divulgation extra-financière | Page 2

actualités internationales Divulgation divulgation extra-financière Gouvernance normes de droit

Les adieux au reporting extra-financier… vraiment ?

Ivan Tchotourian 29 avril 2021 Ivan Tchotourian

Blogging for sustainability offre un beau billet sur la construction européenne du reporting extra-financier : « Goodbye, non-financial reporting! A first look at the EU proposal for corporate sustainability reporting » (David Monciardini et Jukka Mähönen, 26 April 2021). Les auteurs soulignent la dernière position de l’Union européenne (celle du 21 avril 2021 qui modifie le cadre réglementaire du reporting extra-financier) et explique pourquoi celle-ci est pertinente. Du mieux certes, mais encore des critiques !

Extrait :

A breakthrough in the long struggle for corporate accountability?

Compared to the NFRD, the new proposal contains several positive developments.

First, the concept of ‘non-financial reporting’, a misnomer that was widely criticised as obscure, meaningless or even misleading, has been abandoned. Finally we can talk about mandatory sustainability reporting, as it should be.

Second, the Commission is introducing sustainability reporting standards, as a common European framework to ensure comparable information. This is a major breakthrough compared to the NFRD that took a generic and principle-based approach. The proposal requires to develop both generic and sector specific mandatory sustainability reporting standards. However, the devil is in the details. The Commission foresees that the development of the new corporate sustainability standards will be undertaken by the European Financial Reporting Advisory Group (EFRAG), a private organisation dominated by the large accounting firms and industry associations. As we discuss below, the most important issue is to prevent the risks of regulatory capture and privatization of EU norms. What is a step forward, though, is the companies’ duty to report on plans to ensure the compatibility of their business models and strategies with the transition towards a zero-emissions economy in line with the Paris Agreement.

Third, the scope of the proposed CSRD is extended to include ‘all large companies’, not only ‘public interest entities’ (listed companies, banks, and insurance companies). According to the Commission, companies covered by the rules would more than triple from 11,000 to around 49,000. However, only listed small and medium-sized enterprises (SMEs) are included in the proposal. This is a major flaw in the proposal as the negative social and environmental impacts of some SMEs’ activities can be very substantial. Large subsidiaries are thereby excluded from the scope, which also is a major weakness. Besides, instead of scaling the general standards to the complexity and size of all undertakings, the Commission proposes a two-tier regime, running the risk of creating a ‘double standard’ that is less stringent for SMEs.

Fourth, of the most welcomed proposals, however, is strengthening a ‘double materiality’ principle for standards (making it ‘enshrined’, according to the Commission), to cover not only just the risks of unsustainability to companies themselves but also the impacts of companies on society and the environment. Similarly, it is positive that the Commission maintains a multi-stakeholder approach, whereas some of the international initiatives in place privilege the information needs of capital providers over other stakeholders (e.g. IIRC; CDP; and more recently the IFRS).

Fifth, a step forward is the compulsory digitalisation of corporate disclosure whereby information is ‘tagged’ according to a categorisation system that will facilitate a wider access to data.

Finally, the proposal introduces for the first time a general EU-wide audit requirement for reported sustainability information, to ensure it is accurate and reliable. However, the proposal is watered down by the introduction of a ‘limited’ assurance requirement instead of a ‘reasonable’ assurance requirement set to full audit. According to the Commission, full audit would require specific sustainability assurance standards they have not yet planned for. The Commission proposes also that the Member States allow firms other than auditors of financial information to assure sustainability information, without standardised assurance processes. Instead, the Commission could have follow on the successful experience of environmental audit schemes, such as EMAS, that employ specifically trained verifiers.

No time for another corporate reporting façade

As others have pointed out, the proposal is a long-overdue step in the right direction. Yet, the draft also has shortcomings, which will need to be remedied if genuine progress is to be made.

In terms of standard-setting governance, the draft directive specifies that standards should be developed through a multi-stakeholder process. However, we believe that such a process requires more than symbolic trade union and civil society involvement. EFRAG shall have its own dedicated budget and staff so to ensure adequate capacity to conduct independent research. Similarly, given the differences between sustainability and financial reporting standards, EFRAG shall permanently incorporate a balanced representation of trade unions, investors, civil society and companies and their organisations, in line with a multi-stakeholder approach.

The proposal is ambiguous in relation to the role of private market-driven initiatives and interest groups. It is crucial that the standards are aligned to the sustainability principles that are written in the EU Treaties and informed by a comprehensive science-based understanding of sustainability. The announcement in January 2020 of the development of EU sustainability reporting standards has been followed by the sudden move by international accounting body the IFRS Foundation to create a global standard setting structure, focusing only on financially material climate-related disclosures. In the months to come, we can expect enormous pressure on EU policy-makers to adopt this privatised and narrower approach, widely criticised by the academic community.

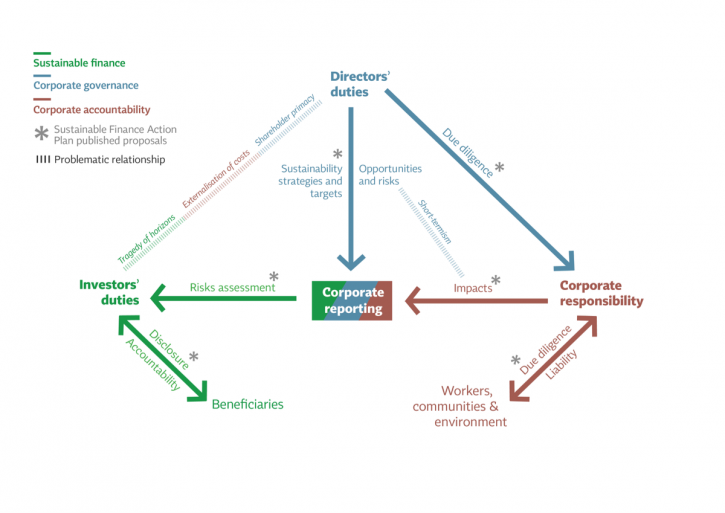

Furthermore, the proposal still represents silo thinking, separating sustainability disclosure from the need to review and reform financial accounting rules (that remain untouched). It still emphasises transparency over governance. Albeit it includes a requirement for companies to report on sustainability due diligence and actual and potential adverse impacts connected with the company’s value chain, it lacks policy coherence. The proposal’s link with DG Justice upcoming legislation on the boards’ sustainability due diligence duties later this year is still tenuous.

After decades of struggles for mandatory high-quality corporate sustainability disclosure, we cannot afford another corporate reporting façade. It is time for real progress towards corporate accountability.

À la prochaine…

Divulgation divulgation extra-financière Gouvernance Normes d'encadrement normes de droit normes de marché Responsabilité sociale des entreprises

La SEC consulte sur le changement climatique

Ivan Tchotourian 14 avril 2021 Ivan Tchotourian

La SEC a publié récemment une nouvelle sur son site indiquant qu’elle chercher l’avis du public sur sa réglementation dans le domaine du changement climatique : « Public Input Welcomed on Climate Change Disclosures » (15 mars 2021). C’est le moment de vous exprimer !

La SEC bouge en ce domaine comme cet extrait du message de la SEC le résume bien : Since 2010, investor demand for, and company disclosure of information about, climate change risks, impacts, and opportunities has grown dramatically. Consequently, questions arise about whether climate change disclosures adequately inform investors about known material risks, uncertainties, impacts, and opportunities, and whether greater consistency could be achieved. In May 2020, the SEC Investor Advisory Committee approved recommendations urging the Commission to begin an effort to update reporting requirements for issuers to include material, decision-useful environmental, social, and governance, or ESG factors. In December 2020, the ESG Subcommittee of the SEC Asset Management Advisory Committee issued a preliminary recommendation that the Commission require the adoption of standards by which corporate issuers disclose material ESG risks.

Extrait :

Questions for Consideration

- How can the Commission best regulate, monitor, review, and guide climate change disclosures in order to provide more consistent, comparable, and reliable information for investors while also providing greater clarity to registrants as to what is expected of them? Where and how should such disclosures be provided? Should any such disclosures be included in annual reports, other periodic filings, or otherwise be furnished?

- What information related to climate risks can be quantified and measured? How are markets currently using quantified information? Are there specific metrics on which all registrants should report (such as, for example, scopes 1, 2, and 3 greenhouse gas emissions, and greenhouse gas reduction goals)? What quantified and measured information or metrics should be disclosed because it may be material to an investment or voting decision? Should disclosures be tiered or scaled based on the size and/or type of registrant)? If so, how? Should disclosures be phased in over time? If so, how? How are markets evaluating and pricing externalities of contributions to climate change? Do climate change related impacts affect the cost of capital, and if so, how and in what ways? How have registrants or investors analyzed risks and costs associated with climate change? What are registrants doing internally to evaluate or project climate scenarios, and what information from or about such internal evaluations should be disclosed to investors to inform investment and voting decisions? How does the absence or presence of robust carbon markets impact firms’ analysis of the risks and costs associated with climate change?

- What are the advantages and disadvantages of permitting investors, registrants, and other industry participants to develop disclosure standards mutually agreed by them? Should those standards satisfy minimum disclosure requirements established by the Commission? How should such a system work? What minimum disclosure requirements should the Commission establish if it were to allow industry-led disclosure standards? What level of granularity should be used to define industries (e.g., two-digit SIC, four-digit SIC, etc.)?

- What are the advantages and disadvantages of establishing different climate change reporting standards for different industries, such as the financial sector, oil and gas, transportation, etc.? How should any such industry-focused standards be developed and implemented?

- What are the advantages and disadvantages of rules that incorporate or draw on existing frameworks, such as, for example, those developed by the Task Force on Climate-Related Financial Disclosures (TCFD), the Sustainability Accounting Standards Board (SASB), and the Climate Disclosure Standards Board (CDSB)?[7] Are there any specific frameworks that the Commission should consider? If so, which frameworks and why?

- How should any disclosure requirements be updated, improved, augmented, or otherwise changed over time? Should the Commission itself carry out these tasks, or should it adopt or identify criteria for identifying other organization(s) to do so? If the latter, what organization(s) should be responsible for doing so, and what role should the Commission play in governance or funding? Should the Commission designate a climate or ESG disclosure standard setter? If so, what should the characteristics of such a standard setter be? Is there an existing climate disclosure standard setter that the Commission should consider?

- What is the best approach for requiring climate-related disclosures? For example, should any such disclosures be incorporated into existing rules such as Regulation S-K or Regulation S-X, or should a new regulation devoted entirely to climate risks, opportunities, and impacts be promulgated? Should any such disclosures be filed with or furnished to the Commission?

- How, if at all, should registrants disclose their internal governance and oversight of climate-related issues? For example, what are the advantages and disadvantages of requiring disclosure concerning the connection between executive or employee compensation and climate change risks and impacts?

- What are the advantages and disadvantages of developing a single set of global standards applicable to companies around the world, including registrants under the Commission’s rules, versus multiple standard setters and standards? If there were to be a single standard setter and set of standards, which one should it be? What are the advantages and disadvantages of establishing a minimum global set of standards as a baseline that individual jurisdictions could build on versus a comprehensive set of standards? If there are multiple standard setters, how can standards be aligned to enhance comparability and reliability? What should be the interaction between any global standard and Commission requirements? If the Commission were to endorse or incorporate a global standard, what are the advantages and disadvantages of having mandatory compliance?

- How should disclosures under any such standards be enforced or assessed? For example, what are the advantages and disadvantages of making disclosures subject to audit or another form of assurance? If there is an audit or assurance process or requirement, what organization(s) should perform such tasks? What relationship should the Commission or other existing bodies have to such tasks? What assurance framework should the Commission consider requiring or permitting?

- Should the Commission consider other measures to ensure the reliability of climate-related disclosures? Should the Commission, for example, consider whether management’s annual report on internal control over financial reporting and related requirements should be updated to ensure sufficient analysis of controls around climate reporting? Should the Commission consider requiring a certification by the CEO, CFO, or other corporate officer relating to climate disclosures?

- What are the advantages and disadvantages of a “comply or explain” framework for climate change that would permit registrants to either comply with, or if they do not comply, explain why they have not complied with the disclosure rules? How should this work? Should “comply or explain” apply to all climate change disclosures or just select ones, and why?

- How should the Commission craft rules that elicit meaningful discussion of the registrant’s views on its climate-related risks and opportunities? What are the advantages and disadvantages of requiring disclosed metrics to be accompanied with a sustainability disclosure and analysis section similar to the current Management’s Discussion and Analysis of Financial Condition and Results of Operations?

- What climate-related information is available with respect to private companies, and how should the Commission’s rules address private companies’ climate disclosures, such as through exempt offerings, or its oversight of certain investment advisers and funds?

- In addition to climate-related disclosure, the staff is evaluating a range of disclosure issues under the heading of environmental, social, and governance, or ESG, matters. Should climate-related requirements be one component of a broader ESG disclosure framework? How should the Commission craft climate-related disclosure requirements that would complement a broader ESG disclosure standard? How do climate-related disclosure issues relate to the broader spectrum of ESG disclosure issues?

À la prochaine…

actualités internationales Divulgation divulgation extra-financière Gouvernance Normes d'encadrement normes de droit normes de marché Responsabilité sociale des entreprises

Approche juridique sur la transparence ESG

Ivan Tchotourian 3 août 2020 Ivan Tchotourian

Excellente lecture ce matin de ce billet du Harvard Law School Forum on Corporate Governance : « Legal Liability for ESG Disclosures » (de Connor Kuratek, Joseph A. Hall et Betty M. Huber, 3 août 2020). Dans cette publication, vous trouverez non seulement une belle synthèse des référentiels actuels, mais aussi une réflexion sur les conséquences attachées à la mauvaise divulgation d »information.

Extrait :

3. Legal Liability Considerations

Notwithstanding the SEC’s position that it will not—at this time—mandate additional climate or ESG disclosure, companies must still be mindful of the potential legal risks and litigation costs that may be associated with making these disclosures voluntarily. Although the federal securities laws generally do not require the disclosure of ESG data except in limited instances, potential liability may arise from making ESG-related disclosures that are materially misleading or false. In addition, the anti-fraud provisions of the federal securities laws apply not only to SEC filings, but also extend to less formal communications such as citizenship reports, press releases and websites. Lastly, in addition to potential liability stemming from federal securities laws, potential liability could arise from other statutes and regulations, such as federal and state consumer protection laws.

A. Federal Securities Laws

When they arise, claims relating to a company’s ESG disclosure are generally brought under Section 11 of the Securities Act of 1933, which covers material misstatements and omissions in securities offering documents, and under Section 10(b) of the Securities Exchange Act of 1934 and rule 10b-5, the principal anti-fraud provisions. To date, claims brought under these two provisions have been largely unsuccessful. Cases that have survived the motion to dismiss include statements relating to cybersecurity (which many commentators view as falling under the “S” or “G” of ESG), an oil company’s safety measures, mine safety and internal financial integrity controls found in the company’s sustainability report, website, SEC filings and/or investor presentations.

Interestingly, courts have also found in favor of plaintiffs alleging rule 10b-5 violations for statements made in a company’s code of conduct. Complaints, many of which have been brought in the United States District Court for the Southern District of New York, have included allegations that a company’s code of conduct falsely represented company standards or that public comments made by the company about the code misleadingly publicized the quality of ethical controls. In some circumstances, courts found that statements about or within such codes were more than merely aspirational and did not constitute inactionable puffery, including when viewed in context rather than in isolation. In late March 2020, for example, a company settled a securities class action for $240 million alleging that statements in its code of conduct and code of ethics were false or misleading. The facts of this case were unusual, but it is likely that securities plaintiffs will seek to leverage rulings from the court in that class action to pursue other cases involving code of conducts or ethics. It remains to be seen whether any of these code of conduct case holdings may in the future be extended to apply to cases alleging 10b-5 violations for statements made in a company’s ESG reports.

B. State Consumer Protection Laws

Claims under U.S. state consumer protection laws have been of limited success. Nevertheless, many cases have been appealed which has resulted in additional litigation costs in circumstances where these costs were already significant even when not appealed. Recent claims that were appealed, even if ultimately failed, and which survived the motion to dismiss stage, include claims brought under California’s consumer protection laws alleging that human right commitments on a company website imposed on such company a duty to disclose on its labels that it or its supply chain could be employing child and/or forced labor. Cases have also been dismissed for lack of causal connection between alleged violation and economic injury including a claim under California, Florida and Texas consumer protection statutes alleging that the operator of several theme parks failed to disclose material facts about its treatment of orcas. The case was appealed to the U.S. Court of Appeals for the Ninth Circuit, but was dismissed for failure to show a causal connection between the alleged violation and the plaintiffs’ economic injury.

Overall, successful litigation relating to ESG disclosures is still very much a rare occurrence. However, this does not mean that companies are therefore insulated from litigation risk. Although perhaps not ultimately successful, merely having a claim initiated against a company can have serious reputational damage and may cause a company to incur significant litigation and public relations costs. The next section outlines three key takeaways and related best practices aimed to reduce such risks.

C. Practical Recommendations

Although the above makes clear that ESG litigation to date is often unsuccessful, companies should still be wary of the significant impacts of such litigation. The following outlines some key takeaways and best practices for companies seeking to continue ESG disclosure while simultaneously limiting litigation risk.

Key Takeaway 1: Disclaimers are Critical

As more and more companies publish reports on ESG performance, like disclaimers on forward-looking statements in SEC filings, companies are beginning to include disclaimers in their ESG reports, which disclaimers may or may not provide protection against potential litigation risks. In many cases, the language found in ESG reports will mirror language in SEC filings, though some companies have begun to tailor them specifically to the content of their ESG reports.

From our limited survey of companies across four industries that receive significant pressure to publish such reports—Banking, Chemicals, Oil & Gas and Utilities & Power—the following preliminary conclusions were drawn:

- All companies surveyed across all sectors have some type of “forward-looking statement” disclaimer in their SEC filings; however, these were generic disclaimers that were not tailored to ESG-specific facts and topics or relating to items discussed in their ESG reports.

- Most companies had some sort of disclaimer in their Sustainability Report, although some were lacking one altogether. Very few companies had disclaimers that were tailored to the specific facts and topics discussed in their ESG reports:

- In the Oil & Gas industry, one company surveyed had a tailored ESG disclaimer in its ESG Report; all others had either the same disclaimer as in SEC filings or a shortened version that was generally very broad.

- In the Banking industry, two companies lacked disclaimers altogether, but the rest had either their SEC disclaimer or a shortened version.

- In the Utilities & Power industry, one company had no disclaimer, but the rest had general disclaimers.

- In the Chemicals industry, three companies had no disclaimer in their reports, but the rest had shortened general disclaimers.

- There seems to be a disconnect between the disclaimers being used in SEC filings and those found in ESG In particular, ESG disclaimers are generally shorter and will often reference more detailed disclaimers found in SEC filings.

Best Practices: When drafting ESG disclaimers, companies should:

- Draft ESG disclaimers carefully. ESG disclaimers should be drafted in a way that explicitly covers ESG data so as to reduce the risk of litigation.

- State that ESG data is non-GAAP. ESG data is usually non-GAAP and non-audited; this should be made clear in any ESG Disclaimer.

- Have consistent disclaimers. Although disclaimers in SEC filings appear to be more detailed, disclaimers across all company documents that reference ESG data should specifically address these issues. As more companies start incorporating ESG into their proxies and other SEC filings, it is important that all language follows through.

Key Takeaway 2: ESG Reporting Can Pose Risks to a Company

This article highlighted the clear risks associated with inattentive ESG disclosure: potential litigation; bad publicity; and significant costs, among other things.

Best Practices: Companies should ensure statements in ESG reports are supported by fact or data and should limit overly aspirational statements. Representations made in ESG Reports may become actionable, so companies should disclose only what is accurate and relevant to the company.

Striking the right balance may be difficult; many companies will under-disclose, while others may over-disclose. Companies should therefore only disclose what is accurate and relevant to the company. The US Chamber of Commerce, in their ESG Reporting Best Practices, suggests things in a similar vein: do not include ESG metrics into SEC filings; only disclose what is useful to the intended audience and ensure that ESG reports are subject to a “rigorous internal review process to ensure accuracy and completeness.”

Key Takeaway 3: ESG Reporting Can Also be Beneficial for Companies

The threat of potential litigation should not dissuade companies from disclosing sustainability frameworks and metrics. Not only are companies facing investor pressure to disclose ESG metrics, but such disclosure may also incentivize companies to improve internal risk management policies, internal and external decisional-making capabilities and may increase legal and protection when there is a duty to disclose. Moreover, as ESG investing becomes increasingly popular, it is important for companies to be aware that robust ESG reporting, which in turn may lead to stronger ESG ratings, can be useful in attracting potential investors.

Best Practices: Companies should try to understand key ESG rating and reporting methodologies and how they match their company profile.

The growing interest in ESG metrics has meant that the number of ESG raters has grown exponentially, making it difficult for many companies to understand how each “rater” calculates a company’s ESG score. Resources such as the Better Alignment Project run by the Corporate Reporting Dialogue, strive to better align corporate reporting requirements and can give companies an idea of how frameworks such as CDP, CDSB, GRI and SASB overlap. By understanding the current ESG market raters and methodologies, companies will be able to better align their ESG disclosures with them. The U.S. Chamber of Commerce report noted above also suggests that companies should “engage with their peers and investors to shape ESG disclosure frameworks and standards that are fit for their purpose.”

À la prochaine…

Divulgation divulgation extra-financière Gouvernance Responsabilité sociale des entreprises

Reporting non-financier : s’inspirer du modèle européen

Ivan Tchotourian 7 juillet 2020 Ivan Tchotourian

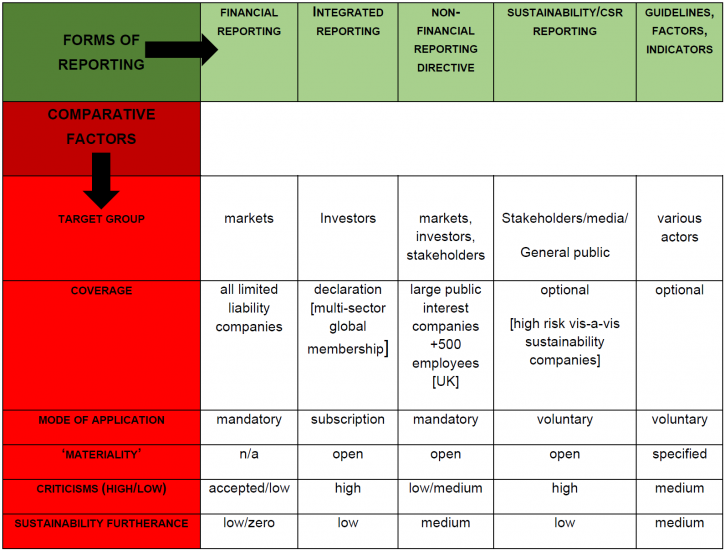

Discussion intéressante sur le reporting non-financier de G. Tsagas et C. Villiers « Why ‘Less is More’ in non-Financial Reporting Initiatives: Concrete Steps Towards Supporting Sustainability » (Oxford Business Law Blog, 10 juin 2020).

Conclusion :

Random and arbitrary compliance with various initiatives makes companies’ sustainable practices ‘less’ rather than ‘more’ transparent. Our paper offers a comprehensive view on different reporting frameworks. It shows that there is a need to provide some clarity in this complex landscape. Fundamentally, the current reporting landscape is unlikely to impact positively on efforts towards sustainability. We suggest in our paper hat the scope of the NFRD, as the most promising of the existing initiatives, should be revisited so as to enhance its contribution to furthering corporations’ sustainable practices. Our paper supports reform of the NFRD which has constituted a positive step in the right direction. What is required now is stronger guidance on what to report and how to report it. Steps are being taken in the right direction towards clarifying metrics around sustainability (World Economic Forum 2020). A standardized and streamlined framework is necessary in order to pin companies down to something more concrete, rather than giving them too much choice on which guidelines, frameworks or recommendations they may opt to follow. Stronger, clearer and more concrete definitions of key concepts are required, as well as clarification of the rights of stakeholders in this area of activity. Proposals for reform that have arisen, with a consultation exercise by the European Commission, (European Commission Consultation 2020) are therefore to be welcomed. We suggest an expansion of the NFRD’s scope and that it represent sustainability as a positive instead of reducing the focus only to negative risks. EU member states and companies should have opportunities for effective compliance with the reporting requirements, with the NFRD better defining the concepts it refers to.

À la prochaine…

Divulgation divulgation extra-financière divulgation financière Gouvernance normes de droit parties prenantes Responsabilité sociale des entreprises

SEC : une réponse à sa consultation sur la divulgation en matière de risque COVID-19

Ivan Tchotourian 4 juillet 2020 Ivan Tchotourian

Par la voix de Carter Dougherty, l’Americans for Financial Reform a adressé sa réponse à la SEC à propos de la divulgation obligatoire du risque COVID-19 : « SEC Should Mandate Disclosures on COVID-19 Risks and Responses » (1er juillet 2020).

Extrait :

The impact of the losses on shareholders will be significant. Investors, however, are being forced to rely on news reports to try to understand how the crisis is impacting companies in their portfolios and how those companies are responding. The SEC must act to require companies to provide consistent, reliable data to investors about the economic impact of the pandemic on their business, human capital management practices, and supply chain risks. These disclosures should include:

- Workplace COVID-19 Prevention and Control Plan—Companies should disclose a written infectious disease prevention and control plan including information such as the company’s practices regarding hazard identification and assessment, employee training, and provision of personal protective equipment.

- Identification, Contact Tracing, and Isolation—Companies should disclose their policies for identifying employees who are infected or symptomatic, contact tracing and notification for potentially exposed employees and customers, and leave policies for infected employees who are isolating.

- Compliance with Quarantine Orders and phased reopening orders—Companies should disclose how they are complying with federal, state, and local government quarantine orders and public health recommendations to limit operations.

- Financial Implications—Companies should disclose the impact of the COVID-19 pandemic on their cash flows and balance sheet as well as steps taken to preserve liquidity such as accessing credit facilities, government assistance, or the suspension of dividends and stock buybacks.

- Executive Compensation—Companies should promptly disclose the rationale for any material modifications of senior executive compensation due to the COVID-19 pandemic, including changes to performance targets or issuance of new equity compensation awards.

- Employee Leave—Companies should disclose whether or not they provide paid sick leave to encourage sick workers to stay home, paid leave for quarantined workers, paid leave at any temporarily closed facilities, and family leave options to provide for childcare or sick family

- Health Insurance—Companies should disclose the health insurance coverage ratio of their workforce and whether the company has a policy to provide employer-paid health insurance for any employees who are laid off during the COVID-19 pandemic.

- Contingent Workers—Companies should disclose if part-time employees, temporary workers, independent contractors, and subcontracted workers receive all the protections and benefits provided to full-time company employees, including those outlined above.

- Supply Chains-Companies should disclose whether they are current on payments to their supply chain vendors. Timely and prompt payments to suppliers will help retain suppliers’ workforces and ensure that a stable supply chain is in place for business operations going forward.

- Workers’ Rights-Companies should disclose their policies for protecting employees who raise concerns about workplace health and safety from retaliation, including whistleblower protections and contractual provisions protecting workers’ rights to raise concerns about workplace conditions.

- Political activity—Companies should disclose all election spending and lobbying activity, especially money spent through third parties like trade associations and social welfare 501(c)4 organizations.

Prior to the onset of COVID-19, it was often argued that human rights, worker protection and supply chain matters were moral issues not relevant to a company’s financial performance. As millions of workers are laid off and supply chains unravel, the pandemic has proven that view wrong. Businesses that protect workers and consumers will be better positioned to continue operations and respond to consumer demand throughout the pandemic. The disclosures outlined above will provide investors with important information to help them understand how COVID-19 is impacting the companies they are invested in. In addition, by requiring these disclosures, the Commission has the opportunity to encourage companies to review their current practices and consider whether updates are necessary in light of recent events. The process of preparing these disclosures may help some public companies to recognize that their current practices are not sufficiently robust to protect their workers, consumers, supply chains and, as a result, their investors’ capital given the impact of the pandemic.

À la prochaine…

actualités internationales Divulgation divulgation extra-financière finance sociale et investissement responsable Gouvernance Normes d'encadrement Responsabilité sociale des entreprises

Il faut améliorer l’information non financière

Ivan Tchotourian 6 juin 2020 Ivan Tchotourian

Pour M. Ben Aamar et Mme Martinez, il faut que les entreprises doivent dépasser le « greenwashing » pour informer les investisseurs sur la résilience de leur modèle économique aux chocs environnementaux. Je vous invite à lire leur tribune : « Améliorer l’information environnementale des investisseurs doit devenir une priorité « (Le Monde, 5 juin 2020).

Extrait :

La pandémie actuelle peut aboutir à une prise de conscience collective et à un renforcement de la lutte contre les causes du dérèglement climatique, ou bien, au contraire, à une mise entre parenthèses des initiatives en ce sens, car l’attention ainsi que toutes les ressources financières seront consacrées à des mesures de relance économique. La cause climatique passerait alors au second plan face à l’urgence, avec, à terme, des conséquences désastreuses.

Le rôle des gouvernants est majeur. Mais pour orienter correctement les flux financiers, publics comme privés, améliorer l’information environnementale des investisseurs doit également devenir une priorité. Le sujet est peu connu du grand public car d’apparence technique. Pourtant, les enjeux sont considérables.

À la prochaine…

actualités internationales Divulgation divulgation extra-financière Gouvernance Normes d'encadrement Nouvelles diverses Responsabilité sociale des entreprises

Rapport français sur la communication non financière des grandes entreprises

Ivan Tchotourian 14 novembre 2019 Ivan Tchotourian

L’AMF France vient de publier son 3e rapport sur la communication des informations non financières.

Résumé :

A l’occasion de son nouveau rapport sur la responsabilité sociale, sociétale et environnementale des sociétés cotées, l’AMF a mené une analyse sur les premières déclarations de performance extra-financière (DPEF) de 24 sociétés cotées françaises. Pour mieux les guider dans cette démarche vers une économie plus durable, le régulateur détaille les enjeux clés de ce reporting extra-financier.

Dans le cadre de sa stratégie 2018-2022, l’AMF a fait de la finance durable un axe prioritaire pour accompagner et encourager l’ensemble du système financier dans sa transition. La qualité des données environnementales et sociales et donc de l’information extra-financière des sociétés cotées constitue un préalable à une telle avancée : elle est indispensable à la décision des investisseurs et au suivi, par ces derniers, de leur politique d’engagement. Pour la quatrième édition de son rapport sur la responsabilité sociale, sociétale et environnementale des sociétés cotées, l’AMF s’est ainsi fixée pour objectif d’accompagner les entreprises dans l’élaboration de leurs futures déclarations de performance extra-financière.

Dans le cadre de leur rapport de gestion pour l’exercice 2018, les entreprises devaient cette année, pour la première fois, élaborer cette déclaration. L’AMF a passé en revue l’information fournie dans la section dédiée à cette déclaration dans leur document de référence par un échantillon de 19 sociétés appartenant à l’indice CAC 40 et de 5 sociétés du SBF 120.

Exemples à l’appui, l’AMF détaille les enjeux d’une communication extra-financière de qualité, que sont :

- la structure, la concision et la cohérence d’ensemble de cette déclaration ;

- le respect des dispositions légales concernant le périmètre de reporting, élargi le cas échéant pour prendre en compte les spécificités du modèle d’affaires ;

- l’information sur le processus d’identification des enjeux et risques extra-financiers, et sur l’horizon de temps auquel ces risques peuvent se matérialiser, ainsi que leurs impacts éventuels ;

- le choix d’indicateurs clés de performance pertinents et justifiés pour illustrer les politiques mises en place ;

- la détermination d’objectifs pour mesurer les progrès réalisés dans le cadre illustrer des politiques mises en place.

Pistes de réflexion pour le cadre européen

Afin d’analyser l’information extra-financière disponible chez plusieurs émetteurs européens du même secteur et de constater dans quelle mesure une convergence des pratiques s’opère, le rapport consacre par ailleurs un chapitre à une comparaison internationale réalisée sur le secteur pétrolier. Les 9 constats issus de cette étude dessinent des pistes de réflexion pour l’avenir du reporting extra-financier comme par exemple la nécessité d’encourager, au niveau européen, une meilleure harmonisation des méthodologies sous-jacentes aux indicateurs de performance extra-financiers.

À la prochaine…