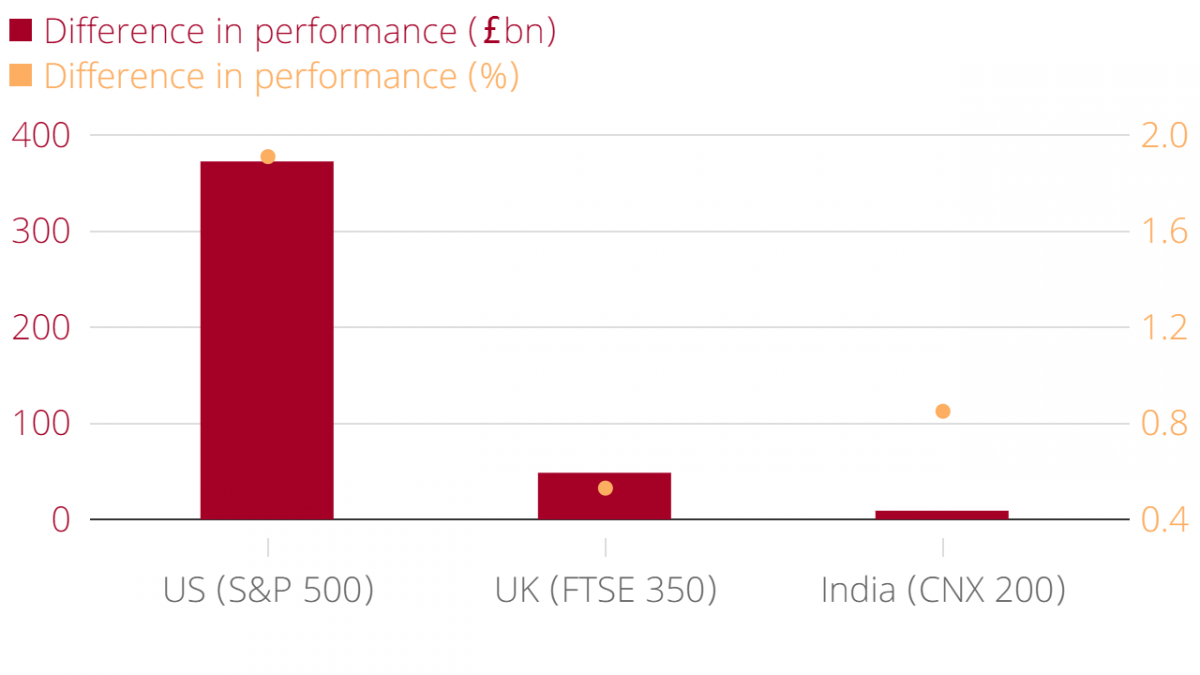

Selon le CityA.M., « The business case for boardroom diversity: Diverse boards outperform male-only peers by £430bn ». Le titre dit tout !

Listed companies in the UK, US and India with at least one woman on their board beat male-only boards by $430bn in 2014, according to a report from Grant Thornton which measured the difference in returns on assets.

Although this isn’t the first study arguing a business case from diversity – a McKinsey report published earlier this year found that the most gender-diverse companies are 15 per cent more likely to outperform the least diverse – it does put an exact value on diversity for business.

À la prochaine…

Ivan Tchotourian

autres publications mission et composition du conseil d'administration

Femmes et CA : étude canadienne récente

Ivan Tchotourian 14 octobre 2015

Selon une enquête de les affaires (ici), parmi les administrateurs recrutés en 2013 par les 50 plus grandes sociétés québécoises du TSX, 40 % étaient des femmes. C’est le double du pourcentage de 20 % de femmes en poste en 2015.

À la prochaine…

Ivan Tchotourian

autres publications mission et composition du conseil d'administration

Palmarès de la Féminisation des Instances Dirigeantes des Entreprises

Ivan Tchotourian 9 octobre 2015

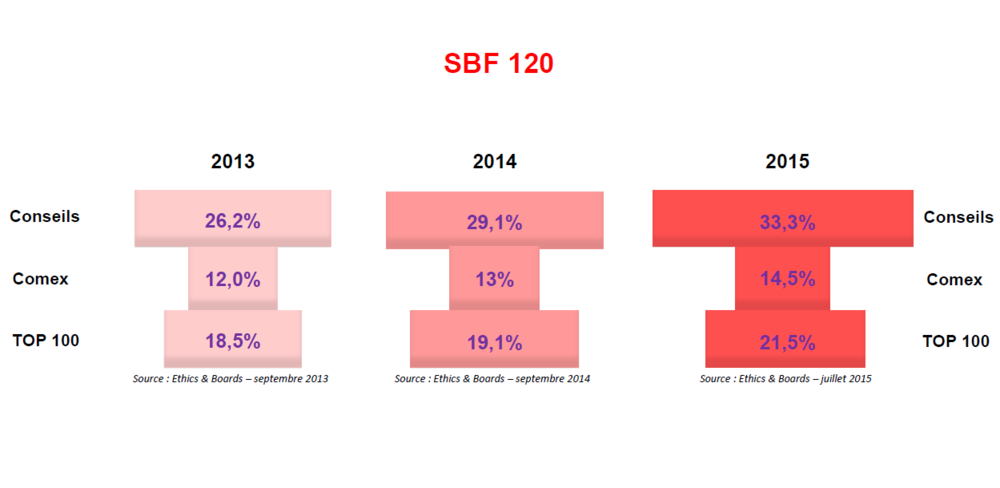

L’observatoire Ethics & Boards vient de publier des statistiques sur la féminisation des instances dirigeants des entreprises du SBF 120 companies.

Pour accéder au classement : cliquez ici.

Pour lire des journaux de presse sur le sujet : cliquez ici.

À la prochaine…

Ivan Tchotourian

mission et composition du conseil d'administration

Retour sur le rôle de surveillant du CA

Ivan Tchotourian 8 octobre 2015

Bonjour à toutes et à tous, voici un intéressant billet tiré de les affaires sur le rôle de surveillant du CA et de l’importance de l’évaluer : « CA: le surveillant » (ici).

À la prochaine…

Ivan Tchotourian

mission et composition du conseil d'administration

Un CA peu ouvert pour les entreprises pétrolières

Ivan Tchotourian 22 septembre 2015

Très intéressante information livrée avec un peu de retard par mes soins : Exxon et Chevron ont refusé à la fin mai 2015 lors de leur assemblée d’avoir un expert climat dans leur CA.

Ainsi, Novethic nous apprend que les assemblées générales (AG) d’Exxon et Chevron, les deux principales compagnies pétrolières américaines, avaient lieu le 28 mai. À l’ordre du jour pour les deux AG, des résolutions sur le climat qui ont obtenu des scores très faibles, à l’inverse des AG de leurs homologues européennes, Shell et BP. Chevron et Exxon n’auront donc pas d’expert du climat indépendant dans leur conseil d’administration, et devraient continuer à contester l’importance du risque carbone.

Pour en savoir plus, cliquez ici.

Cela laisse songeur sur la volonté des entreprises d’aller de l’avant dans le domaine de la responsabilité sociétale, d’autant que la composition du CA est un élément important !

À la prochaine…

Ivan Tchotourian

autres publications mission et composition du conseil d'administration

Quand le CA doit penser activiste

Ivan Tchotourian 22 septembre 2015

Selon une étude du cabinet Norton Rose Fulbright, les CA doivent davantage penser comme les activistes. Tel est le sens d’un article publié dans le Financial Post intitulé « Boards should think more like activist investors: Norton Rose Fulbright » (21 septembre 2015).

Directors are doing a better job when it comes to corporate governance, but that may not be enough to keep activist shareholders at bay, according to a white paper published Monday by law firm Norton Rose Fulbright. Boards have to think more like activists and can do so by focusing on value creation at all times, says the paper, which was produced in collaboration with RBC Capital Markets and The Boston Consulting Group. Directors, many of whom are former executive at other companies, should regularly engage with senior managers to “critically examine” strategy development and value creation alternatives.

À la prochaine…

Ivan Tchotourian

mission et composition du conseil d'administration

Et le risque lié à la culture d’entreprise ?

Ivan Tchotourian 20 septembre 2015

Matteo Tonello du The Conference Board a publié le 13 juillet 2015 un très intéressant billet sur le blogue The Harvard Law School Forum on Corporate Governance and Financial Regulation consacré au risque d’appréhension par le CA du risque de culture de l’entreprise : « The Next Frontier for Boards, Oversight of Risk Culture ».

Over the past 15 years expectations for board oversight have skyrocketed. In 2002 the Sarbanes-Oxley Act put the spotlight on board oversight of financial reporting. The 2008 global financial crisis focused regulatory attention on the need to improve board oversight of management’s risk appetite and tolerance. Most recently, in the wake of a number of high-profile personal data breaches, questions are being asked about board oversight of cyber-security, the newest risk threatening companies’ long term success. This post provides a primer on the next frontier for boards: oversight of “risk culture.” (…)

This global regulatory storm has culminated in a series of papers from the Financial Stability Board (FSB), a global regulatory advisory body formed following the onset of the global financial crisis. Its main objective is to provide guidance to national financial sector and securities regulators around the world. In its most recent paper, issued in 2014, the FSB called on national regulators to actively assess the “risk appetite framework” and “risk culture” of systemically important financial institutions (SIFI), including assessing boards’ effectiveness in overseeing their company’s risk culture. The FSB summarized the new expectations of national financial sector regulators as follows:

“…efforts should be made by financial institutions and by supervisors to understand an institution’s culture and how it affects safety and soundness. While various definitions of culture exist, supervisors are focusing on the institution’s norms, attitudes and behaviour related to risk awareness, risk taking and risk management, or the institutions’ risk culture.”

The Financial Reporting Council (FRC), the United Kingdom’s national securities regulator, reacted to the FSB’s recommendations by updating The UK Corporate Governance Code that applies to all UK public companies. Provision C.2.3 of the Code mandates that the board should annually review and report on the effectiveness of their company’s risk management and internal control systems. Specifically, Item 43 in Section 5 of the guidance requires the board, in its annual review of effectiveness, to consider the company’s “willingness to take on risk (its ‘risk appetite’), the desired culture within the company and whether this culture has been embedded.”

The FRC, recognizing that there is little tangible guidance available to boards on how to oversee a company’s culture, stated that, in 2015, the initial year of implementation of the new board oversight requirements, it will focus on “company culture: how best to assess culture and practices and embed good corporate behaviour throughout companies.”

Financial regulators globally, including the SEC, are expected to follow the UK’s lead and significantly increase their focus on board oversight of corporate culture generally, and risk culture in particular. In a global survey conducted by KMPG, 1,500 audit committee members ranked government regulation second among risks that pose the greatest challenge for their company. Oversight of risk culture may be one of those areas of new government regulation.

À la prochaine…

Ivan Tchotourian