Gouvernance | Page 2

Gouvernance mission et composition du conseil d'administration place des salariés

Pour ou contre les salariés au CA ?

Ivan Tchotourian 12 septembre 2016

« Should boards include an employee representative? » de Richard Dunnett dans Director (12 septembre 2016) propose 2 points de vue radicalement différents sur la question.

- Oui pour Stefan Stern, directeur du High Pay Centre

Something is too often lacking from the conversation at board level: an eyewitness account from the shop floor. How easy it is to forget the perspective of ordinary employees, even in the middle of discussi

ons that will have a direct impact on their lives. ‘Consultation’ is, sadly, one of the most abused management terms. It makes practical sense to listen to the views of colleagues before taking decisions that affect them. So introducing the employees’ point of view into the boardroom, through employee representatives, must make sense.

- Non pour Jim Prior, P-DG de The Partners and Lambie-Nairn

The proposal betrays a fundamental misunderstanding of how companies work in its failure to distinguish between leadership and governance. In most large companies it is the executive leadership team that makes the decisions which most affect employees, not the board. Yes, corporate leaders should listen to employees but the role of the board should be to identify and act on situations where leaders fail to listen, not to do the listening for them.

À la prochaine…

Ivan Tchotourian

engagement et activisme actionnarial mission et composition du conseil d'administration Normes d'encadrement rémunération

Rémunération : la grogne continue

Ivan Tchotourian 10 août 2016

Sous la plume de Gérard Bérubé, Le Devoir offre une belle photographie du débat que soulève en Grande-Bretagne la rémunération des hauts-dirigeants : « Vers un vote britannique contraignant sur la rémunération des grands patrons ». Les choses vont-elles changer ? Rien n’est moins sûr…

La progression de la rémunération des hauts dirigeants s’est accélérée au Royaume-Uni en 2015. Le gouvernement britannique pourrait récupérer la balle au bond pour modifier le paysage du « say on pay », avec l’imposition d’un vote contraignant pouvant servir de référence dans l’univers boursier.

L’agence Reuters indiquait lundi que la rémunération moyenne des hauts dirigeants britanniques avait augmenté de plus de 10 % en 2015, à 5,5 millions de livres. Selon l’étude du High Pay Centre, elle a atteint 5,48 millions de livres (9,4 millions $CAN) en 2015, contre 4,96 millions l’année précédente, pour les patrons des entreprises composant le FTSE 100, indice de référence de la Bourse de Londres. Ces émoluments équivalent à 140 fois le salaire moyen de leurs employés, ajoute l’étude, qui parle d’un bond de 33 % de la rémunération de ces grands patrons depuis 2010.

Reuters rappelle que la nouvelle première ministre britannique, Theresa May, s’est élevée contre le phénomène pour critiquer publiquement ces écarts croissants de salaires qui s’éloignent des intérêts à long terme des entreprises. « Avant de prendre la tête du gouvernement en juillet, Theresa May a proposé de rendre contraignant le vote des actionnaires sur la rémunération des dirigeants [qui est purement consultatif et sans effet direct]. Elle a aussi prôné davantage de transparence dans la définition des objectifs qui déclenchent le versement de primes et souhaité rendre public dans chacune de ces grandes entreprises le ratio entre le salaire du patron et celui du salarié moyen », peut-on lire.

À la prochaine…

Ivan Tchotourian

engagement et activisme actionnarial mission et composition du conseil d'administration normes de droit

Vers un tremblement de terre en Grande-Bretagne ?

Ivan Tchotourian 11 juillet 2016

May expressed discontent with the current model of corporate governance used by FTSE companies and in particular the effectiveness of supposedly independent non-executive directors. ‘In practice, they are often drawn from the same narrow social and professional circles as the executive team and the scrutiny they provide is often limited,’ she said. So, she suggests, workers and even consumers should be given a seat at the table.

May wrote she wants to tackle the ‘unhealthy and growing gap between what these companies pay their workers and what they pay their bosses.’ Specifically she wants to make shareholder votes on corporate pay packages binding instead of advisory and ‘simplify the way bonuses are paid so that the bosses’ incentives are better aligned with the long-term interests of the company.’

À la prochaine…

Ivan Tchotourian

autres publications mission et composition du conseil d'administration

Femmes, CA et Grande-Bretagne : « Women on boards: 5 year summary »

Ivan Tchotourian 2 novembre 2015

En 2011, Lord Davies avait publié des recommandations pour accroître la proportion des femmes au sein des CA des entreprises de l’indice FTSE100 avec un objectif d’au moins 25 % de femmes à l’horizon 2015. Quel est le bilan ?

Positif, pardi ! En effet, un rapport publié le 29 octobre 2015 (« Women on boards: 5 year summary (Davies Review) », Department for Business, Innovation & Skills) démontre que l’objectif a été atteint.

There are more women on FTSE 350 boards than ever before, with representation of women more than doubling since 2011 – now at 26.1% on FTSE 100 boards and 19.6% on FTSE 250 boards. We have also seen a dramatic reduction in the number of all-male boards. There were 152 in 2011. Today there are no all-male boards in the FTSE 100 and only 15 in the FTSE 250.

Parmi les 5 recommandations faites pour le futur, signalons :

- The national call for action and voluntary, business-led approach is continued for a further five year period, ensuring substantive and sustainable improvement in women’s representation on Boards of FTSE 350 companies into the future

- Increasing the voluntary target for women’s representation on Boards of FTSE 350 companies, to a minimum of 33% to be achieved in the next five years.

- All stakeholders to work together to ensure increasing numbers of women are appointed to the roles of Chair, Senior Independent Director and into Executive Director positions on Boards of FTSE 350 companies.

- All FTSE Listed companies now assess the gender balance on their Boards and take prompt action to address any shortfall

À la prochaine…

Ivan Tchotourian

autres publications mission et composition du conseil d'administration

Planifier la succession du CA : le FRC consulte

Ivan Tchotourian 29 octobre 2015

Le Financial reporting Council vient de publier un document de consultation : « UK Board Succession Planning » (ici). Voici ce qu’on peut y lire…

The FRC’s interest stems primarily from the fact that the quality of succession planning is one of the most frequent issues highlighted as a consequence of board evaluation. Stakeholders have suggested that we promote good practice to raise quality. The FRC also wishes to address the Parliamentary Commission on Banking Standards’ recommendations to the FRC on issues around director nomination, in which it commented that there is a ‘widespread perception that some “natural challengers” are sifted out by the nomination process. The nomination process greatly influences the behaviour of non-executive directors and their board careers.’

This paper is the result of discussions with a wide range of interested parties – individually and through group sessions – and analysis of other research. Our stakeholders have been extremely generous with their time and candid with their views, for which we are grateful. The aim of this paper is to look at the key issues, to identify suggestions for good practice and, more specifically, to examine how the nomination committee can play its role effectively. We are seeking to provoke discussion, and welcome your feedback on our approach and the issues and questions we have posed.

Issues explored in the paper include:

- how effective board succession planning is important to business strategy and culture;

- the role of the nomination committee;

- board evaluation and its contribution to board succession;

- identifying the internal and external ‘pipeline’ for executive and non-executive directors;

- ensuring diversity; and

- the role of institutional investors.

À la prochaine…

Ivan Tchotourian

mission et composition du conseil d'administration

La féminisation : ça rapporte !

Ivan Tchotourian 22 octobre 2015

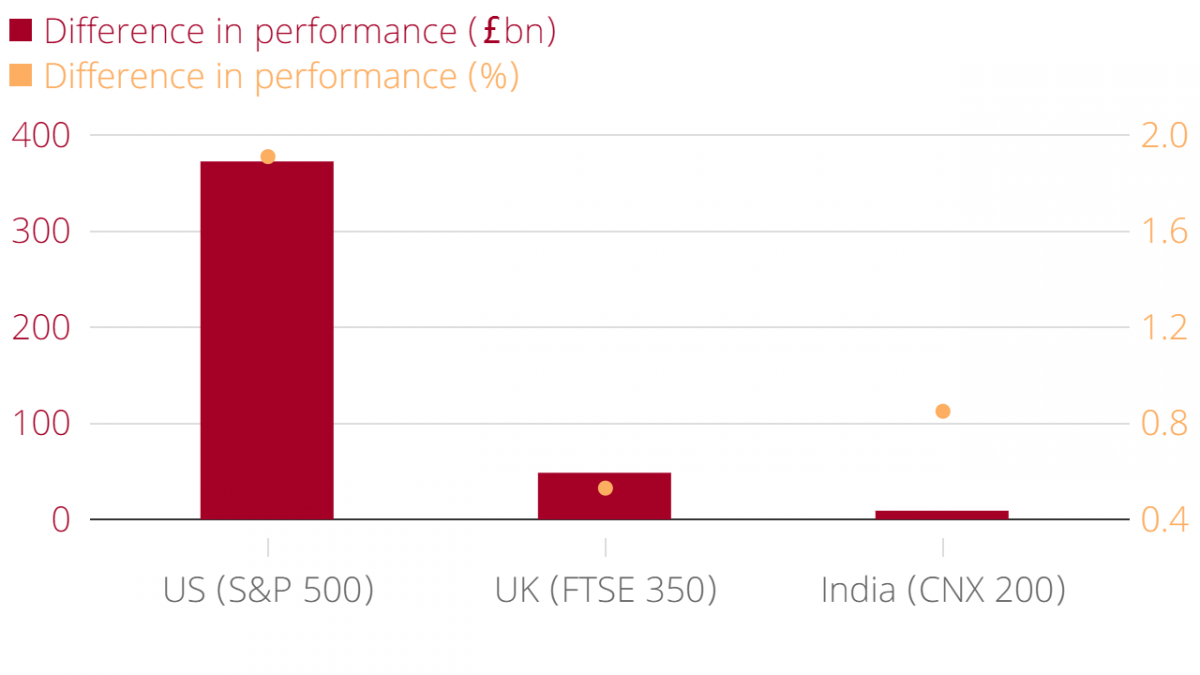

Selon le CityA.M., « The business case for boardroom diversity: Diverse boards outperform male-only peers by £430bn ». Le titre dit tout !

Listed companies in the UK, US and India with at least one woman on their board beat male-only boards by $430bn in 2014, according to a report from Grant Thornton which measured the difference in returns on assets.

Although this isn’t the first study arguing a business case from diversity – a McKinsey report published earlier this year found that the most gender-diverse companies are 15 per cent more likely to outperform the least diverse – it does put an exact value on diversity for business.

À la prochaine…

Ivan Tchotourian

autres publications Gouvernance

Détention des actions des entreprises britanniques : voulez-vous en savoir plus ?

Ivan Tchotourian 11 septembre 2015

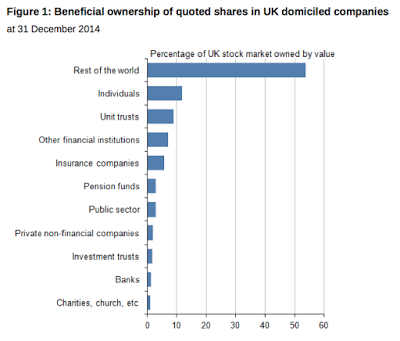

L’Office for National Statistics a publié le 2 septembre 2015 une étude très intéressante intitulée « Ownership of quoted shares for UK domiciled companies, 2014 ».

C’est effrayant de constater que la détention la plus importante (en termes de valeur des actions britanniques détenues) relève du reste du monde … « with 54% of the total at the end of 2014, similar to 2012 but higher than the 2010 level of 43%. Individuals owned the next largest proportion of shares at the end of 2014, with 12% of the total, higher than the estimated 10% they held in 2010 and 2012 ». Quant aux pays de provenance des détenteurs, notons que l’Amérique du Nord possède plus de 46 % des actions, suivie par l’Europe (26 %) et l’Asie (16 %).

La synthèse de cette étude est la suivante :

- The broad make-up of share ownership remained the same at the end of 2014 as it was in 2012, with rest of the world investors holding significantly more shares (in terms of value) than any other sector.

- Rest of the world ownership stood at an estimated 54% of the value of the UK stock market at the end of 2014. This was up from 31% in 1998 but unchanged from the 2012 estimate.

- UK individuals owned an estimated 12% of quoted UK shares by value at the end of 2014, an increase from the historic low of 10% in 2010 and 2012.

- Unit trusts held an estimated 9% by value at the end of 2014, slightly down from the 2012 level but still much higher than in 1998, when they only accounted for 2% of share ownership.

- Other financial institutions held an estimated 7% by value at the end of 2014, similar to 2012 but lower than the estimated 12% they held in 2010.

- Insurance companies held an estimated 6% and pension funds an estimated 3% by value at the end of 2014, continuing the downward trends in these sectors seen in recent years.

- The majority of shares by value are held in multiple-ownership pooled accounts, where the beneficial owner is not held centrally and must be established by means of a Companies Act 2006 Section 793 request. As in 2012, these accounted for over half (59%) of the total holdings by value at the end of 2014. Multiple ownership pooled accounts have been allocated to sectors using further analysis of share registers.

- This statistical bulletin provides estimates of holdings of ordinary shares in UK domiciled, quoted companies by sector of beneficial ownership, and also incorporates revisions to the 2012 data originally published in September 2013.

- The beneficial owner is the underlying owner; the person or body who receives the benefits of holding the shares, for example income through dividends (see Annex A for details). Companies included are those which are listed on the London Stock Exchange and are domiciled in the United Kingdom; that is, their country of incorporation is the UK. At the end of 2014, shares in quoted UK domiciled companies were valued at a total of £1.7 trillion.

Pour accéder au rapport en format pdf : cliquez ici.

À la prochaine…

Ivan Tchotourian